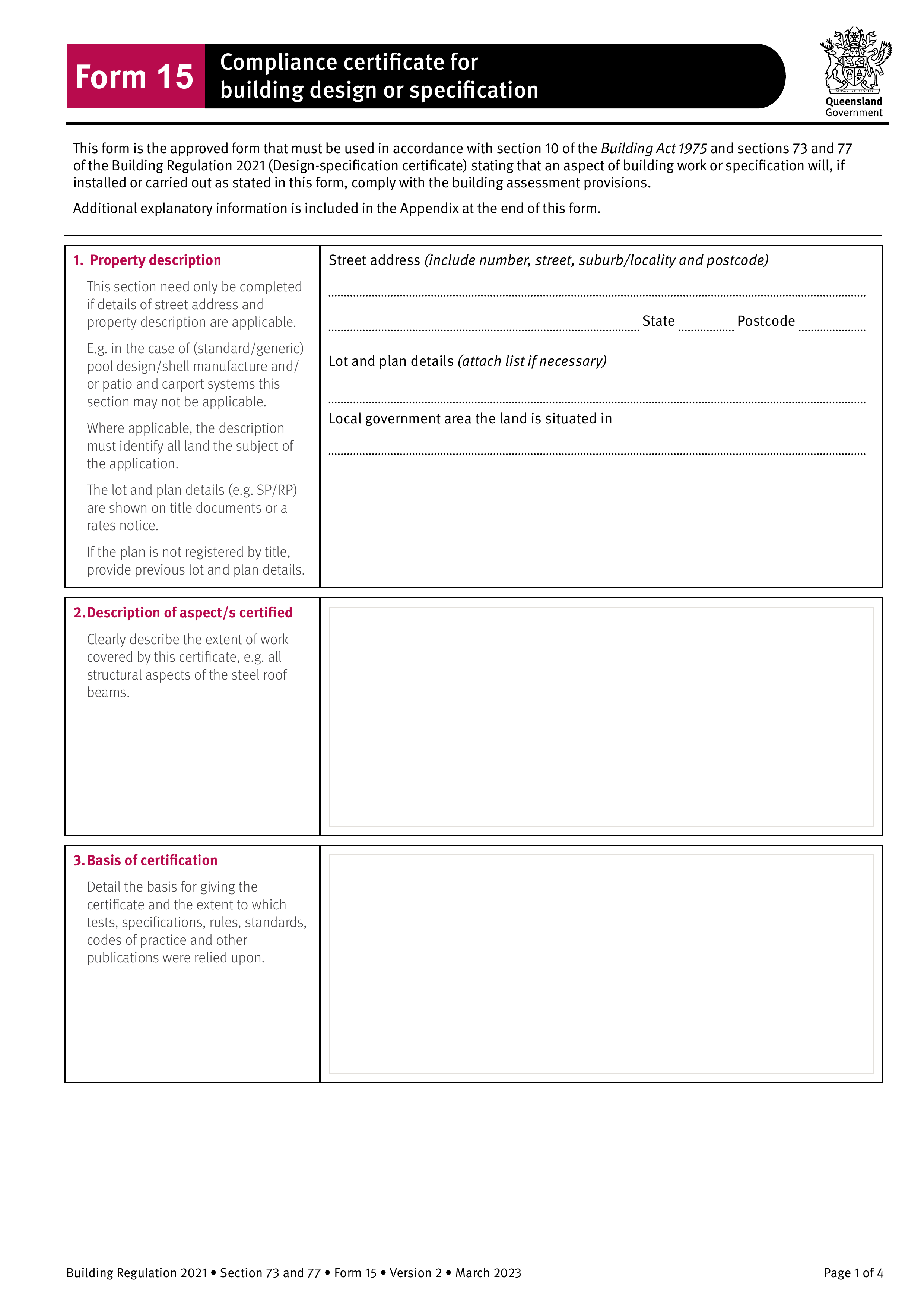

What is NAB Discharge Authority Form?

A Discharge Authority form is essential for homeowners who have fully repaid their home loan. This document informs your lender that you have satisfied your mortgage, allowing them to remove it from your property’s title. By completing this form, you confirm to both the lender and the public that there are no outstanding loan obligations on the property, enabling you to sell it or use it without any lingering financial ties.

What is NAB Discharge Authority Form used for?

Form NAB Discharge Authority is essential for managing your mortgage. It serves the following purposes:

- Notify Lender: Inform the lender to start the discharge of mortgage process.

- Release Security: Remove the lender's security interest from the property.

- Finalize Repayment: Confirm that the home loan has been fully repaid.

- Document Release: Ensure the release is documented as a matter of public record.

- Avoid Delays: Prevent unnecessary legal fees and complications with future real estate transactions.

