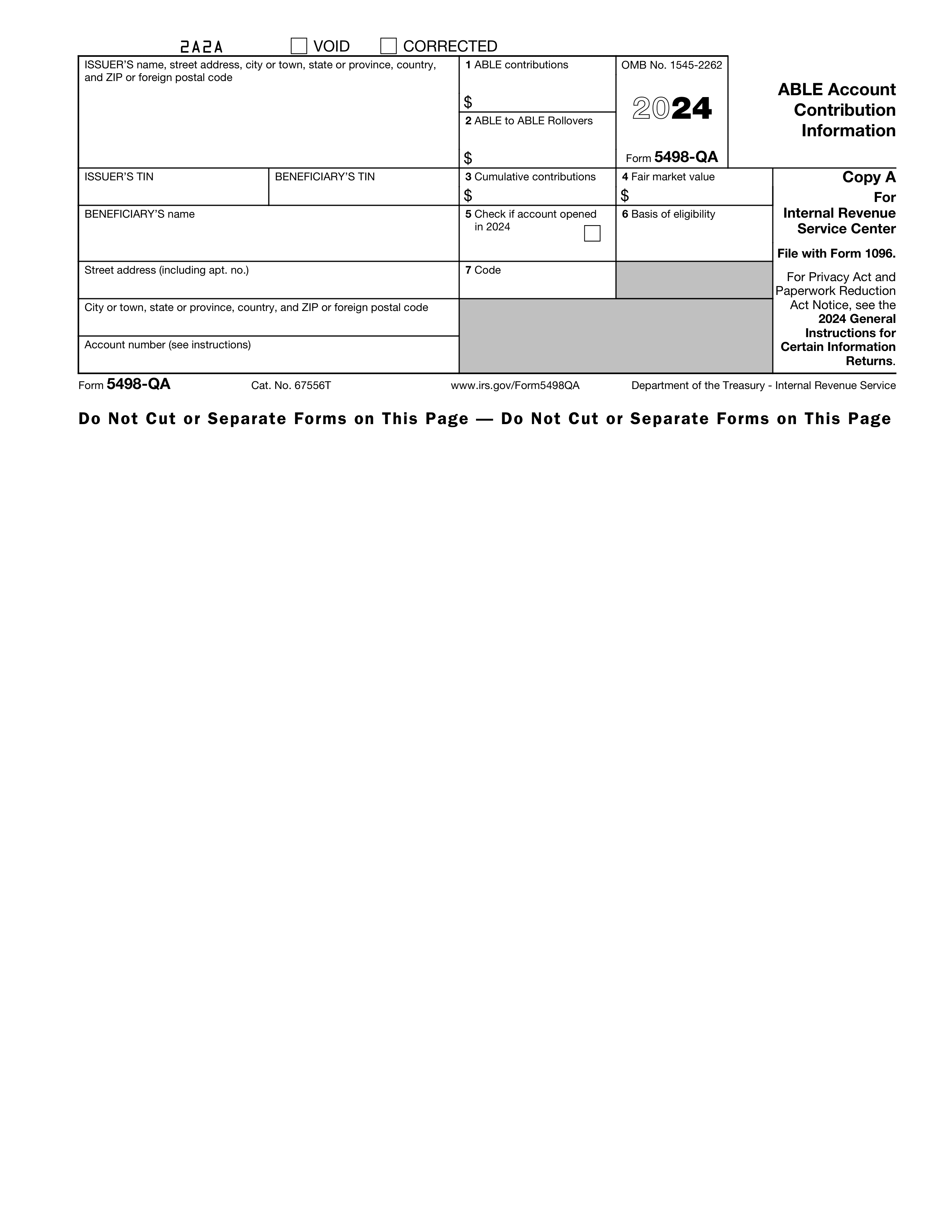

What is Form 5498-ESA?

Form 5498-ESA is used to report contributions to a Coverdell Education Savings Account (ESA). This form is important because it helps the IRS track how much money has been contributed to your ESA, which can be used for qualified education expenses. You receive this form from your financial institution, and it is necessary for your tax records. Keeping it safe ensures you can accurately report your contributions and any tax benefits you may qualify for when filing your taxes.

What is Form 5498-ESA used for?

Form 5498-ESA is used to report contributions to Coverdell Education Savings Accounts (ESA). This form is important for taxpayers and educational savings:

- to report contributions made to the Coverdell ESA.

- to provide information about the account's earnings.

- to indicate the beneficiary's information.

- to help ensure compliance with tax regulations.

How to fill out Form 5498-ESA?

- 1

Enter the name and address of the beneficiary in the designated fields.

- 2

Provide the beneficiary's Social Security Number (SSN).

- 3

Fill in the contributions made during the tax year in the appropriate box.

- 4

Indicate any rollover contributions, if applicable.

- 5

Complete the required information about the account owner.

- 6

Review all entries for accuracy before finalizing.

Who is required to fill out Form 5498-ESA?

Individuals and educational institutions complete Form 5498-ESA for Coverdell ESA contributions. Financial institutions file the form to report contributions.

The IRS and account holders use the form to track contributions and ensure compliance.

When is Form 5498-ESA not required?

You don’t need to file Form 5498-ESA if you didn’t make any contributions to a Coverdell Education Savings Account (ESA) during the tax year. Additionally, if you don’t have a Coverdell ESA or if your contributions are below the reporting threshold, this form isn’t required.

Also, if you only received distributions from the account without making new contributions, you won't need to submit this form.

When is Form 5498-ESA due?

The deadline for Form 5498-ESA is May 31 of the year following the tax year for which contributions were made. This means if you made contributions in 2023, you need to submit this form by May 31, 2024.

Remember, this form is important for reporting contributions to a Coverdell Education Savings Account. It’s good to keep track of your contributions throughout the year to ensure accurate reporting.

How to get a blank Form 5498-ESA?

To get a blank Form 5498-ESA, simply visit our website. The form is pre-loaded in our editor, allowing you to fill in the necessary information directly. Once completed, you can download it for your records.

Do you need to sign Form 5498-ESA?

Form 5498-ESA, which is for Coverdell ESA Contribution Information, does not require a signature according to IRS guidelines. However, it's always best to confirm this information directly with the IRS.

Regulations can change, and checking for recent updates can help minimize any potential liabilities. Always stay informed to ensure compliance with the latest requirements.

Where to file Form 5498-ESA?

Form 5498-ESA must be filed by mail. It cannot be submitted online. Ensure you have the correct information before sending.

Keep a copy of the completed form for your records. Always check the IRS guidelines for any changes to filing procedures.