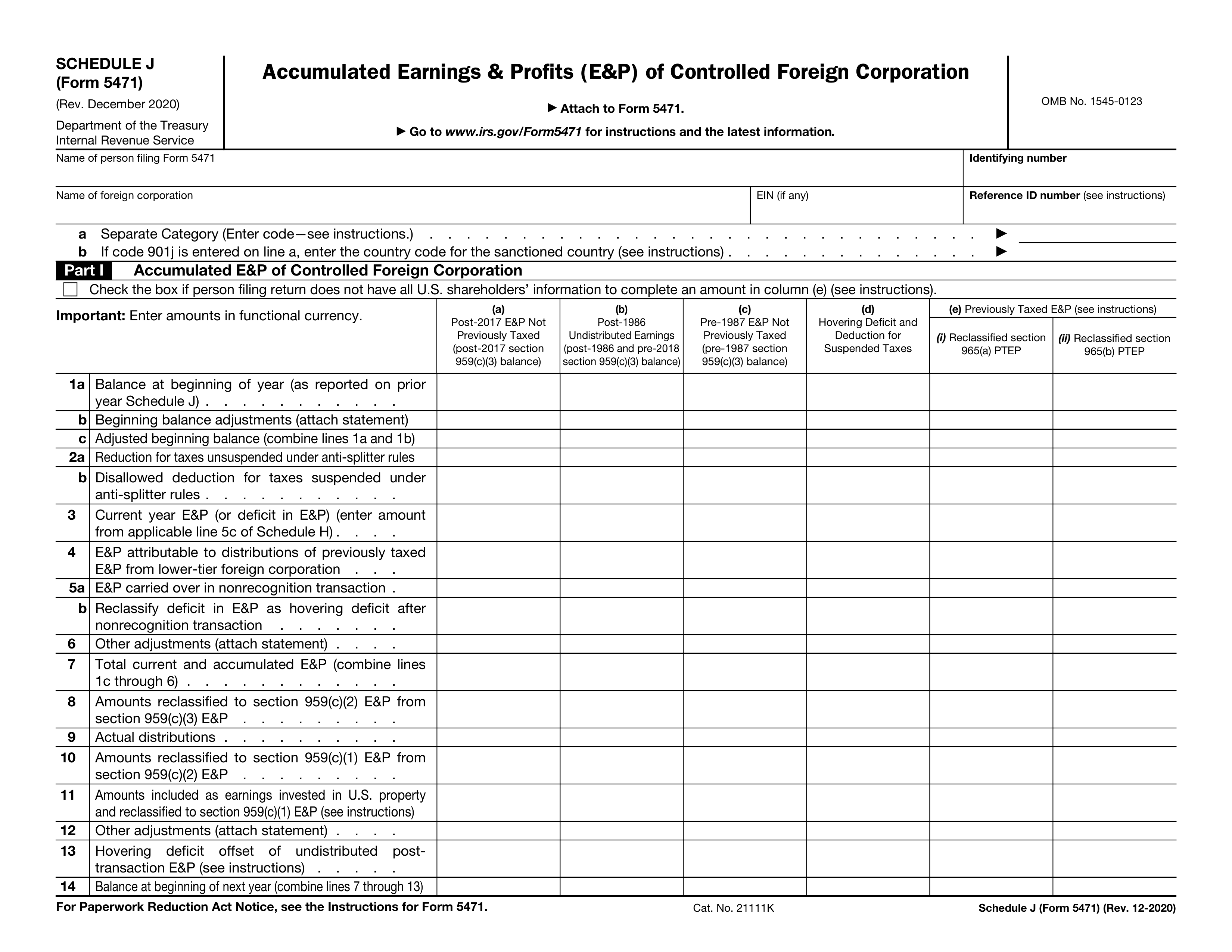

What is Form 5471 Schedule E?

Form 5471 Schedule E is used by U.S. citizens and residents to report income, war profits, and excess profits taxes paid or accrued from foreign corporations. This form helps the IRS track international income and ensures taxpayers comply with U.S. tax laws. Completing Schedule E is important because it contributes to accurate tax reporting and can affect your overall tax liability. Failing to file it correctly may lead to penalties or issues with your tax return.

What is Form 5471 Schedule E used for?

Form 5471 Schedule E reports specific taxes for certain foreign corporations. It is used to:

- to report income taxes paid or accrued.

- to disclose war profits taxes.

- to detail excess profits taxes.

How to fill out Form 5471 Schedule E?

- 1

Review the instructions for Form 5471 Schedule E on the IRS website to understand specific requirements.

- 2

Gather all relevant financial information related to income, war profits, and excess profits taxes.

- 3

Enter your income details in the appropriate fields, ensuring accuracy.

- 4

Complete the sections for war profits and excess profits taxes paid or accrued.

- 5

Double-check all entries for correctness and completeness before finalizing the form.

Who is required to fill out Form 5471 Schedule E?

Form 5471 Schedule E is completed by U.S. citizens, residents, and certain foreign corporations for reporting income and taxes related to foreign corporations. This ensures compliance with U.S. tax laws.

After completion, the form is used by the IRS to assess tax liability and verify reported income.

When is Form 5471 Schedule E not required?

Form 5471 Schedule E isn't required for individuals who do not have any foreign corporation interests or do not meet the ownership thresholds. If you own less than 10% of a foreign corporation or do not meet the criteria for controlled foreign corporations, you can skip this form.

Additionally, if you are not subject to U.S. tax on foreign income, you are not obligated to file Schedule E. Always consult the IRS guidelines for clarification.

When is Form 5471 Schedule E due?

The deadline for Form 5471 Schedule E is the 15th day of the 4th month after the end of the tax year. For most taxpayers, this means it is due on April 15.

If you need an extension, you can file Form 4868 for a 6-month extension. However, keep in mind that this extension is for filing the form only, not for paying any taxes owed.

How to get a blank Form 5471 Schedule E?

To get a blank Form 5471 Schedule E, Income, War Profits, and Excess Profits Taxes Paid or Accrued, simply go to our platform. The form is pre-loaded in our editor, ready for you to fill out. You can easily download it once completed.

Do you need to sign Form 5471 Schedule E?

Form 5471 Schedule E does not require a signature according to official IRS sources. However, it's wise to verify any recent updates directly on the IRS website.

Always check for the latest information to avoid any potential issues. Keeping informed helps you minimize liability and ensure compliance with tax regulations.

Where to file Form 5471 Schedule E?

Form 5471 Schedule E can only be filed by mail. You must send it to the appropriate IRS address based on your location.

Online filing is not supported for this form. Ensure you keep copies for your records after mailing your submission.