What is Form 712?

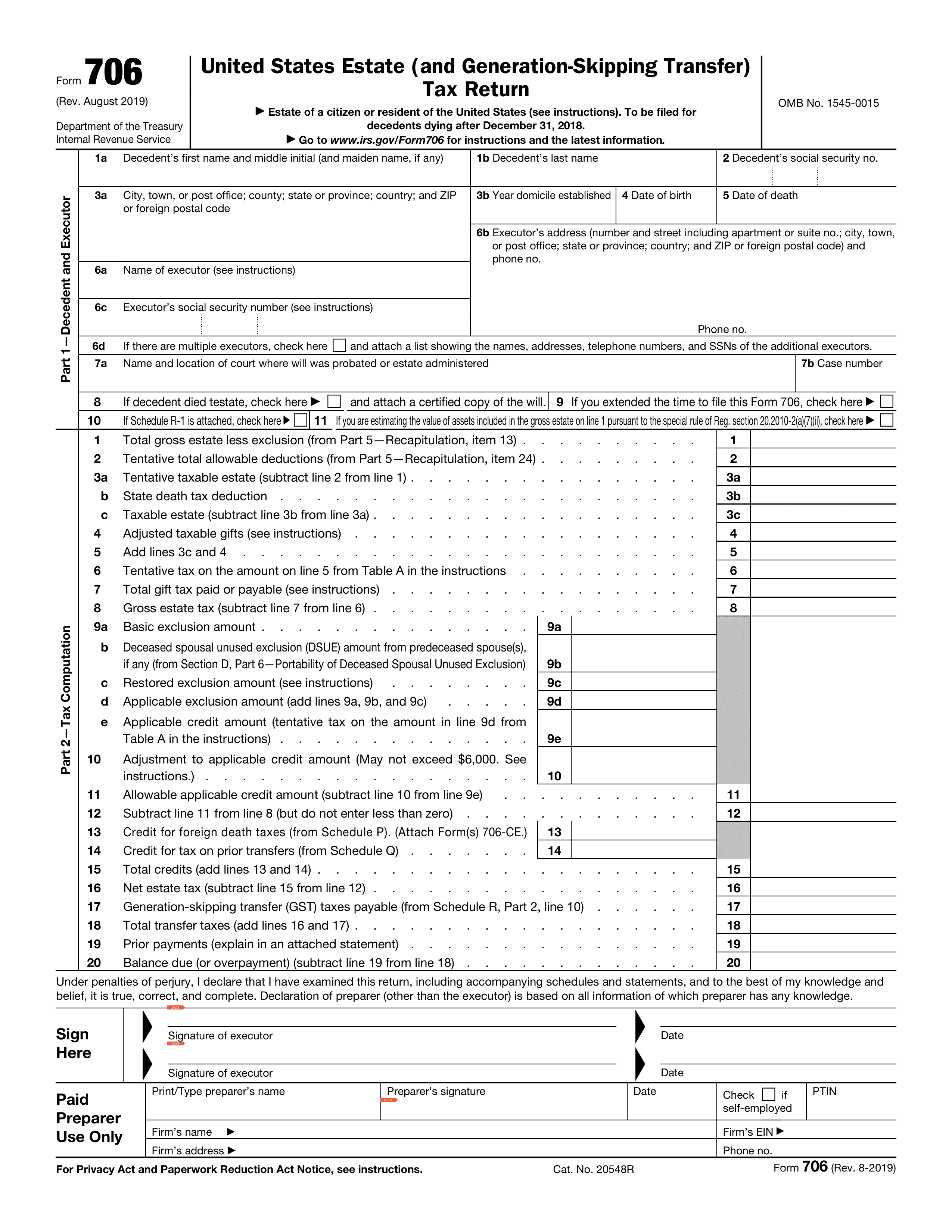

Form 712, known as the Life Insurance Statement, is crucial for reporting the value of life insurance policies for estate tax purposes. When someone passes away, the proceeds from their life insurance may be included in their estate's total value. This form provides the IRS with important details about these policies, helping them assess any estate taxes that may apply. Accurate completion of Form 712 ensures the estate is reported correctly, which is essential for compliance with tax laws.

What is Form 712 used for?

Form 712 is used to report the value of life insurance policies for estate tax purposes:

- to provide the necessary information about the policy.

- to assess the policy's value at the time of the insured’s death.

- to ensure accurate reporting for estate tax calculations.

How to fill out Form 712?

- 1

Review the instructions for Form 712 to understand required information.

- 2

Fill out the decedent's information, including name and date of death.

- 3

Enter details about the insurance policies, including policy numbers and coverage amounts.

- 4

Double-check all entries for accuracy and completeness.

- 5

Sign the form using an electronic signature if allowed.

- 6

Download the completed form for submission to the IRS or relevant authority.

Who is required to fill out Form 712?

Form 712 is completed by estate executors and administrators for estate tax purposes.

Beneficiaries and tax professionals use the form for valuation and reporting to the IRS.

When is Form 712 not required?

Form 712 isn't necessary when the estate's gross value falls below the federal estate tax exemption threshold, which is $12.92 million for 2023.

Additionally, if life insurance proceeds go directly to a beneficiary and the decedent didn't own the policy or have incidents of ownership at death, form 712 is not required. The same applies when assets consist solely of non-taxable items or if life insurance proceeds are held in an irrevocable life insurance trust (ILIT).

When is Form 712 due?

The deadline for Form 712 is generally within nine months after the date of the decedent's death. If you need more time, you can request an extension.

Make sure to gather all necessary information before filling out the form. Check the IRS website for specific instructions and any updates to deadlines that may apply.

How to get a blank Form 712?

To get a blank Form 712, simply visit our website. The form is pre-loaded in our editor, ready for you to fill out. Once you've completed the necessary fields, you can download the form for your records.

How to sign Form 712 online?

To sign IRS Form 712 online using PDF Guru, first, open the blank version of the form in the PDF editor. Fill out all necessary fields, making sure to provide accurate information.

After completing the form, click on the option to create a simple electronic signature. Place your signature in the designated area before downloading the finalized document. Always consult official sources for specific signature requirements to ensure compliance.

Where to file Form 712?

Form 712 cannot be filed online. The only option available is to complete the form and submit it by mail to the appropriate IRS address.

When mailing Form 712, ensure it is sent to the right location based on your state. Always double-check for accuracy before sending to avoid delays.