What is Form ASIC 492?

Form 492, known as the Request for Correction, is essential for addressing errors in documents submitted to the Australian Securities and Investments Commission (ASIC). If you spot mistakes such as typos, incorrect dates, or inaccurate information on your submitted documents, this form allows you to correct them. It plays a crucial role in keeping your company records accurate and ensuring that your business information is correct. Remember, this form is intended solely for correcting past mistakes, not for updating current details.

What is Form ASIC 492 used for?

Form ASIC 492 is important for ensuring your company details are accurate. Here’s what it can do for you:

- Correct director details, including names or birth dates.

- Fix incorrect officeholder addresses.

- Amend spelling mistakes in registered or business addresses.

- Update shareholder information, such as share count or class.

- Change start or end dates for directors or secretaries.

- Resolve duplicate lodgements.

- Correct errors in original company registration forms.

- Fix details for AFS or credit licensees.

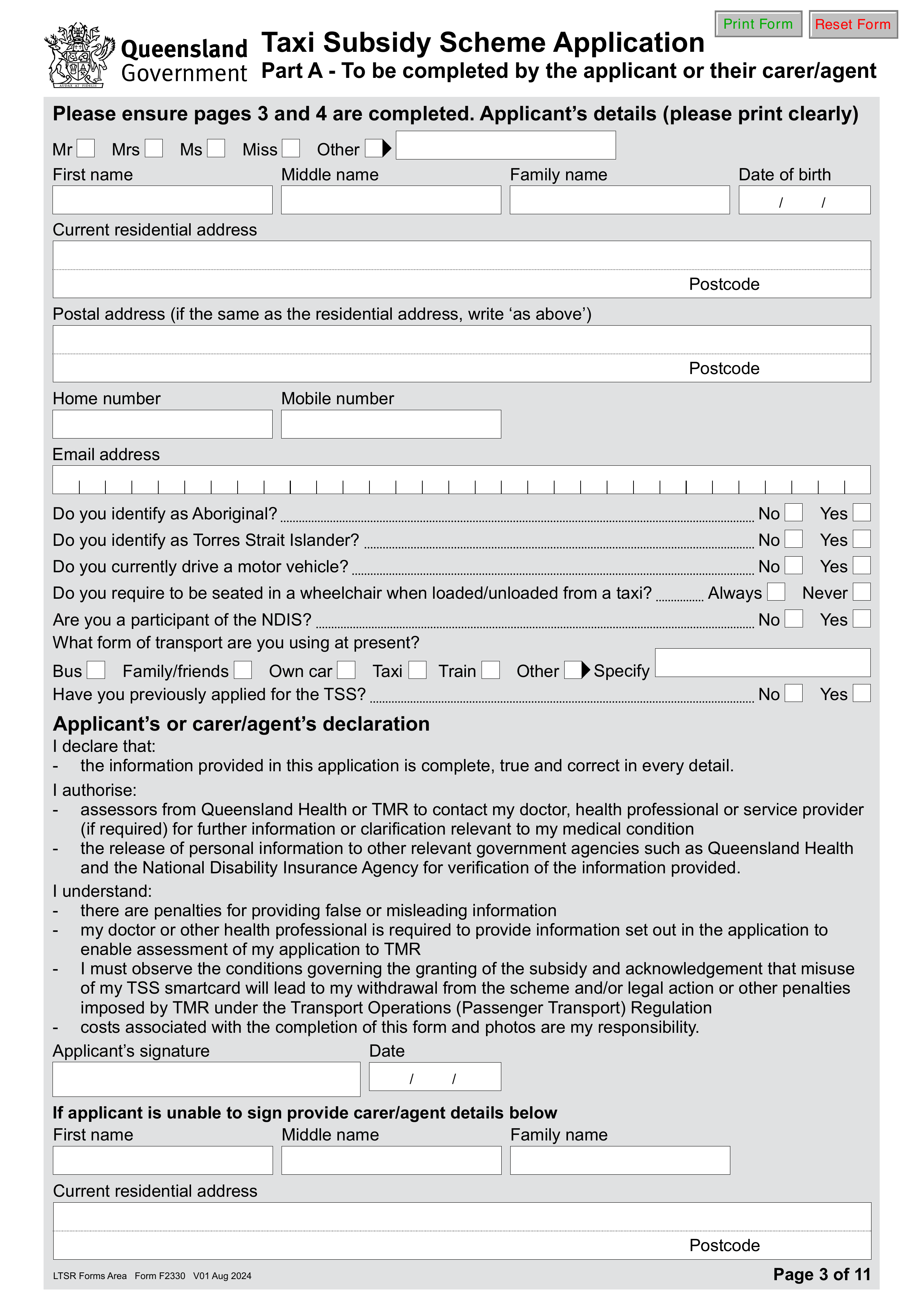

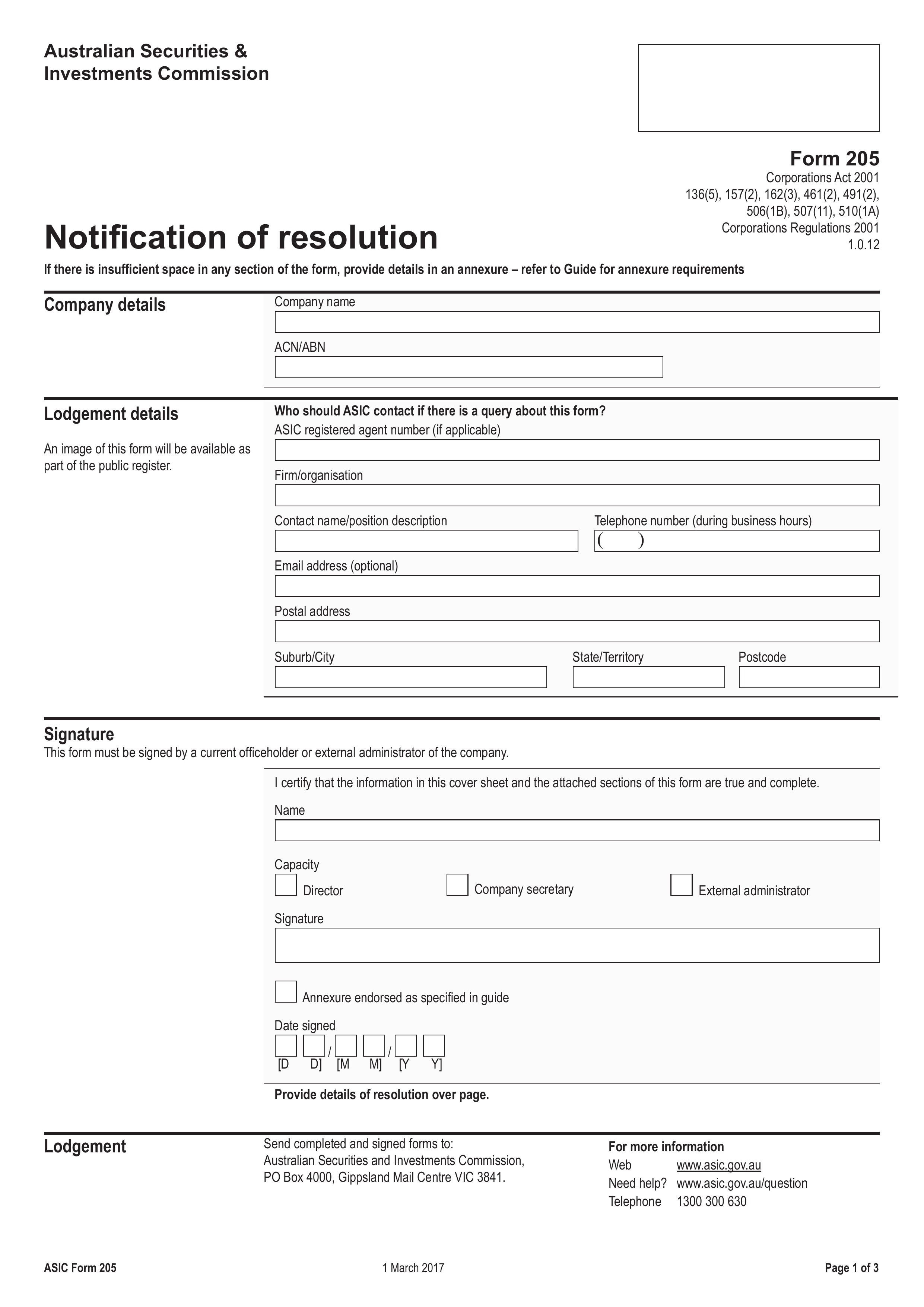

How to fill out Form ASIC 492?

- 1

Identify the error in your previously lodged document.

- 2

Provide the correct information in the relevant sections of Form 492.

- 3

Fill in the company/scheme details, including ACN/ARBN/ARSN/ABN and credit licence or representative number (if applicable).

- 4

Complete the lodgement details, including your contact information and postal address.

- 5

Attach any necessary supporting documents, like birth certificates or identification, if required.

Who is required to fill out Form ASIC 492?

Companies, foreign companies, and pooled groups are responsible for completing Form 492 to notify ASIC of corrections to previously lodged documents. Authorized representatives, such as current directors or secretaries, will sign the form to confirm the corrections.

