This website is not affiliated with any government agency or tax authority. Form last updated: 03/2024. Please verify this is the current version before use.

IRS W-9W-9 Form 2025 Printable Template

Easily complete & submit your W-9 form

Fill out your form

Our user-friendly editor helps you quickly enter personal & business details in the W9 template.

Sign the form

Add your electronic signature to the fillable W9 form to certify it came directly from you.

Send it to the requester

Download and instantly print or share your signed W-9 with the requester.

What is a W-9 used for?

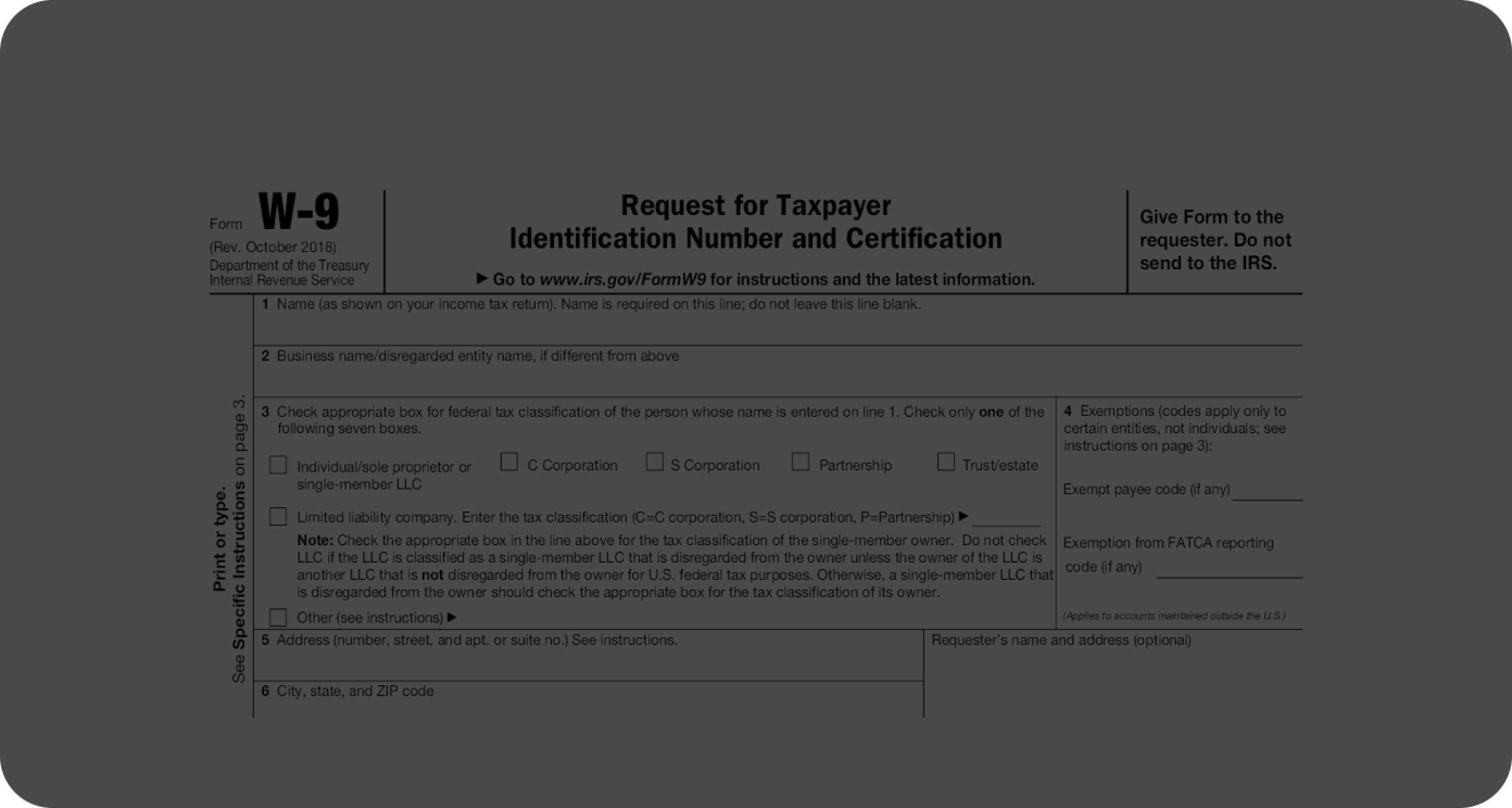

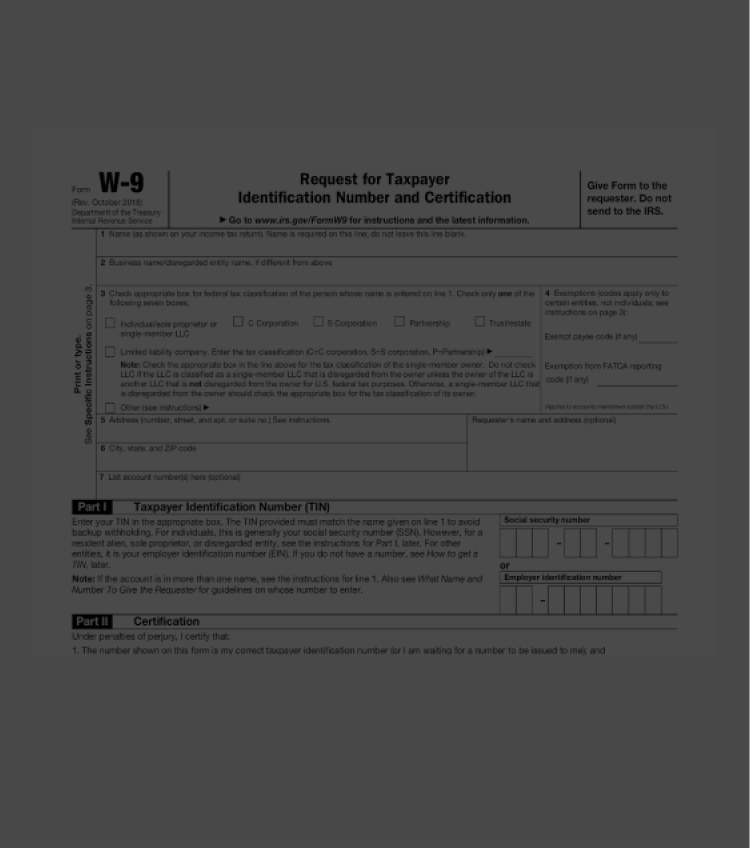

In simple terms, you fill out the W-9 tax form to give your details to companies or people who pay you. The main information you have to include on this form is your name, business name if applicable, address, tax identification number (TIN), and tax classification. The purpose of the W-9 is to allow payers to accurately report payments made to contractors, freelancers, vendors, etc., so that the IRS has a record of income for tax purposes. Basically, the W-9 helps facilitate 1099 tax reporting.

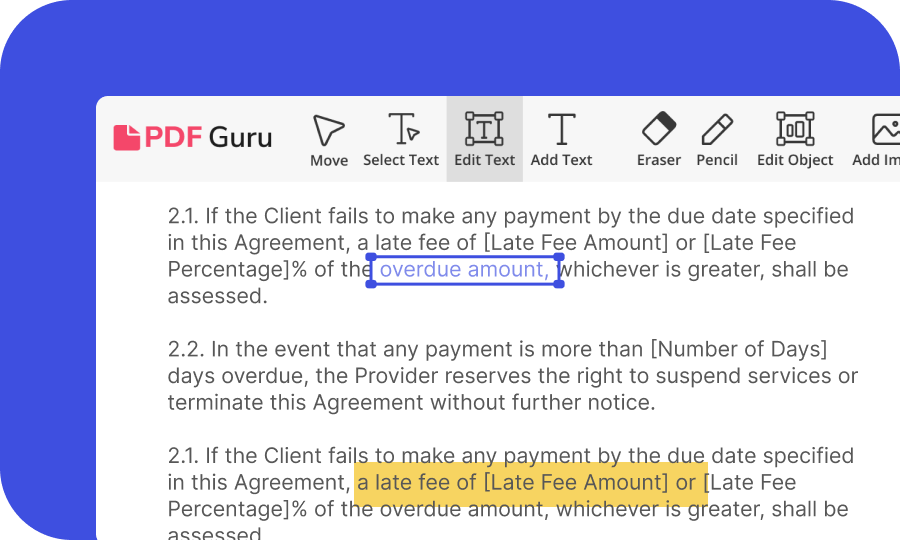

You can fill out W9 form in several ways. For instance, you can use our PDF maker to complete an editable W9 template and sign it. Alternatively, you can print out the form and fill it out by hand, but that would require more paperwork. If you edit and download a W-9 form PDF using our tool, you'll be able to share the copy with the requester.

According to W 9 requirements, this form may also be requested by financial institutions or other entities when establishing some types of financial accounts for the independent contractor. It helps to verify the contractor's identity and prevent identity theft. Overall, the W-9 form is necessary for collecting taxpayer information to accurately report payments and maintain legal and financial records.

Who needs to fill out a W-9 form

A W-9 fillable form needs to be completed by any individual or business that works as an independent contractor, freelancer, or vendor providing services to a company, organization, or individual payer. Whenever you begin working with a new client, they will likely ask you to send them a completed W-9 so they can properly document payments to you and report to the Internal Revenue Service (IRS). Even if you already have sent the payer this document, you may have to provide an updated one each year you continue receiving payments.

Difference between W-9 and 1099 forms

The W-9 and 1099 forms are both used for tax reporting in the United States, but they serve different purposes. The W-9 form is typically completed by the person or business receiving payment to collect the necessary information for tax purposes.

On the other hand, the 1099 form is used to report income paid to a non-employee, such as an independent contractor or freelancer. This form is completed by the entity or business that made the payment to the individual or company. The 1099 form includes information such as the recipient's name, address, and TIN, as well as the amount of income paid. In summary, while the W-9 form collects information from individuals or businesses receiving payment, the 1099 form reports income paid to non-employees.

How to fill out a W-9 online?

-

Click the Fill Form button under this section to complete the W9 form online

-

In the Editor window that opens, enter your personal, business, and tax ID information in the fillable W-9 form

-

Certify the form with your digital signature and date

-

Download or email the completed form to the person or company that requested it from you