This website is not affiliated with any government agency or tax authority. Form last updated: 03/2024. Please verify this is the current version before use.

Fill IRS 10991099 Information Request Form

Filling your 1099 Form is easy with PDF Guru

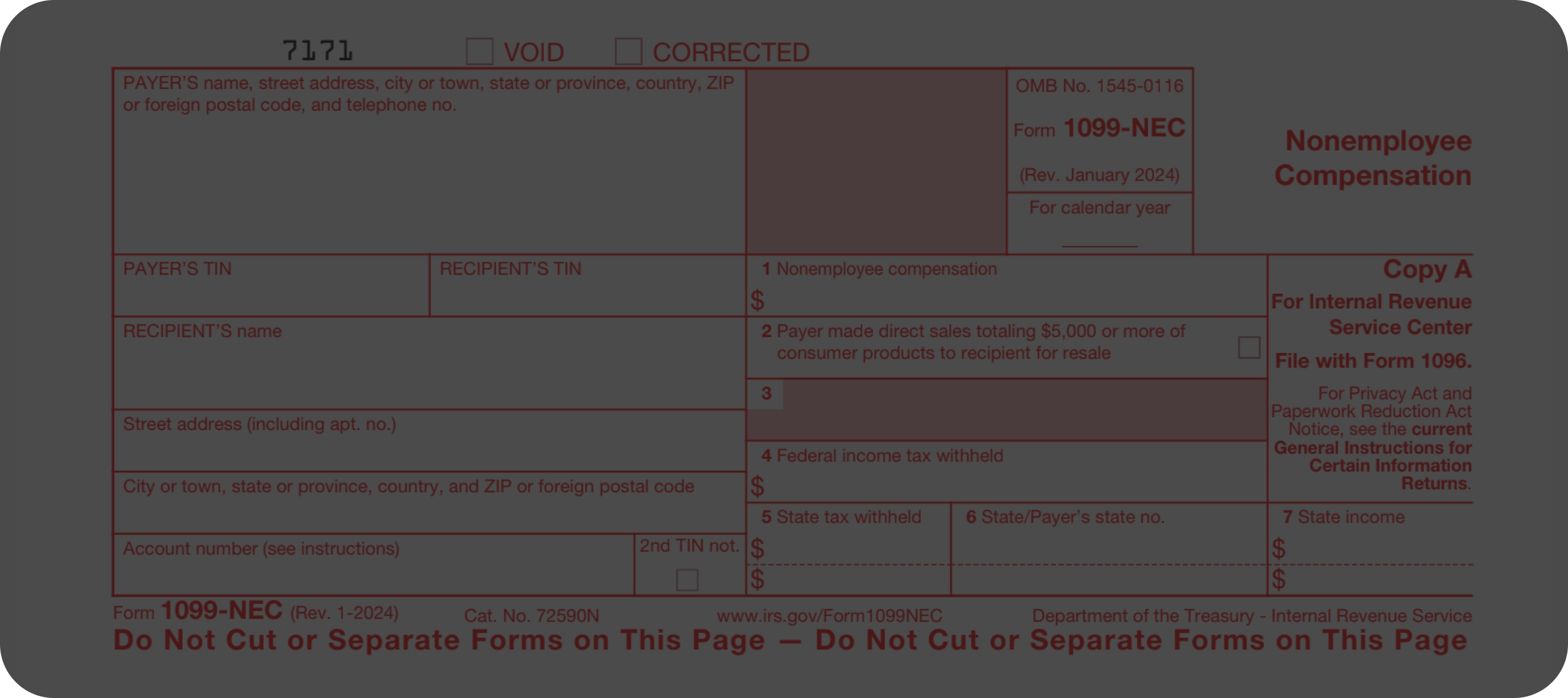

Fill out the 1099 form

Access our 1099 Form 2023 and provide the required information, such as your name, contact details, etc.

Save it or print it out

Download your printable 1099 Form 2023 or simply save the filled-out form as a digital file.

Submit your tax return

Send your completed form to the IRS electronically or present it to them in person.

What is Form 1099?

It’s likely that many people need clarification about the 1099 Form meaning and usage. This is a tax return form aimed at businesses that engage in non-employee compensation to individuals who earned more than $600 during the year. Originally, this form was used until 1982, when it stopped being required. After that year, businesses would instead use the 1099-MISC Form to report payments to non-employees. However, the IRS reintroduced tax form 1099 in 2020 to separate non-employee compensation payments from miscellaneous income reported on the 1099-MISC form.

What is a 1099 tax form used for?

- You paid someone who is not employed by your business

- The payment was made for a service falling within the course of your business

- The receiver is either an individual, an estate, a partnership, or a corporation

- The total annual amount of the payment is at least $600

The compensation to a non-employee can take the following forms:

- Monetary fees

- Benefits

- Prizes

- Commissions

- Any other form of compensation

How to file Form 1099?

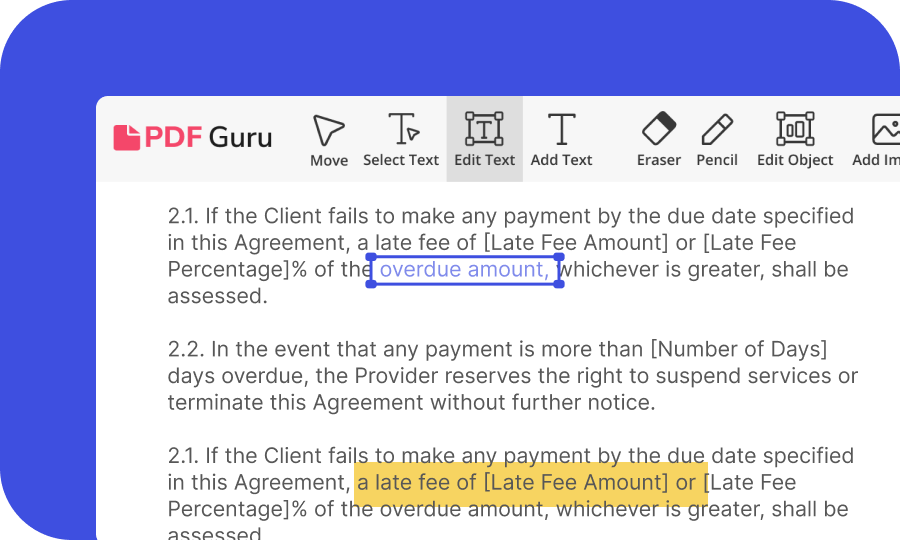

-

Click on the Get Form button

-

Fill out the complete form, providing all the required data, such as your name, address, TIN, etc

-

Review all the information you’ve given

-

Download the completed, printable 1099 Form 2023