What is Form DR 0107?

Form DR 0107 is the Colorado Nonresident Partner or Shareholder Agreement. This form is important for nonresident partners or shareholders of a Colorado business to report their income accurately to the state. It ensures that nonresidents pay the correct amount of state tax on their share of income. Completing this form helps maintain compliance with Colorado tax laws and avoids potential penalties. It is crucial for both the business and the individual to properly fill out this form to prevent any issues with the state tax authority.

What is Form DR 0107 used for?

Form DR 0107 is used for reporting Colorado income by nonresident partners or shareholders. Here’s what it’s used for:

- to declare income earned in Colorado.

- to ensure proper tax compliance.

- to establish the partnership or corporation’s tax responsibility.

How to fill out Form DR 0107?

- 1

Open Form DR 0107 in the PDF editor.

- 2

Fill in your name, address, and identification details accurately.

- 3

Provide information about the partnership or corporation, including tax ID numbers.

- 4

Complete the sections related to the distribution of income and responsibilities.

- 5

Review all entries for accuracy.

- 6

Sign the form electronically.

- 7

Download the completed form for submission to the Colorado Department of Revenue.

Who is required to fill out Form DR 0107?

Nonresident partners or shareholders of Colorado partnerships or S corporations complete form DR 0107 for tax purposes. Afterward, it is used by individuals not residing in Colorado who earn income from these entities.

When is Form DR 0107 not required?

A nonresident partner or shareholder does not need to file form DR 0107 if they are included in a composite return (Form 106) submitted by the partnership or S corporation.

Additionally, if the partnership or S corporation opts to withhold and remit the applicable tax on behalf of the nonresident partner or shareholder using Form DR 0108, the DR 0107 form is also unnecessary.

When is Form DR 0107 due?

The deadline for Form DR 0107 is April 15, 2025, for the 2024 tax year. The form must be submitted by the partnership or S corporation along with Form DR 0106. If April 15 falls on a weekend or holiday, it is due the next business day.

This form is only required for the year the agreement is made and should be filed with the Colorado Department of Revenue. It's important to keep track of these dates to avoid any penalties.

How to get a blank Form DR 0107?

To obtain a blank form DR 0107, Colorado Nonresident Partner or Shareholder Agreement, you can visit our website where we have this form pre-loaded for you to fill out. The Colorado Department of Revenue issues this form.

How to sign Form DR 0107 online?

To sign form DR 0107, start by accessing the form on PDF Guru. Click on "Fill Form" to open the blank version in the PDF editor. Complete the necessary fields, then use the electronic signature option to create your signature where required.

After signing, click "Done" to download your completed form. Remember to check Colorado's official guidelines for any specific signature requirements related to this form before submitting it.

Where to file Form DR 0107?

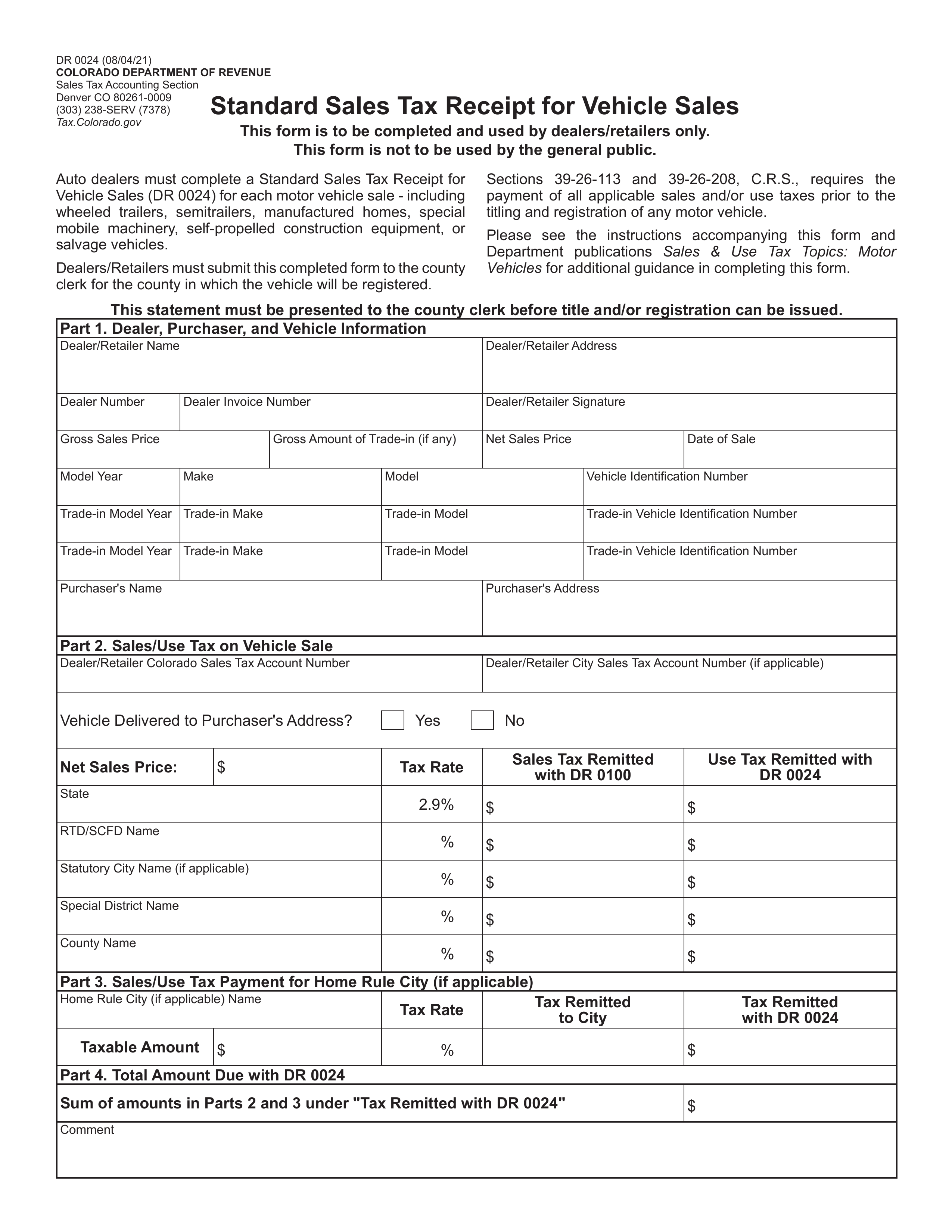

Form DR 0107 must be submitted to the county clerk for the Colorado Department of Revenue.

Submission methods: mail or electronic.