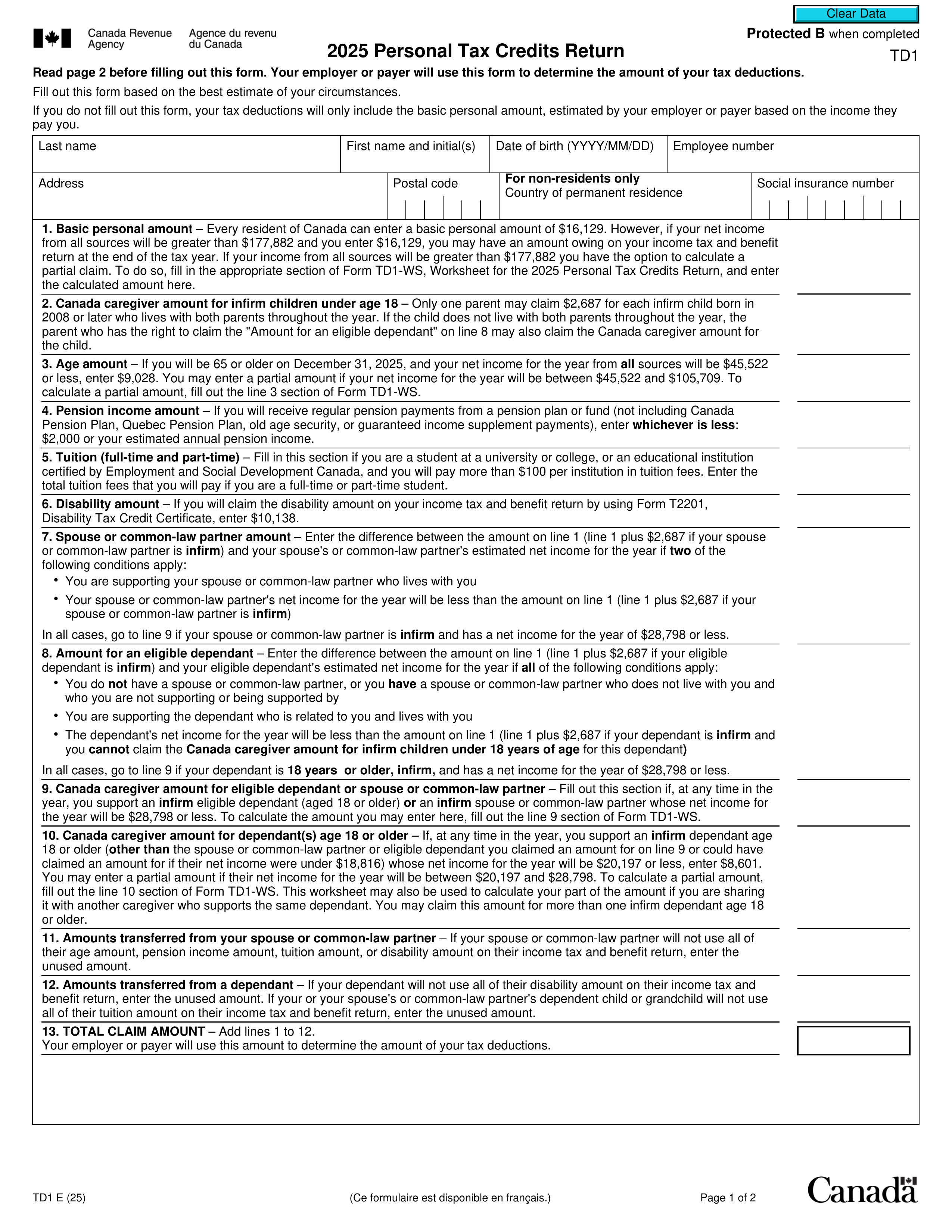

What is Form TD1NS-WS?

The Form TD1NS-WS Worksheet for the 2025 Nova Scotia Personal Tax Credits Return is designed to assist you in calculating partial claims for specific tax credits. If your expected income falls between $25,000 and $75,000, this worksheet will help you determine the appropriate amount of additional tax credit you can claim. Accurately completing this form is crucial for ensuring that your provincial tax deductions reflect your income, allowing you to receive the correct tax credits that you are entitled to.

What is Form TD1NS-WS used for?

Form TD1NS-WS is important for managing your tax credits in Nova Scotia. Here’s what it helps with:

- Calculate partial claims for those earning between $25,000 and $75,000.

- Enter unused amounts for dependents with leftover disability, tuition, or education credits.

- Determine tax deductions for employers or payers on provincial tax.

- Update personal details when changing jobs or if your situation changes.

How to fill out Form TD1NS-WS?

- 1

Fill out the worksheet to calculate partial claims for eligible tax credits.

- 2

Ensure you have all necessary information, including your age and estimated taxable income.

- 3

Complete the sections for the basic personal amount and age amount.

- 4

Keep the filled-out worksheet for your records; do not submit it to your employer or payer.

- 5

Use the calculated amounts on Form TD1NS for your tax credits return.

Who is required to fill out Form TD1NS-WS?

Individuals calculating partial claims for eligible tax credits must complete Form TD1NS-WS. This includes those considering factors like taxable income and age.

Employers or payers use the completed form to determine provincial tax deductions, ensuring accurate adjustments to meet the individual's tax obligations.

When is Form TD1NS-WS not required?

You don’t need Form TD1NS-WS if your taxable income is $25,000 or less, or over $75,000. If you’re under 65, or your net income falls outside these ranges, skip the worksheet. Non-residents are also exempt unless they meet certain conditions.

When is Form TD1NS-WS due?

The deadline for Form TD1NS-WS is December 31, 2025. This worksheet is for personal use only and helps you calculate your eligible tax credits. Remember, you do not submit this form to your employer; it's used to assist in filling out the official TD1NS form for tax deductions.

How to get a blank Form TD1NS-WS?

To get a blank Form TD1NS-WS, simply visit our platform. The Canada Revenue Agency issues this form for Nova Scotia, and we have a blank version ready for you to fill out. Remember, our website aids in filling and downloading but not filing forms.

Do you need to sign Form TD1NS-WS?

You do not need to sign the Form TD1NS-WS Worksheet for the 2025 Nova Scotia Personal Tax Credits Return. This form is merely a worksheet meant for calculating partial claims for eligible tax credits, and it is intended for your records. To fill out the form, use PDF Guru to complete it and download your copy. Always check for the latest updates regarding form requirements.

Where to file Form TD1NS-WS?

After completing the TD1NS-WS Worksheet for the 2025 Nova Scotia Personal Tax Credits Return, keep it for your records.

You don't need to submit this form anywhere. Your employer or payer will use it to calculate your provincial tax deductions.