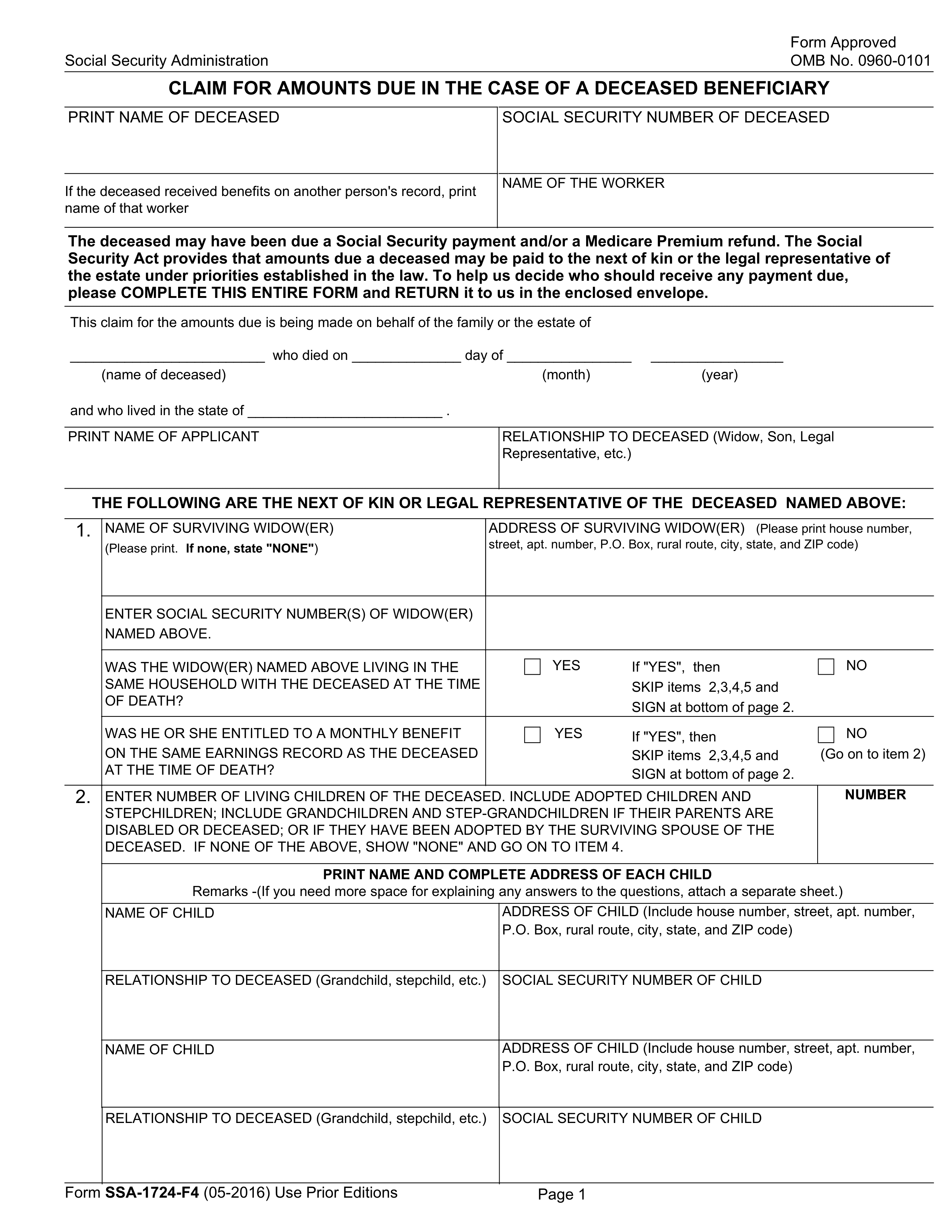

What is Form 8971?

Form 8971, "Information Regarding Beneficiaries Acquiring Property From a Decedent," is a vital tax form that the executor of an estate must complete. It reports the final value of property distributed to beneficiaries, ensuring that both the IRS and the beneficiaries receive accurate information. This helps maintain consistency in tax reporting and clarifies the value of inherited property. If the estate is required to file an estate tax return after July 2015, this form must be submitted to comply with regulations.

What is Form 8971 used for?

Form 8971 is important for managing estate distributions. Here's what it does:

- Reporting Values: Reports the final estate tax value of property to the IRS.

- Beneficiary Information: Gives each beneficiary a copy of their Schedule A, detailing the property they receive.

- Compliance: Ensures compliance with IRS regulations for estates filing Form 706 after July 31, 2015.

How to fill out Form 8971?

- 1

Enter the decedent’s name, date of death, and Social Security number (if available). Include the executor’s name, phone number, and Taxpayer Identification Number (TIN).

- 2

List all beneficiaries along with their TINs or Social Security numbers.

- 3

Prepare a copy of Form 8971 Schedule A for each beneficiary, including details of inherited property, valuation amount, and date of valuation.

- 4

Ensure to file Form 8971 with the IRS separately from the estate tax return (Form 706 or 706-NA).

Who is required to fill out Form 8971?

The executor of an estate or individuals required to file Form 706 or Form 706-NA are responsible for completing Form 8971. This includes anyone involved in the estate settlement process after the decedent's passing.

Once Form 8971 is completed, each beneficiary must receive a Schedule A detailing the property acquired. Executors are required to distribute these statements to both the IRS and beneficiaries within 30 days of the estate tax return's due date.

When is Form 8971 not required?

Form 8971 is not required if the gross estate plus adjusted taxable gifts is below the basic exclusion amount. Executors do not need to file it if they submit forms like 706-CE, 706-GS, or 706-QDT solely for GSTT or DSUE allocations. Additionally, if the executor files other estate tax-related forms, Form 8971 is unnecessary.

When is Form 8971 due?

The deadline for Form 8971 is 30 days after the estate tax return (Form 706) is filed with the IRS. If this due date lands on a Saturday, Sunday, or legal holiday, the executor can file on the next business day. Make sure to keep track of these dates to avoid any potential penalties.

How to get a blank Form 8971?

To get a blank Form 8971, issued by IRS, visit our website. The form is pre-loaded in our editor, allowing you to fill it out directly without needing to download a template. Remember, our platform aids in filling and downloading but does not support filing forms.

How to sign Form 8971 online?

The handwritten signature is placed in the designated signature area on the paper form. If filing electronically, follow IRS e-file signature procedures. After filling out the form on PDF Guru, download it, and ensure your signature is applied under penalties of perjury. Always check for the latest updates regarding IRS requirements to stay compliant.

Where to file Form 8971?

To submit Form 8971, you need to print it and prepare it for mailing. Remember, this form cannot be submitted online.

Once you have completed the form, send it to the Internal Revenue Service at the designated mailing address for Form 8971. Make sure to check the latest instructions for any updates. Do not attach Form 8971 to the estate’s Form 706 or Form 706-NA; it must be filed separately from any other estate tax returns.