What is Form 8804?

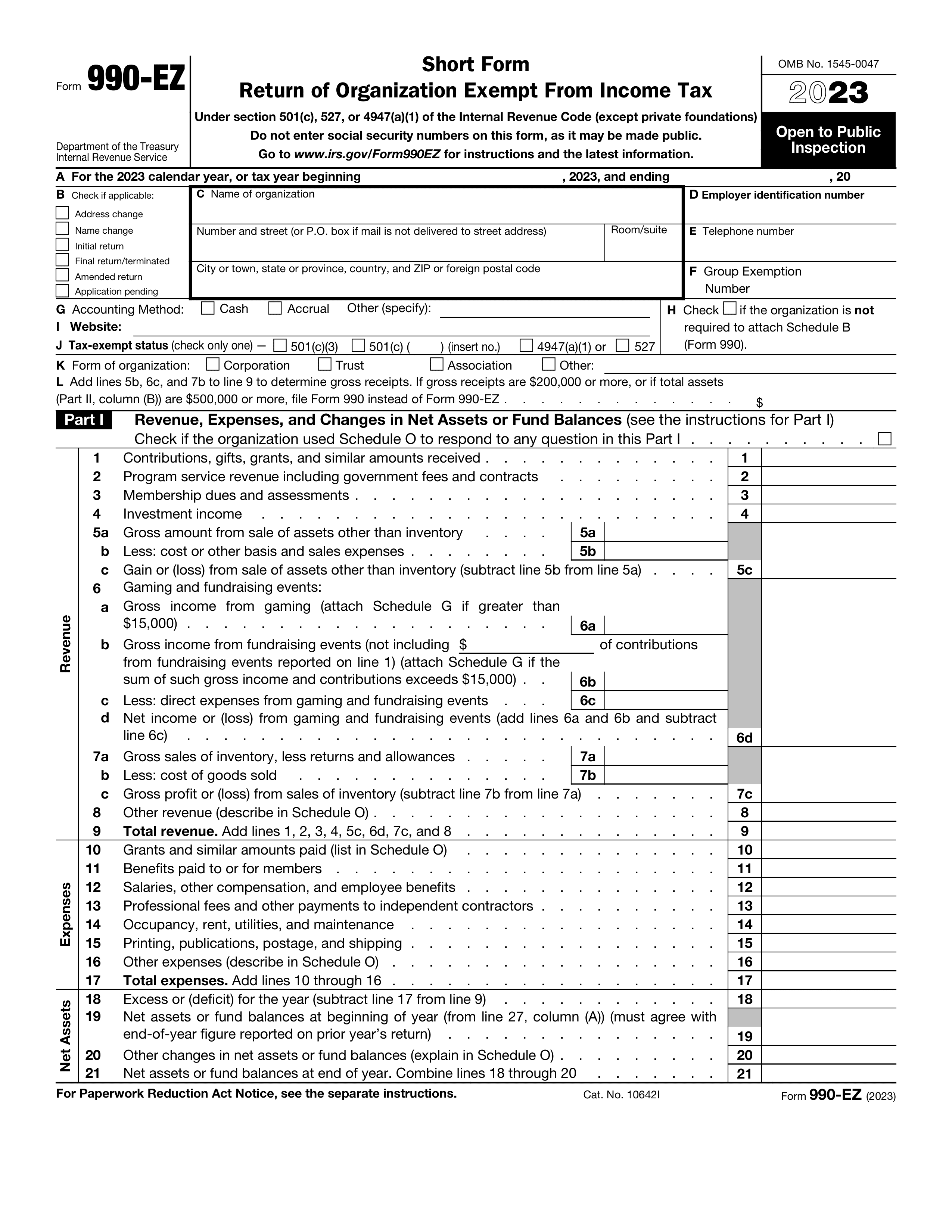

Form 8804 is a crucial document for partnerships and limited liability companies (LLCs) treated as partnerships for tax purposes. This form is used to report the partnership's total annual income and calculate the withholding tax on foreign partners' share of that income. It ensures that income from U.S. operations paid to foreign partners is properly taxed. Filling out Form 8804 is essential for these entities to comply with U.S. tax laws and avoid penalties. It helps maintain transparency with the IRS regarding the income and taxes withheld for foreign partners.

What is Form 8804 used for?

The Form 8804 is a critical document for partnerships and entities treated as partnerships for income tax purposes. Here's what it's used for:

- To report the total liability for the section 1446 tax.

- To pay any remaining underpayment of the section 1446 tax.

How to fill out Form 8804?