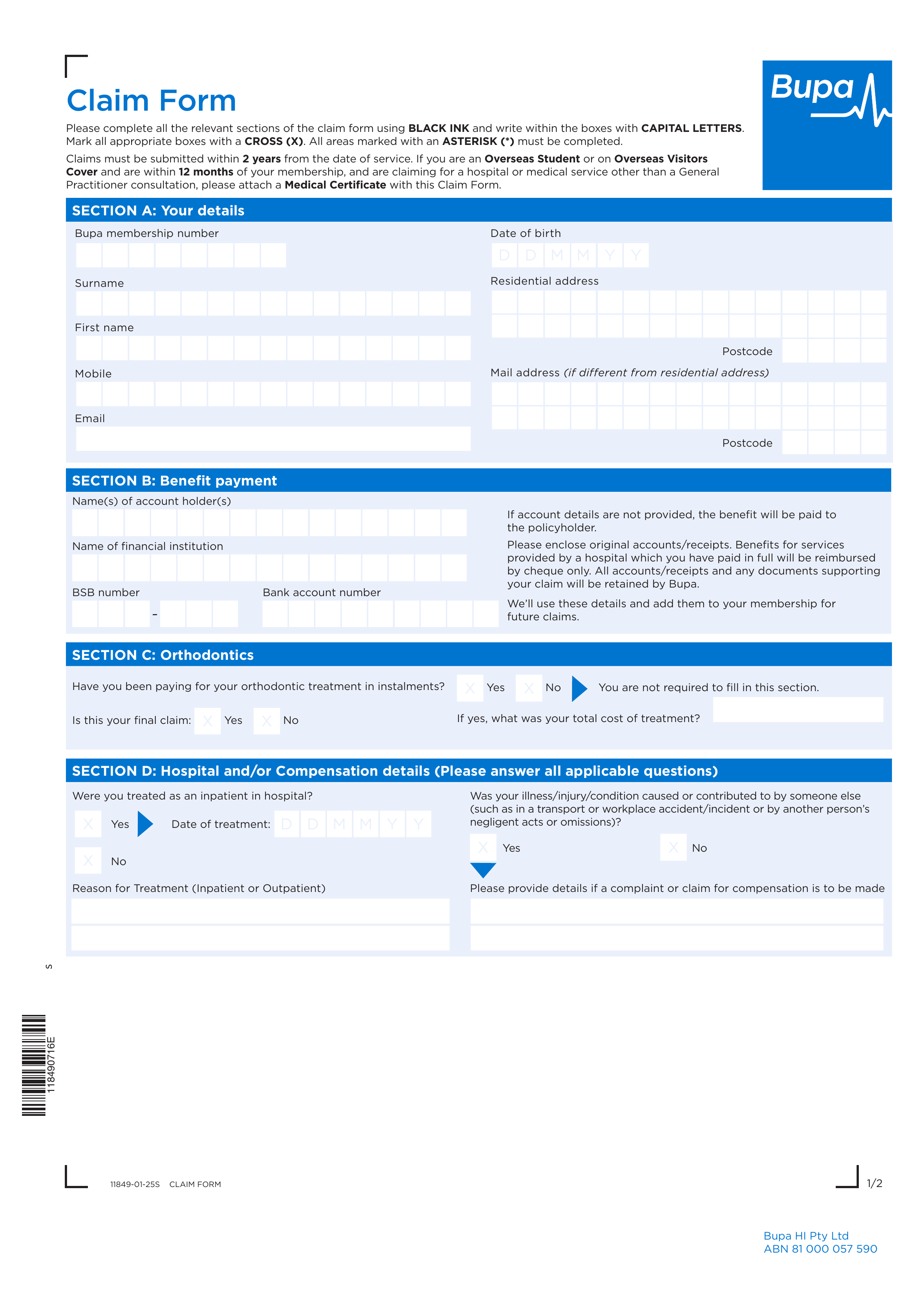

How to fill out NAB Discharge Authority Form?

- 1

Fill in necessary information in the form.

- 2

Ensure all details are correct and complete.

- 3

Submit the completed form to your broker or lender for processing.

- 4

Allow the minimum required processing time, typically 20 business days, before booking a settlement.

