What is Form NAT 71121?

The Notice of Intent to Claim or Vary a Deduction for Personal Super Contributions (NAT 71121) is an essential form for super fund members. It allows you to notify your super fund about personal contributions made in a financial year. By completing this form, you can claim a tax deduction for these contributions or adjust an existing claim. This process is crucial to ensure you receive the correct deductions and prevent any complications with your tax return.

What is Form NAT 71121 used for?

Form NAT 71121 is an important tool for managing your super contributions. Here’s what it’s used for:

- Claiming a tax deduction for personal super contributions made from after-tax income.

- Increasing the amount of contributions claimed as a deduction by submitting a new notice.

- Reducing the amount of contributions claimed as a deduction by lodging a variation notice.

- Correcting errors in previously submitted notices, such as overestimating or underestimating deductions.

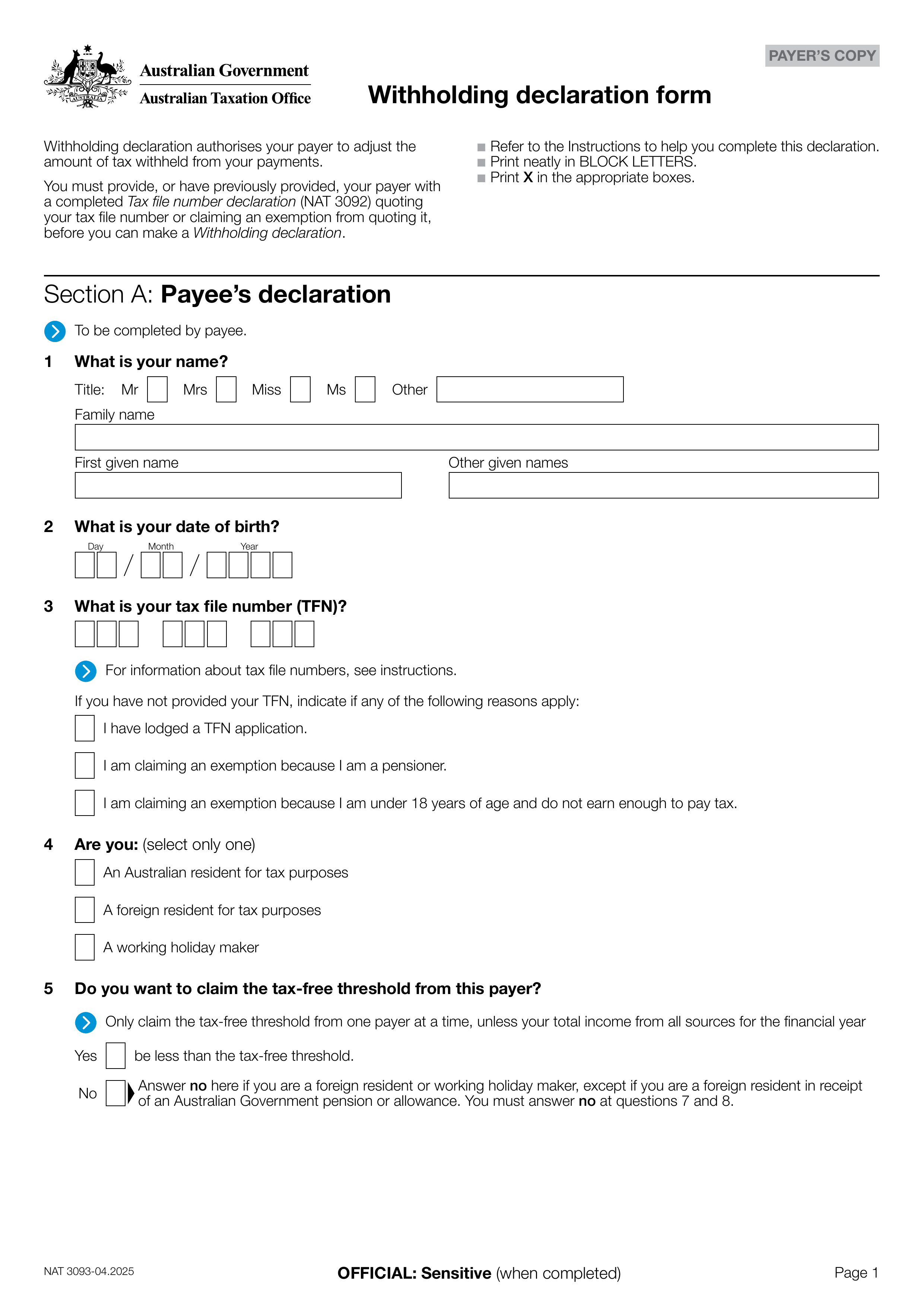

How to fill out Form NAT 71121?

- 1

Print clearly using a black pen only.

- 2

Use BLOCK LETTERS and print one character per box.

- 3

Place X in ALL applicable boxes.

- 4

Complete Section A: Your details (e.g., Tax file number, USI if known).

- 5

Complete Section B: Super fund’s details (e.g., Fund name, ABN, member account number).

- 6

Ensure the notice is in the approved form (NAT 71121).

Who is required to fill out Form NAT 71121?

Super fund members intending to claim a tax deduction for their personal super contributions are responsible for completing Form NAT 71121.

After filling out the form, these members submit it to their super fund to notify them of the intended deduction, ensuring proper acknowledgment and processing.

When is Form NAT 71121 not required?

You don’t need to complete Form NAT 71121 if you don’t plan to claim a tax deduction for your personal super contributions. Also, if you’ve already lodged your tax return and missed the deadline for claiming deductions, you can skip this form.

When is Form NAT 71121 due?

The deadline for Form NAT 71121 is the earlier of two dates: either the day you lodge your income tax return for the year when the contributions were made, or the last day of the income year after the contributions were made. Be sure to keep track of these dates to avoid any issues with your submission.

How to get a blank Form NAT 71121?

To get a blank Form NAT 71121 issued by the Australian Taxation Office, simply visit our platform. You'll find the form pre-loaded in our editor, ready for you to fill out. Remember, PDF Guru helps with filling and downloading forms, but not filing them.

How to sign Form NAT 71121 online?

To sign the NAT 71121 form, use a handwritten signature as official sources do not specify the acceptance of electronic or digital signatures. After filling out the form using PDF Guru, you can download it for your records. Remember to check for the latest updates regarding signature requirements before proceeding, as submission cannot be completed through our platform.

Where to file Form NAT 71121?

You can submit the NAT 71121 form by mailing it directly to your super fund. This is a reliable option to ensure your submission reaches the right place.

Alternatively, check if your super fund offers an online submission option. Funds like AustralianSuper allow you to complete the form on their website for convenience.