When is Form ASIC 492 not required?

Form ASIC 492 isn't required for acquisitions that don’t need justification beyond full and open competition. Additionally, custom slaughter and processing operations under Public Law 90-492 are exempt from certain regulations, so they also do not need to file Form 492.

When is Form ASIC 492 due?

The deadline for Form ASIC 492 is not fixed. This form can be submitted at any time to correct factual mistakes in documents already lodged with ASIC. It should be mailed to ASIC, and there is no fee for submitting it. Use this form to fix errors such as typos, wrong addresses, or incorrect shareholder details, not for reporting new changes.

How to get a blank Form ASIC 492?

To get a blank Form ASIC 492, simply visit our platform. We have the form pre-loaded in our editor, ready for you to fill out. Remember, while our website allows you to fill and download the form, we do not support filing.

How to sign Form ASIC 492?

To sign Form 492 correctly, ensure you use a handwritten signature, as electronic or digital signatures are not accepted. The form must be signed by a current director, secretary, or registered agent. After filling out the form using PDF Guru, download it for your records. For any updates or changes to the signing process, it's recommended to check official sources regularly. Remember, PDF Guru facilitates filling and downloading, but not submission.

Where to file Form ASIC 492?

Form 492 can be submitted online by company officeholders, liquidators, and registered agents. Ensure you have all necessary details ready for a smooth online lodgement.

If you prefer paper submission, mail the completed form to the Australian Securities and Investments Commission (ASIC). Check Australia Post delivery times to avoid any delays or late fees.