What is Form SA304(A)?

The SA304(A) form is essential for those seeking the Carer Payment in Australia. It collects important details about the income and assets of individuals aged 16 or over who are receiving care. This information is vital to confirm the financial circumstances of the person being cared for, allowing caregivers to qualify for their payment. The form must be completed by the individual receiving care or their nominee to ensure accurate assessment and support for the caregiver.

What is Form SA304(A) used for?

Form SA304(A) is essential for carers to ensure they receive the Carer Payment. Here’s what it’s used for:

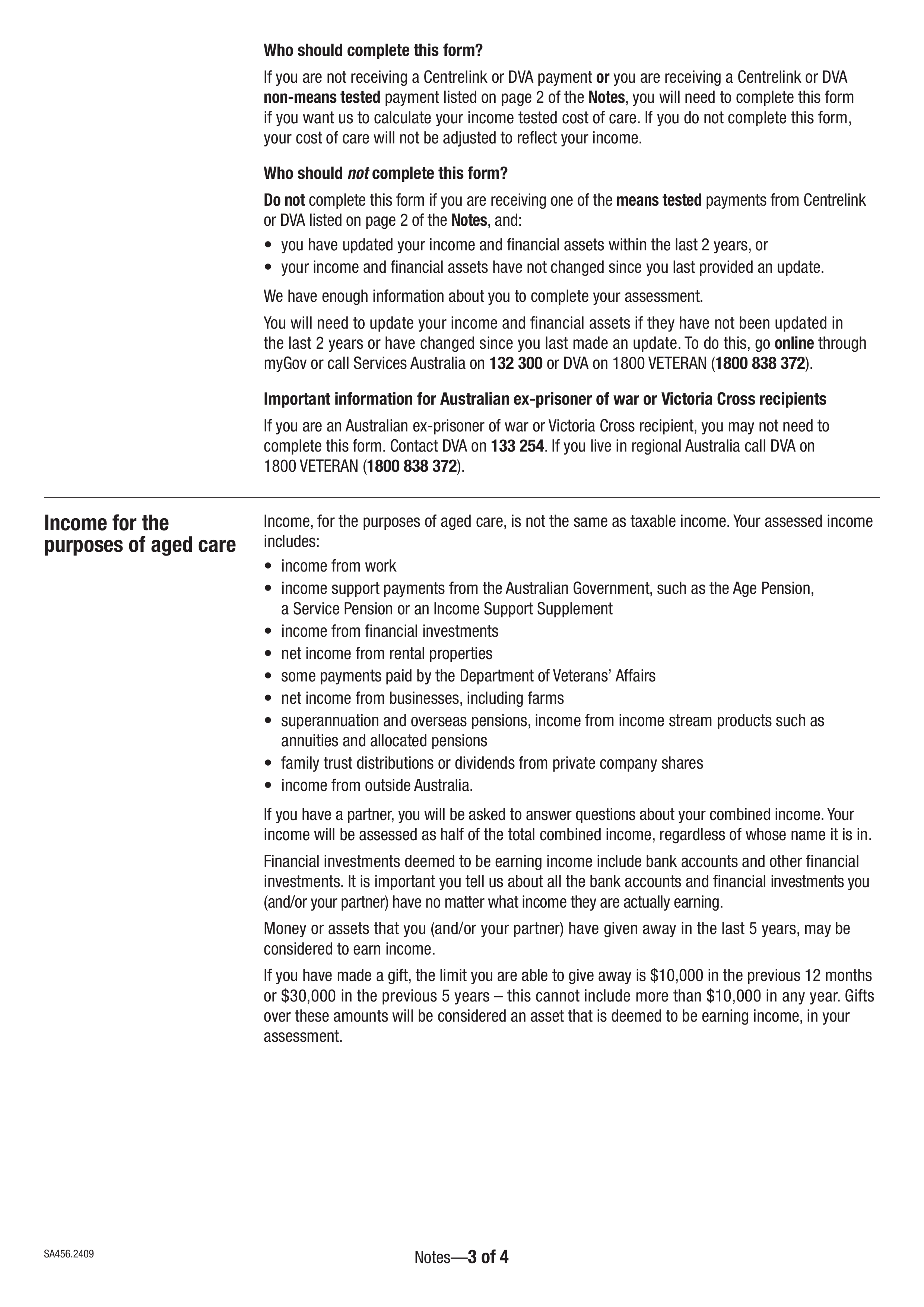

- Reports income and assets of the person being cared for.

- Assesses the financial situation for payment eligibility.

- Required for individuals aged 16 years or older who are receiving care.

How to fill out Form SA304(A)?

- 1

Fill in all necessary fields with accurate information about the person being cared for.

- 2

Review the form to ensure all required details are completed correctly.

- 3

Download the filled form for your records.

- 4

Submit the completed form to Services Australia for processing.

Who is required to fill out Form SA304(A)?

Form SA304(A) must be completed by the individual being cared for or their nominee. This ensures accurate income and asset details are provided.

Services Australia uses the information submitted in this form to process the Carer Payment, which supports individuals aged 16 years or older receiving care.

When is Form SA304(A) not required?

Form SA304(A) is not required for individuals under 16 years old or if you do not need financial support for caring for someone with a disability or serious illness. Additionally, if the person you care for does not meet the eligibility criteria for the Carer Payment, you do not need to fill out this form.

When is Form SA304(A) due?

The deadline for Form SA304(A) is 14 days from the date you complete it. Make sure to return the form along with any necessary supporting documents. Remember to answer all required questions and ensure the form is signed and dated to avoid any delays.

How to get a blank Form SA304(A)?

To get a blank Form SA304(A), simply visit our platform. You'll find the form pre-loaded in our editor, ready for you to fill out. Remember, PDF Guru assists with filling and downloading forms, but not filing them.

How to sign Form SA304(A) online?

To sign the Carer Payment - Income and assets details of the person being cared for - 16 years or over form (SA304(A)), an electronic signature is valid. Official guidance from Services Australia suggests using a trustworthy solution that adheres to eSignature laws. PDF Guru allows you to create simple electronic signatures for your forms. Remember to check for the latest updates and download your completed form, as PDF Guru does not support submission.

Where to file Form SA304(A)?

You can submit the Carer Payment form SA304(A) online through the Centrelink online portal. This method is fast and convenient.

Alternatively, you can mail the completed form to the address specified by Services Australia. Ensure you check the correct mailing details before sending.