What is CGW (Capital Gains Worksheet)?

The Qualified Dividends and Capital Gain Tax Worksheet helps you calculate the tax owed on certain types of income. This form is important because it distinguishes between regular income and more favorable tax rates for qualified dividends and capital gains. Completing this worksheet ensures you're paying the correct amount of tax, which can save you money. Understanding how to fill it out correctly is essential for accurate tax filing and compliance with IRS guidelines.

What is the Capital Gains Worksheet used for?

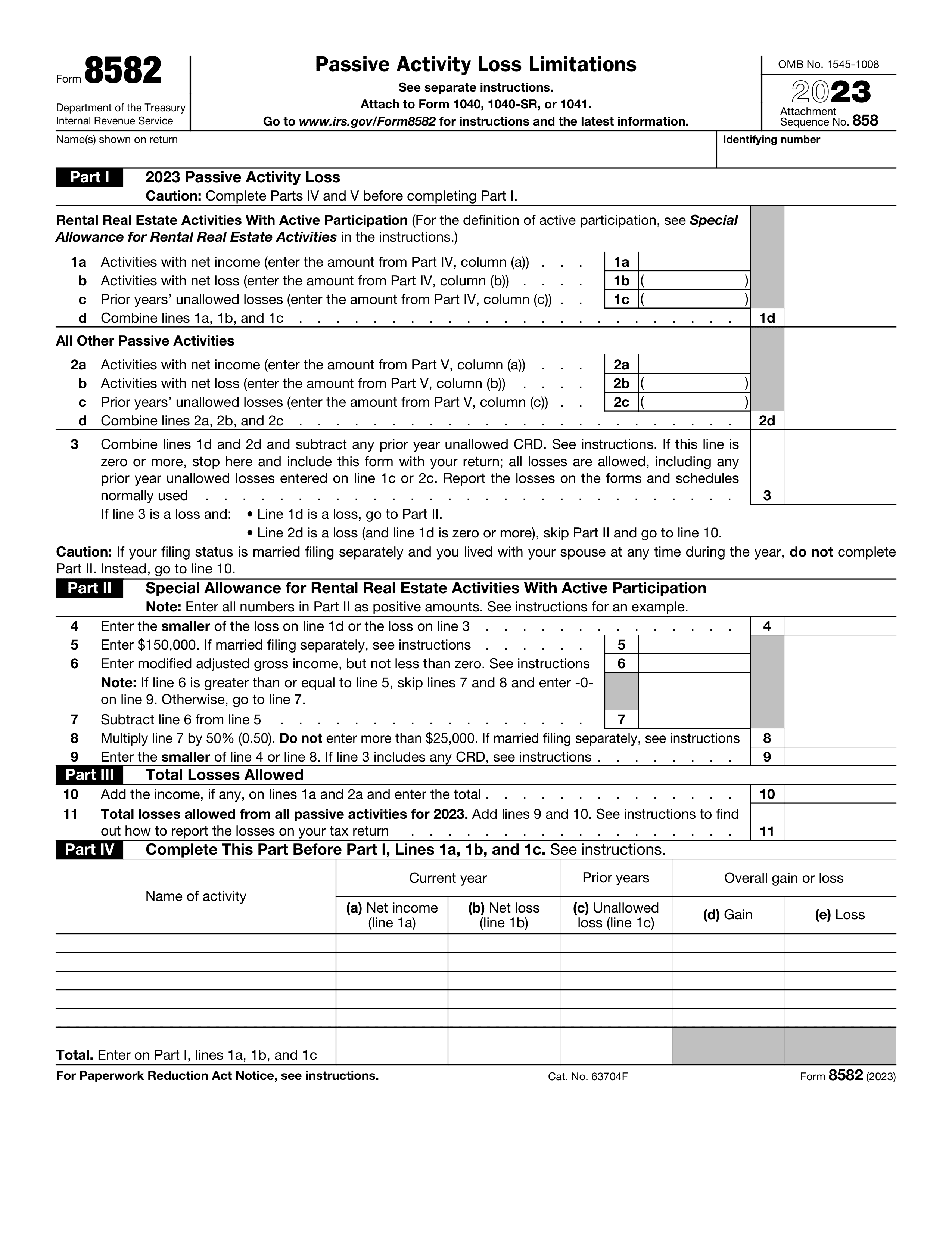

Capital Gains Worksheet helps taxpayers calculate their tax on capital gains and qualified dividends. Here’s what it’s used for:

- to determine tax rates on capital gains.

- to calculate the tax owed on qualified dividends.

- to ensure accurate reporting of income.

How to fill out a Capital Gains Worksheet?

