What is Form 1122?

Form 1122, Authorization and Consent of Subsidiary Corporation to be Included in a Consolidated Income Tax Return, is important for corporations with subsidiaries. This form allows a parent company to include its subsidiary's income, deductions, and credits on its consolidated tax return. By filing Form 1122, the subsidiary gives permission for this inclusion, ensuring compliance with IRS regulations. This can simplify the tax process and potentially reduce the overall tax liability for the parent corporation.

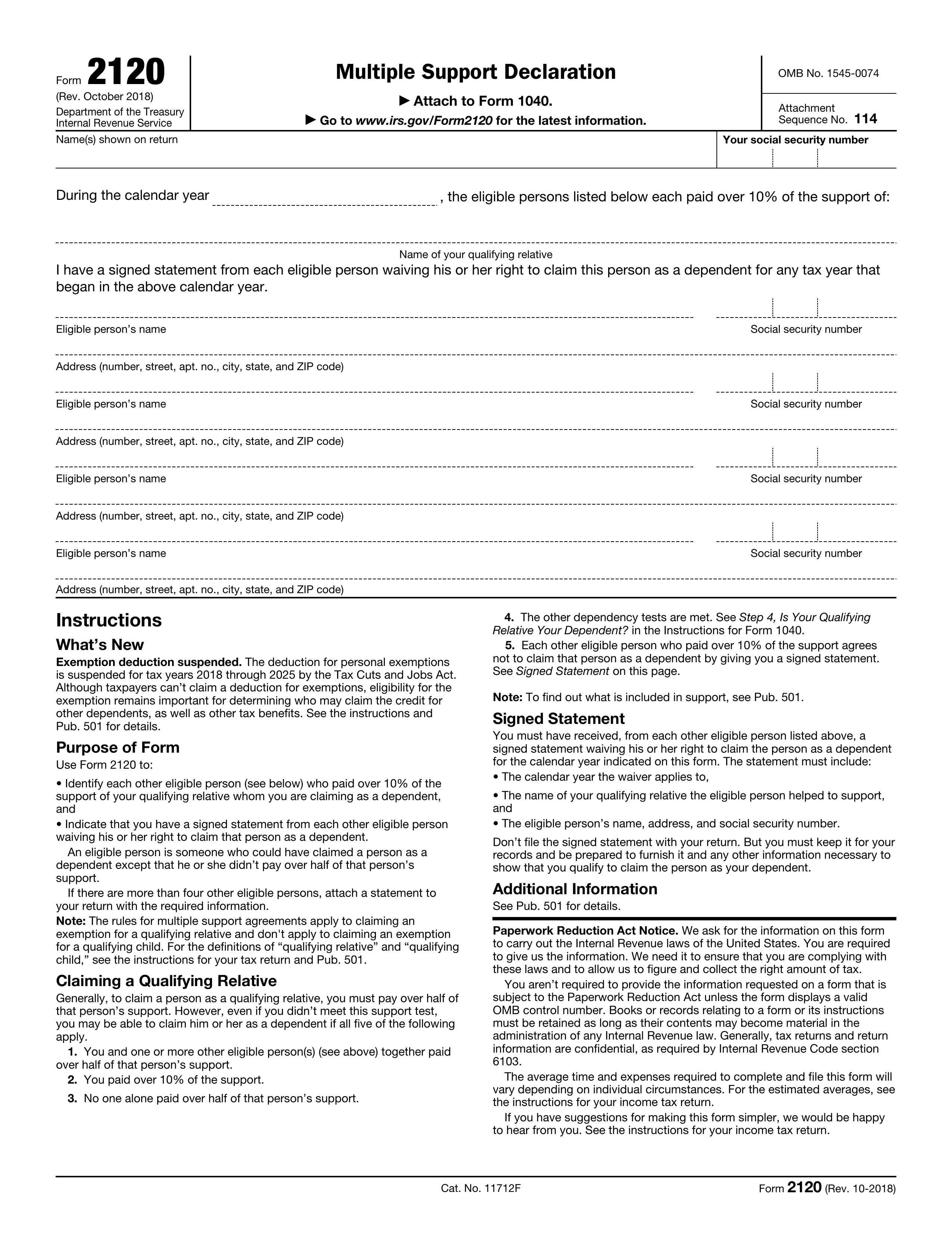

What is Form 1122 used for?

Form 1122 is used by subsidiary corporations to consent to being included in a consolidated income tax return. Here’s what it’s for:

- to authorize the parent corporation's tax return.

- to confirm the subsidiary's inclusion in the consolidated return.

- to ensure compliance with IRS regulations.

How to fill out Form 1122?

- 1

Gather necessary information about the subsidiary corporation and the parent corporation.

- 2

Fill out the form with accurate details, including names, addresses, and Employer Identification Numbers (EIN).

- 3

Confirm that all sections are complete and accurate to avoid delays.

- 4

Check official sources for the latest requirements on signatures to ensure validity.

- 5

Review the form to ensure all information is correct before submission.

Who is required to fill out Form 1122?

Form 1122 is completed by subsidiary corporations and their parent companies for tax purposes. It is necessary for filing a consolidated income tax return.

Afterward, the IRS uses the form to verify the inclusion of the subsidiary in the parent company’s tax return.

When is Form 1122 not required?

Form 1122 isn’t necessary for subsidiary corporations that are not part of a consolidated tax return. If a subsidiary corporation is filing its own tax return separately, it doesn’t need this form.

Additionally, if a parent corporation has no subsidiaries or if all subsidiaries are disregarded entities for tax purposes, Form 1122 is also unnecessary. Always check specific IRS guidelines to confirm your situation.

When is Form 1122 due?

The deadline for Form I-690 is not specified, as it depends on the individual's specific situation and the processing time by USCIS. Generally, it is recommended to file as soon as possible after determining the need for a waiver. The form must be mailed to the appropriate address, and the filing fee is $715.

How to get a blank Form 1122?

To get a blank Form 1122, which is issued by the IRS for authorization and consent of a subsidiary corporation to be included in a consolidated income tax return, simply visit our website. We have a pre-loaded version ready for you to fill out and download.

How to sign Form 1122?

To sign Form 1122, you should first download the PDF version of the form. After filling out the necessary information, print the form to provide a handwritten signature.

Ensure that all required fields are completed before signing. It's also wise to check for any updates on the IRS website for the latest signing requirements.

Where to file Form 1122?

Form 1122 can be filed by mail but cannot be submitted online. Ensure you have the correct mailing address for the IRS.

When mailing, keep a copy for your records. Check for any specific instructions that may accompany the form for proper submission.