What is Form 3554?

Form 3554, also known as the New Employment Credit, is used by businesses in California to claim a tax credit for hiring qualified employees. This form helps encourage job creation and supports the state's economy. By filling out this form, employers can reduce their tax burden, making it an important tool for businesses looking to grow while benefiting from state incentives. Completing Form 3554 correctly ensures that you can take full advantage of this credit.

What is Form 3554 used for?

Form 3554 is used to claim the New Employment Credit. Here’s what it’s used for:

- to report qualified new employees.

- to calculate the credit amount.

- to submit to the IRS for tax benefits.

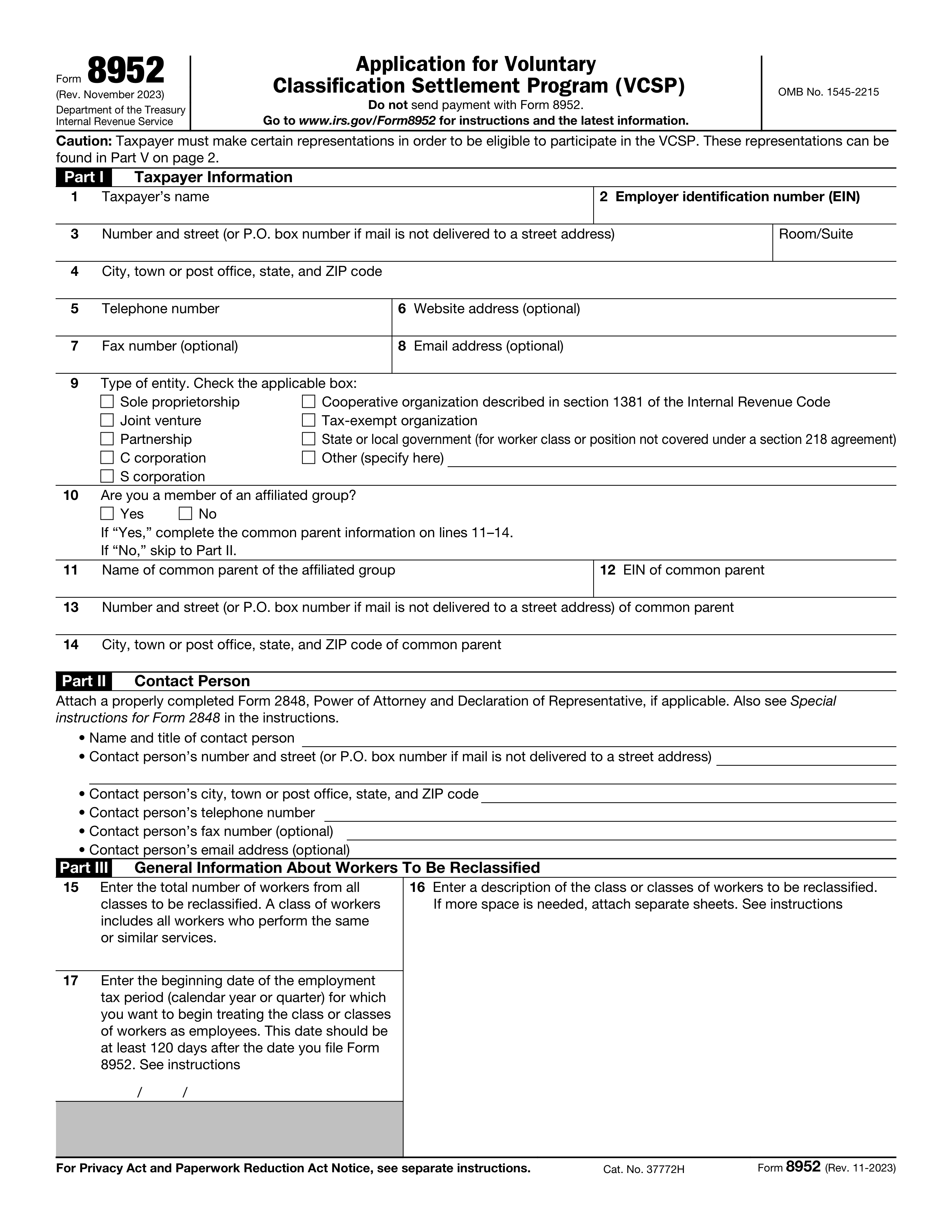

How to fill out Form 3554?

- 1

Gather required information, including your business details and eligible wages.

- 2

Locate the appropriate sections on Form 3554 for the New Employment Credit.

- 3

Enter your business name, address, and Employer Identification Number (EIN).

- 4

Fill in the qualified wages and number of employees.

- 5

Review all entries for accuracy before submission.

Who is required to fill out Form 3554?

Form 3554 is for employers claiming credits for new jobs created. It is specifically for businesses hiring qualified employees.

Employers complete this form and submit it to the IRS to receive tax credits associated with hiring new employees.

When is Form 3554 not required?

Form 3554 for the New Employment Credit is not needed if your business did not hire any new employees during the tax year. Additionally, if your business operates in a location or industry that does not qualify for this credit, you can skip this form. Always check the specific eligibility criteria related to your business situation before filing.

When is Form 3554 due?

The deadline for Form 3554 is typically the 15th day of the 3rd month after the end of the tax year. If you file your taxes on time, this form should be submitted along with your tax return.

Make sure to check for any updates from the IRS or state tax authority for specific due dates, as they may vary. Complete the form accurately to ensure you receive any eligible credits.

How to get a blank Form 3554?

To get a blank Form 3554, simply visit our website. The form is pre-loaded in our editor, so you can start filling it out right away. Once you're finished, you can download your completed form for your records.

Do you need to sign Form 3554?

Form 3554, the New Employment Credit, does not require a signature based on official sources. However, it's always wise to check with the IRS for the latest updates.

Regulations can change, and staying informed helps minimize any liability for misinformation. Be sure to verify details directly with the IRS before filing.

Where to file Form 3554?

Form 3554 can be filed by mail. Ensure you have the correct address for submission based on your location.

Currently, this form cannot be submitted online. Always check the IRS website for any updates regarding filing options.