What is Form 4797?

Form 4797, Sales of Business Property, is used to report the sale of business assets, like equipment or real estate. It helps calculate any gains or losses from these sales, which affect your taxes. Completing this form is essential for accurately reporting income and ensuring compliance with IRS regulations. By filing Form 4797, you provide the IRS with important information about your business transactions, which can impact your overall tax liability. Understanding and filling out this form correctly is crucial for every business owner.

What is Form 4797 used for?

Form 4797, Sales of Business Property, is used to report sales, exchanges, or involuntary conversions of business assets. Here’s what it’s for:

- to report gains or losses from sales.

- to calculate depreciation recapture.

- to determine if the property qualifies as like-kind.

How to fill out Form 4797?

- 1

Gather all necessary information about the property sold, including purchase price, sale price, and any depreciation taken.

- 2

Open Form 4797 in the PDF editor and start filling in your details.

- 3

Complete Part I for sales of property used in a trade or business, ensuring accuracy in figures.

- 4

Fill out Part III if applicable, for like-kind exchanges.

- 5

Review your entries for errors before finalizing.

- 6

For the signature, check official IRS guidelines for current requirements.

Who is required to fill out Form 4797?

Form 4797 is completed by business owners and real estate investors to report sales of business property. Accountants may also fill it out for clients.

Afterward, the form is used by the IRS to assess capital gains or losses from the reported sales.

When is Form 4797 not required?

If you sell business property, you might not need Form 4797 in certain situations. For example, if you only sell personal property that does not qualify as business property, skip this form.

Additionally, if your business is a sole proprietorship and you sold an asset for less than $300, you can report the gain or loss on Schedule C instead, making Form 4797 unnecessary.

When is Form 4797 due?

The deadline for Form I-690 is not specified, as it depends on the individual's specific situation and the processing time by USCIS. Generally, it is recommended to file as soon as possible after determining the need for a waiver. The form must be mailed to the appropriate address, and the filing fee is $715.

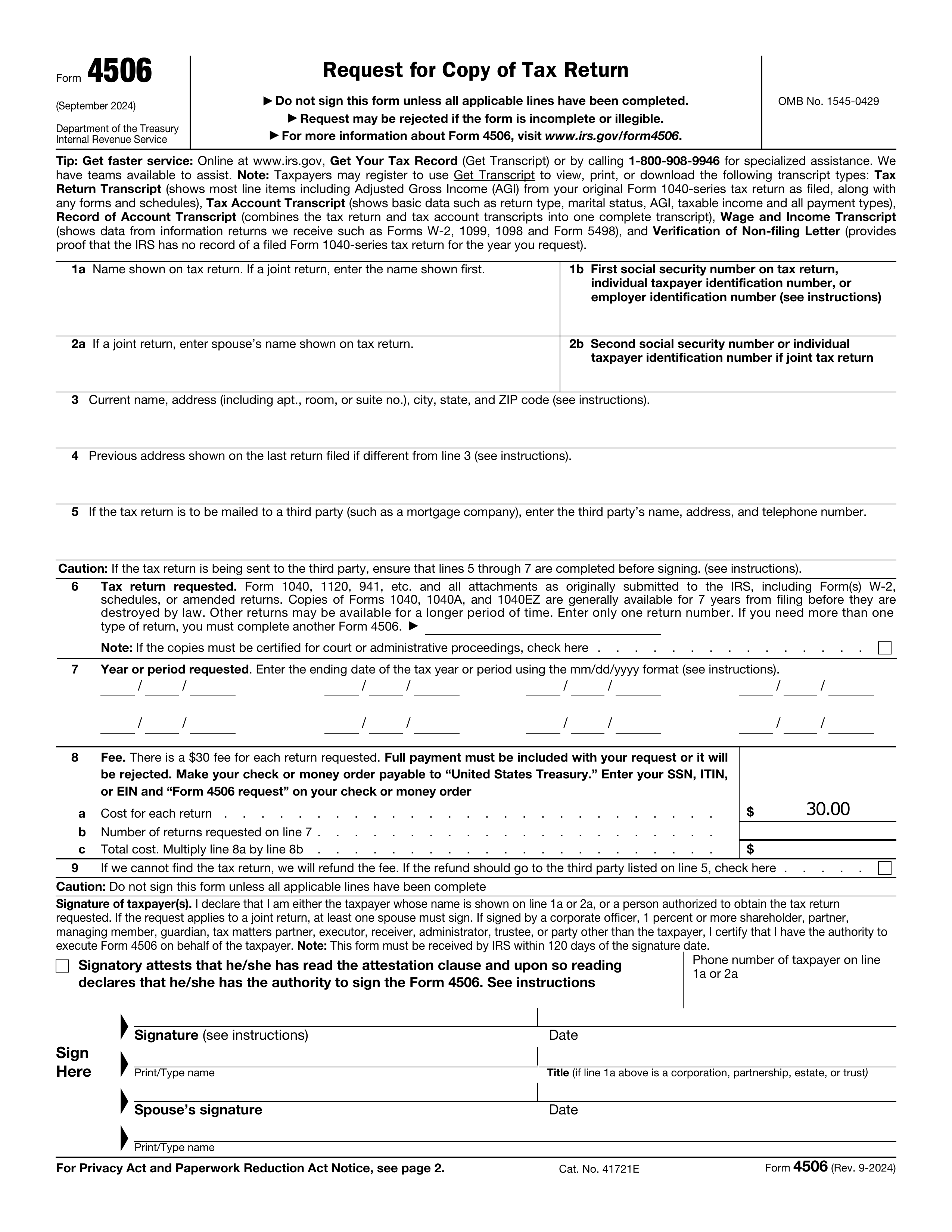

How to get a blank Form 4797?

To get a blank Form 4797, Sales of Business Property, simply visit our website where you'll find the form pre-loaded in our editor. The IRS issues this form for reporting the sale of business property. You can fill it out and download it for your records.

How to sign Form 4797?

To sign Form 4797, Sales of Business Property, online using PDF Guru, first open the blank form in the PDF editor. Fill out all necessary fields accurately, ensuring you provide the correct information as required by the IRS.

Once you have completed the form, click on the option to create an electronic signature if needed. After signing, download the form for your records. Always check official IRS guidelines to ensure your signature meets their requirements.

Where to file Form 4797?

Form 4797 can be filed by mail or through tax software that supports e-filing. Check with the software provider for specific instructions.

When filing by mail, send the completed form to the address listed in the IRS instructions for your location. Make sure to keep a copy for your records.