What is Form 8899?

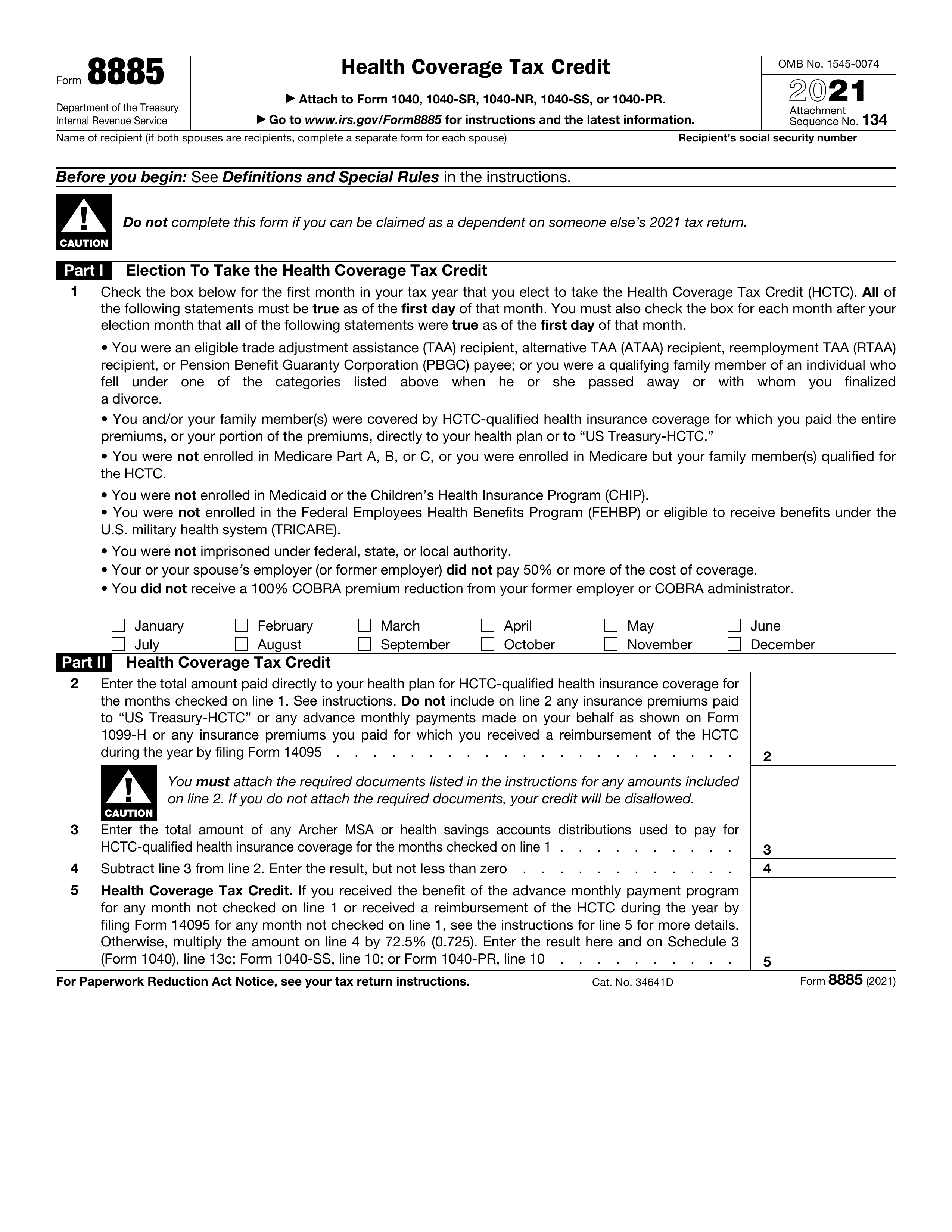

Form 8889 is essential for reporting activities related to Health Savings Accounts (HSAs). It allows you to report contributions made to your HSA, including those from your employer, and helps you calculate the tax deduction for these contributions. Additionally, it requires you to report any distributions from your HSA and determine whether those distributions are taxable and must be included in your income. Filling out this form ensures you can take advantage of the tax benefits associated with HSAs while remaining compliant with IRS regulations.

What is Form 8899 used for?

Form 8889 is important for individuals with Health Savings Accounts (HSAs). Here’s what it’s used for:

- Reporting HSA Contributions: Includes contributions from you and your employer.

- Calculating HSA Deduction: Determines your tax deduction for these contributions.

- Reporting Distributions: Tracks any withdrawals from your HSA.

- Tax Calculation: Figures out taxes on non-medical withdrawals.

- Eligibility Verification: Confirms you meet HSA eligibility requirements.

How to fill out Form 8899?

- 1

Review the instructions for Form 8889 thoroughly.

- 2

Gather all necessary documentation for your HSA contributions.

- 3

Fill out the HSA contributions and deduction sections accurately.

- 4

Ensure accuracy if filing jointly or separately with a spouse.

- 5

Report distributions from HSAs and earnings after death if applicable.

- 6

Complete Part II if the account beneficiary differs from the estate.

- 7

Include the form with your tax return when submitting.

Who is required to fill out Form 8899?

Individuals with Health Savings Accounts (HSAs) are responsible for completing Form 8889. They must report contributions and distributions related to their accounts.

HSA account holders who contributed to or took distributions from their HSAs during the tax year use Form 8889 to report activities and claim deductions on their federal income tax return.

When is Form 8899 not required?

You don't need to file Form 8889 if you don't have a Health Savings Account (HSA) or if you're not eligible for one. Additionally, if you aren't required to file a tax return, such as not being covered under a high deductible health plan (HDHP) or having other insurance coverage, you can skip this form.

When is Form 8899 due?

The deadline for Form 8889 is typically April 15. If this date falls on a Saturday, Sunday, or legal holiday, you can file it on the next business day. Make sure to submit the form by this date to report your Health Savings Account contributions and distributions.

How to get a blank Form 8899?

To get a blank Form 8889, Health Savings Accounts (HSAs), simply visit our website. This form is issued by the Internal Revenue Service (IRS) of the Department of the Treasury. Remember, our platform helps you fill out and download forms, but we do not assist with filing them.

Do you need to sign Form 8899?

No, you do not need to sign Form 8889. This form is used to report contributions and distributions from Health Savings Accounts and is attached to your tax return, which requires your name and social security number at the top. For the most accurate information, it's always a good idea to check for the latest updates. Once you've filled out the form using PDF Guru, you can easily download it for your records.

Where to file Form 8899?

Form 8889 must be submitted with your federal tax return, typically attached to Form 1040.

Mail it to the appropriate address for your tax return. Remember to keep HSA receipts for three years for potential audits.