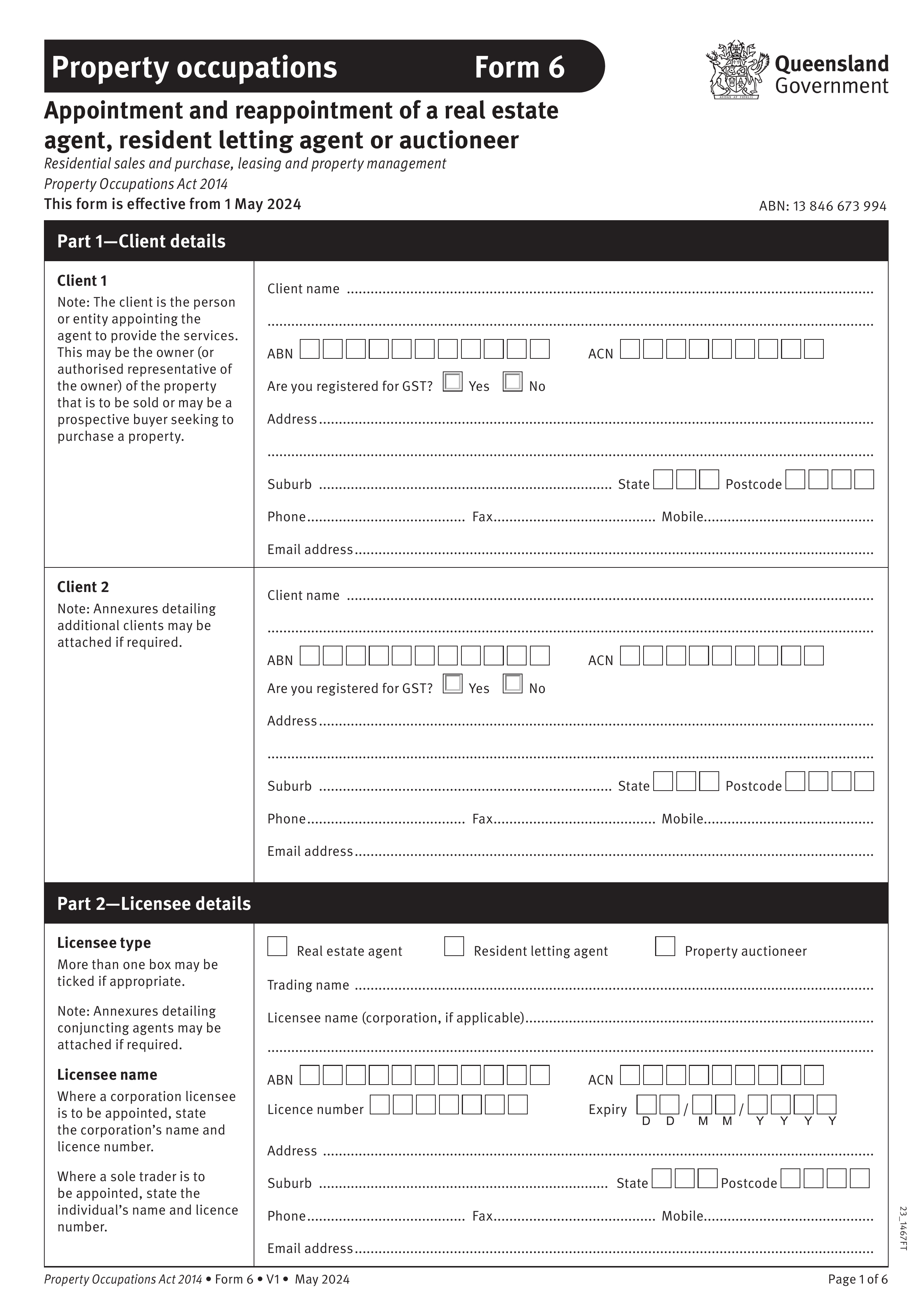

Who is required to fill out NAB Discharge Authority Form?

Homeowners, real estate agents, brokers, legal representatives, and financial institutions are responsible for completing the Discharge Authority Form to ensure accurate processing of mortgage discharges and property transfers.

After completion, homeowners and their representatives use the form for releasing properties from mortgages. Real estate agents and brokers help submit it to financial institutions, while legal representatives manage it during property transfers.

When is NAB Discharge Authority Form not required?

Form NAB Discharge Authority isn't needed when the property transfer is exempt. This includes transfers to a surviving joint tenant, a junior lienholder after foreclosure, or to a borrower in jointly owned property who continues to occupy it, provided the transfer happens after at least 12 months.

When is NAB Discharge Authority Form due?

The deadline for Form NAB Discharge Authority is at least one month before your planned discharge date in 2024. For 2025, it's important to monitor submission timelines to prevent any delays. Submitting the form on time is key to ensuring a smooth process for releasing your property from the mortgage agreement.

How to get a blank NAB Discharge Authority Form?

To get a blank Discharge Authority form, simply visit our website. The form is typically issued by financial institutions like the Bank of Melbourne. We have a pre-loaded version in our editor, ready for you to fill out. Remember, PDF Guru helps with filling and downloading but does not support filing forms.

How to sign NAB Discharge Authority Form?

To sign the NAB Discharge Authority Form, you should use a handwritten signature, as official sources do not allow electronic or digital signatures for this form. After filling out the form using PDF Guru, you can add your handwritten signature by printing it, signing it, and then scanning it back into a PDF. Always check for the latest updates regarding signing requirements to ensure compliance. Remember, PDF Guru allows you to fill and download the form, but submission must be handled separately.

Where to file NAB Discharge Authority Form?

To submit the Discharge Authority form, prepare it for mailing by ensuring all fields are completed and signed.

Send the signed form to the relevant party, like your broker or mortgage servicer, as it cannot be submitted online.