- 1

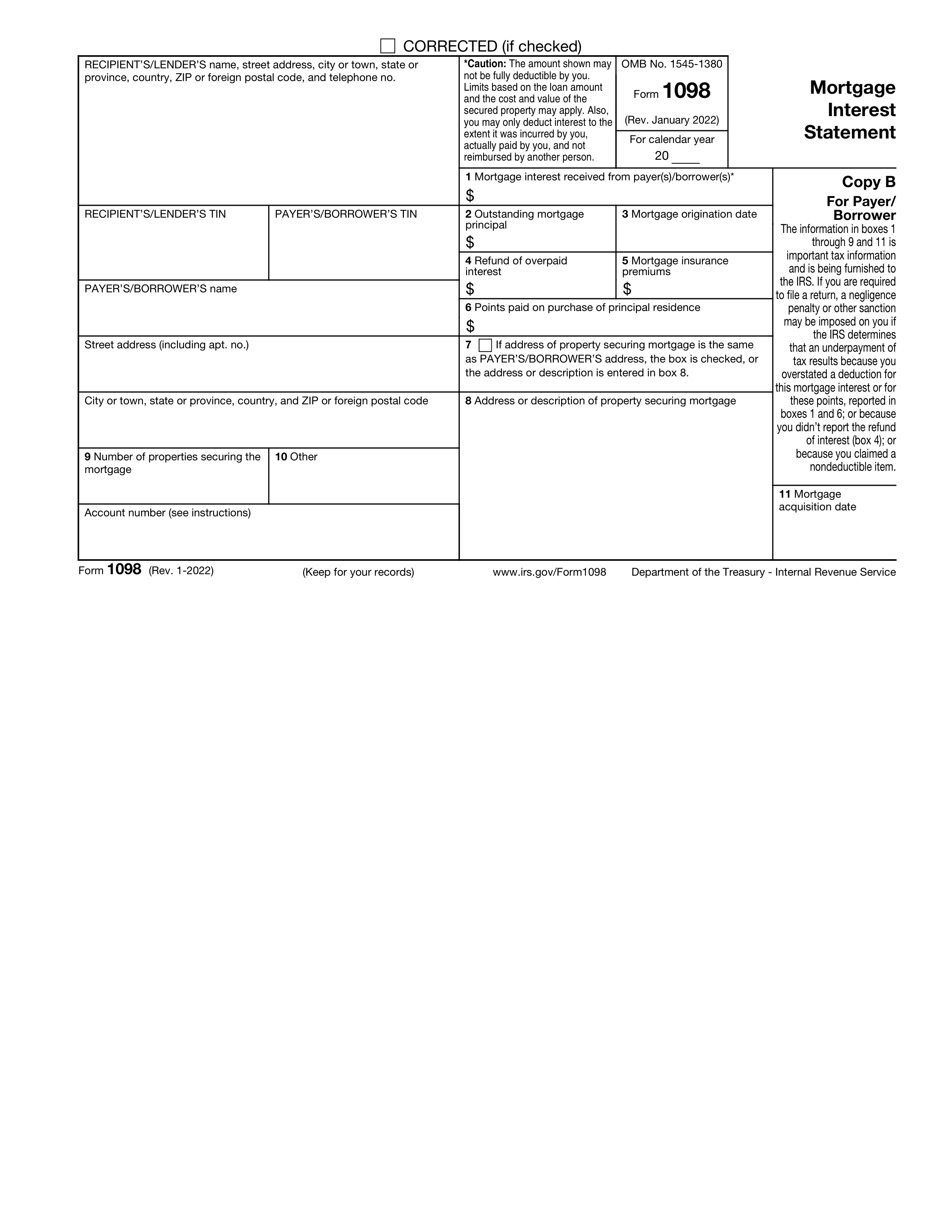

Gather your financial documents, including Form 1099-DIV and any relevant records of stock sales.

- 2

Locate the Capital Gains Worksheet in your PDF editor.

- 3

Fill in your total capital gains and losses from sales.

- 4

Input qualified dividends in the designated line.

- 5

Calculate the tax by following the instructions on the worksheet.

- 6

Review your entries for accuracy.

Who is required to fill out a Capital Gains Worksheet?

Taxpayers with capital gains or qualified dividends must complete the Capital Gains Worksheet. This includes individuals and businesses reporting investment income.

After completion, it’s used by the IRS to assess tax liability and by taxpayers to calculate owed taxes.

When is a Capital Gains Worksheet not required?

You don't need to file the Qualified Dividends and Capital Gain Tax Worksheet if your taxable income is below certain thresholds. For example, if your total taxable income is less than $40,400 for single filers or $80,800 for married couples filing jointly, you can skip this worksheet.

Additionally, if your only capital gains come from assets held for more than one year and fall into the zero percent capital gains tax bracket, this form is unnecessary.

When is a Capital Gains Worksheet due?

The deadline for the Capital Gains Worksheet is the same as your tax return filing date. Typically, this is April 15 unless it falls on a weekend or holiday.

Make sure to gather all necessary documents, including your Form 1099-DIV, to accurately fill out the worksheet. This will help ensure you report your dividends and capital gains correctly, avoiding any issues with the IRS.

How to get a blank Capital Gains Worksheet?

To get a blank Capital Gains Worksheet, simply visit our website. The form is pre-loaded in our editor, ready for you to fill out. After completing the necessary fields, you can download your finished form for future use.

Do you need to sign a Capital Gains Worksheet?

Capital Gains Worksheet does not require a signature according to current guidelines. However, it’s always a good idea to check the latest information from the IRS.

Tax regulations can change, so verifying through official sources is essential. This helps minimize any potential issues with your tax filing.

Where to file the Capital Gains Worksheet?

You can file the Qualified Dividends and Capital Gain Tax Worksheet by mail. This is done by printing the completed form and sending it with your tax return.

Currently, there is no option to file this worksheet online. Always ensure that your information is accurate to avoid delays in processing.