What is Form 1095-C?

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is a document that large employers must provide to their full-time employees. This form details the months you were eligible for health coverage and outlines the cost of the least expensive monthly premium under your employer’s plan. Even if you didn’t enroll in the plan, you will still receive this form. It serves as important information for you and the IRS to determine eligibility for a premium tax credit when you applied for Marketplace coverage. Remember to keep it with your tax records for future reference.

What is Form 1095-C used for?

Form 1095-C is important for understanding your health coverage:

- Reporting Health Coverage: Documents the health coverage offered by your employer.

- Eligibility Determination: Helps determine if you qualify for the premium tax credit.

- IRS Compliance: Reports health coverage information to the IRS for compliance.

- Employee Records: Provides a statement of your health coverage for annual tax records.

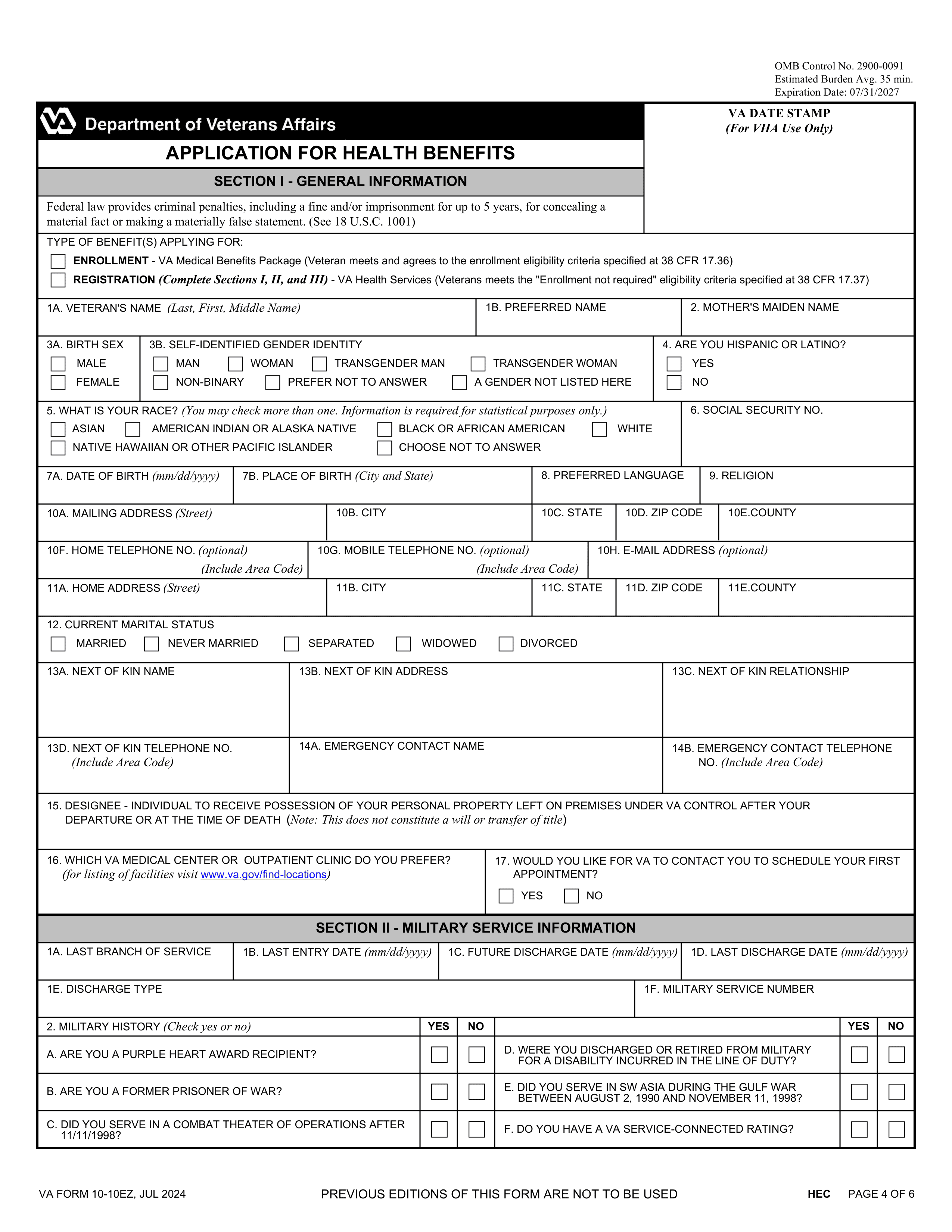

How to fill out Form 1095-C?

- 1

Enter the employee's name, Social Security Number, and address in Part I.

- 2

Provide the employer's address, contact number, and Employer Identification Number (EIN).

- 3

Report health care plans details in Part II.

- 4

Identify eligible months for the employee and the plan year start.

- 5

Use additional codes from the IRS Form 1095-C instructions for the plan type.

- 6

Include covered family members' information in Part III.

- 7

Enter their date of birth and tax identification number.

Who is required to fill out Form 1095-C?

Applicable Large Employers (ALEs) with 50 or more full-time employees are responsible for completing Form 1095-C. This form is necessary for reporting health insurance coverage offered to employees as required by the Affordable Care Act.

Employees who receive Form 1095-C use it to verify their health insurance status when filing taxes. They should keep it with their annual tax records for reference.

When is Form 1095-C not required?

Form 1095-C is not required for part-time employees who do not enroll in the health insurance plan. Additionally, self-insured Applicable Large Employers may choose between Form 1095-C and 1095-B based on their situation. Employees who are not full-time or are in a waiting period also do not need to receive this form.

When is Form 1095-C due?

The deadline for Form 1095-C is March 3, 2025, for employees. Employers must file paper forms with the IRS by February 28, 2025, and electronic forms by March 31, 2025. This form provides important information about the health coverage offered by employers throughout the tax year.

How to get a blank Form 1095-C?

Form 1095-C, issued by the IRS, is essential for Applicable Large Employers (ALEs) to report health insurance offers to employees and the IRS. Our platform has a blank version of this form ready for you to fill out. Remember, PDF Guru aids in filling and downloading but not filing forms.

Do you need to sign Form 1095-C?

No, you do not need to sign Form 1095-C. According to the IRS, this form does not require a signature or any additional explanation. However, it’s always a good idea to check for the latest updates to ensure compliance. With PDF Guru, you can fill out the form, download it for your records, and manage your documentation efficiently, while keeping in mind that submission and sharing are not supported.

Where to file Form 1095-C?

Once you have completed Form 1095-C, you need to submit it to the IRS. Mailing addresses differ based on your state, so double-check where to send your form.

Make sure to send your form to the correct IRS Center. For example, some states use Austin, TX, while others go to Kansas City, MO.