- 1

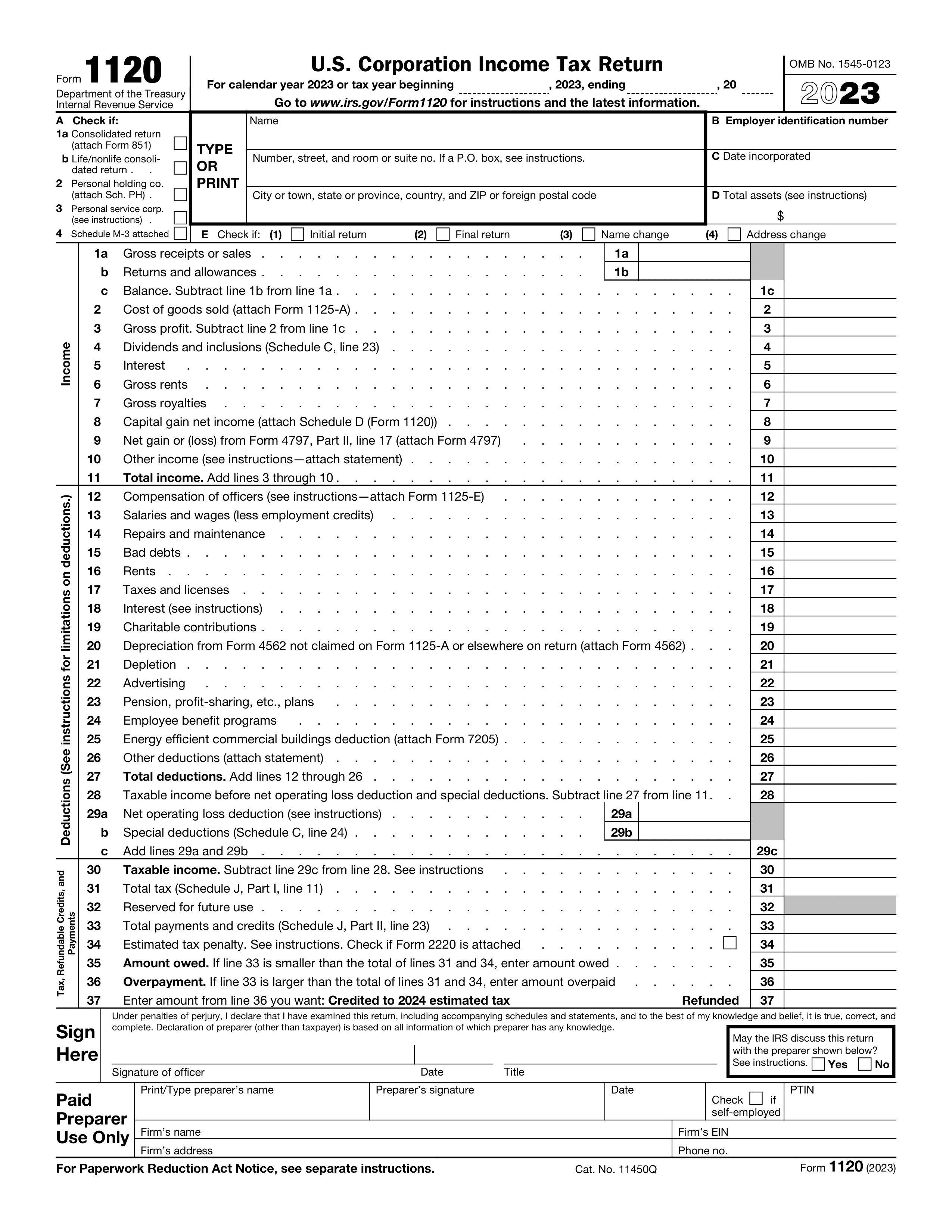

Start by entering the partnership's EIN, name, and address in the designated fields.

- 2

Specify the tax year for which the form 8804 is being prepared.

- 3

Complete the Withholding Tax section, calculating the total tax due based on the partnership's income.

- 4

If applicable, fill in the details of any credits that reduce the amount owed.

- 5

Review the form for accuracy, ensuring all necessary sections are completed.

- 6

Create an electronic signature if the form accepts this type of signature.

- 7

Download the completed form and prepare it for submission according to the official guidelines.

Who is required to fill out Form 8804?

Partnerships with income effectively connected to a U.S. trade or business must fill out Form 8804 as part of their tax obligations.

IRS uses Form 8804 to assess and collect withholding taxes on the partnership's income, ensuring proper tax compliance.

When is Form 8804 not required?

Certain individuals and entities are exempt from the requirement to complete Form 8804. This includes partnerships that do not have any income effectively connected with a U.S. trade or business during the tax year.

Additionally, foreign partners who do not have any U.S. source income from the partnership also do not need to fill out this form.

When is Form 8804 due?

The deadline for Form 8804 is March 15th of the year following the partnership's tax year. If the due date falls on a weekend or legal holiday, the deadline is the next business day.

This form is crucial for partnerships that have income effectively connected with a U.S. trade or business. Submitting on time helps avoid penalties.

How to get a blank Form 8804?

To get a blank form 8804, visit our platform where the form is pre-loaded in our editor, ready for you to fill out. Remember, our website helps you fill out and download the form, but we don't assist with filing it.

How to sign Form 8804 online?

Signing Form 8804 online with PDF Guru is simple. First, load the form in the PDF editor provided by the platform.

After filling out the necessary fields, you can create an electronic signature for the form, if it accepts this type of signature. Then, download your completed document.

Where to file Form 8804?

Form 8804 can be submitted through mail. This method allows for physical documentation to be sent to the designated address.

Some forms might also offer online submission options, providing a digital method for sending required information to the appropriate authorities.