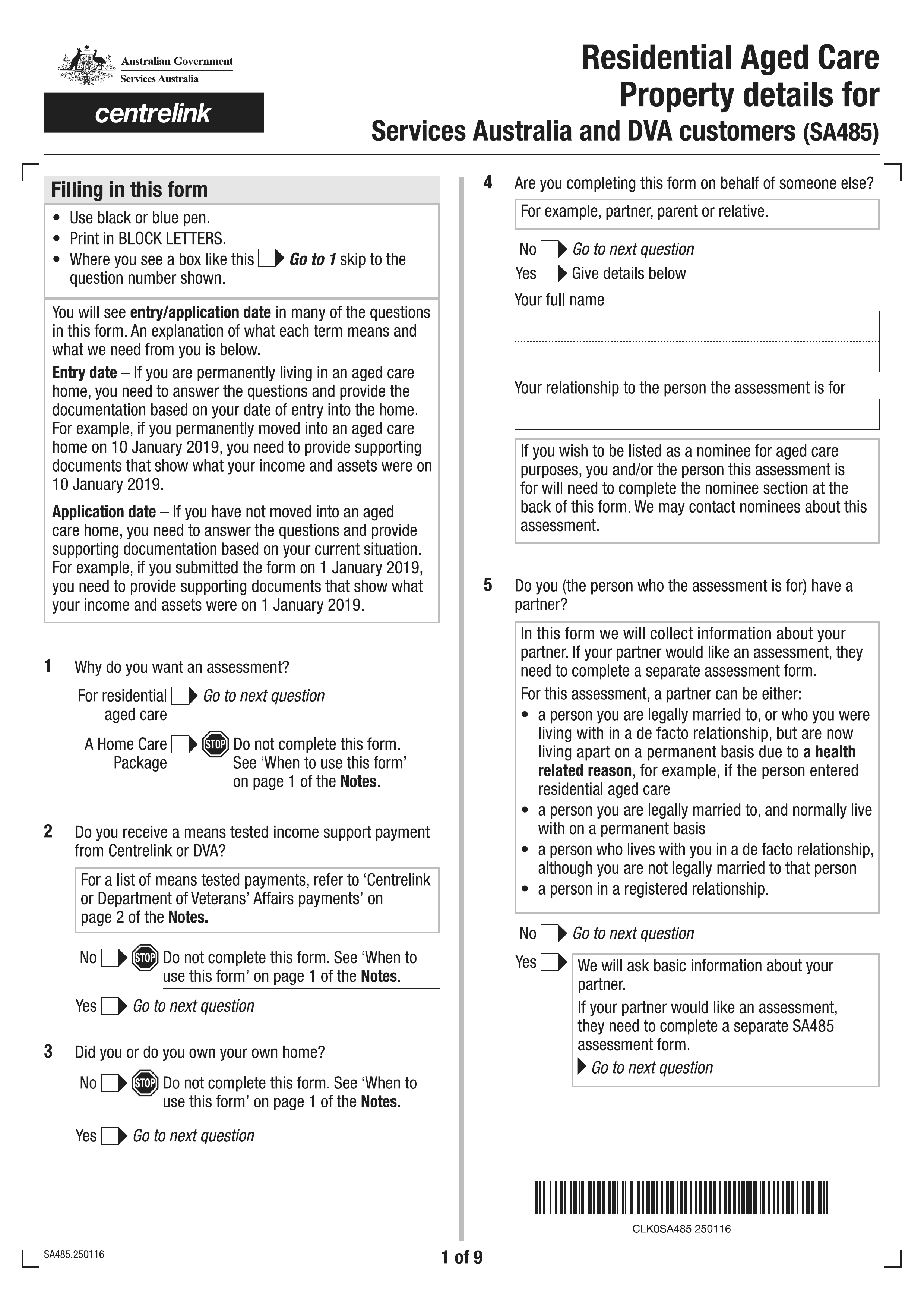

What is Form MOD IA?

The Income and Assets form (MOD IA) is essential for reporting your income and asset values to Services Australia. This form helps determine your eligibility for various payments, including pensions. By detailing your income sources—such as wages and investments—and listing your assets, like bank accounts and property, you enable Services Australia to accurately assess your financial situation. This assessment ensures you receive the correct benefits based on your current financial status, making it crucial to fill out the MOD IA form correctly.

What is Form MOD IA used for?

Form MOD IA is important for assessing financial situations. It serves several key purposes:

- Assessing Financial Situation: Evaluates an individual’s financial status.

- Determining Eligibility: Checks if someone qualifies for financial assistance, loans, or government programs.

- Calculating Benefits: Figures out the benefits or assistance amount based on income and assets.

- Reporting Income and Assets: Lists all income sources and total value of assets like bank accounts and property.

How to fill out Form MOD IA?

- 1

Gather all relevant financial documents, including pay stubs, tax returns, and bank statements.

- 2

List all sources of income, like salaries, rental income, and investments.

- 3

Calculate the total monthly or annual income by summing all sources.

- 4

Document all assets, including properties and savings accounts.

- 5

Evaluate the value of each asset and total them.

- 6

Clearly categorize the information into sections for income and assets in the form.

- 7

Double-check all entries for accuracy and completeness before downloading.

Who is required to fill out Form MOD IA?

Form MOD IA is completed by individuals seeking government benefits from Services Australia, including pensions and social security payments. These individuals provide essential information about their income and assets to support their claims for financial assistance.

When is Form MOD IA not required?

You don’t need to complete Form MOD IA if you’re not claiming any payments or providing details about your income and assets. This applies to individuals who aren’t applying for government assistance, loans, mortgages, rental housing, or financial assessments. If you fall into this category, you can skip this form entirely.

When is Form MOD IA due?

The deadline for Form MOD IA is when you are making a payment claim that requires reporting your income and assets. The exact due date varies based on the specific claim and the instructions given by Services Australia. Always check your claim details to ensure you submit the form on time.

How to get a blank Form MOD IA?

To get a blank Form MOD IA, simply visit our platform where you'll find the form pre-loaded in our editor. You can fill it out directly without needing to download a template from other sources. Remember, our website assists with filling and downloading forms, but not filing them.

How to sign Form MOD IA online?

To sign the Income and Assets form (MOD IA) correctly, you can create an electronic signature using PDF Guru. While this signature can be legally binding, ensure it meets necessary requirements outlined by ESIGN, UETA, and eIDAS. Remember, a simple signature like typing your name won't suffice. After filling out the form in our PDF editor, download it for your records. Always check for the latest updates to stay compliant, as PDF Guru does not support form submission.

Where to file Form MOD IA?

The Income and Assets form (MOD IA) must be submitted by mail. Ensure you have followed the instructions to find the correct authority to send it to.

Double-check the guidelines included with the form for the proper address. This ensures your submission reaches the right department without delay.