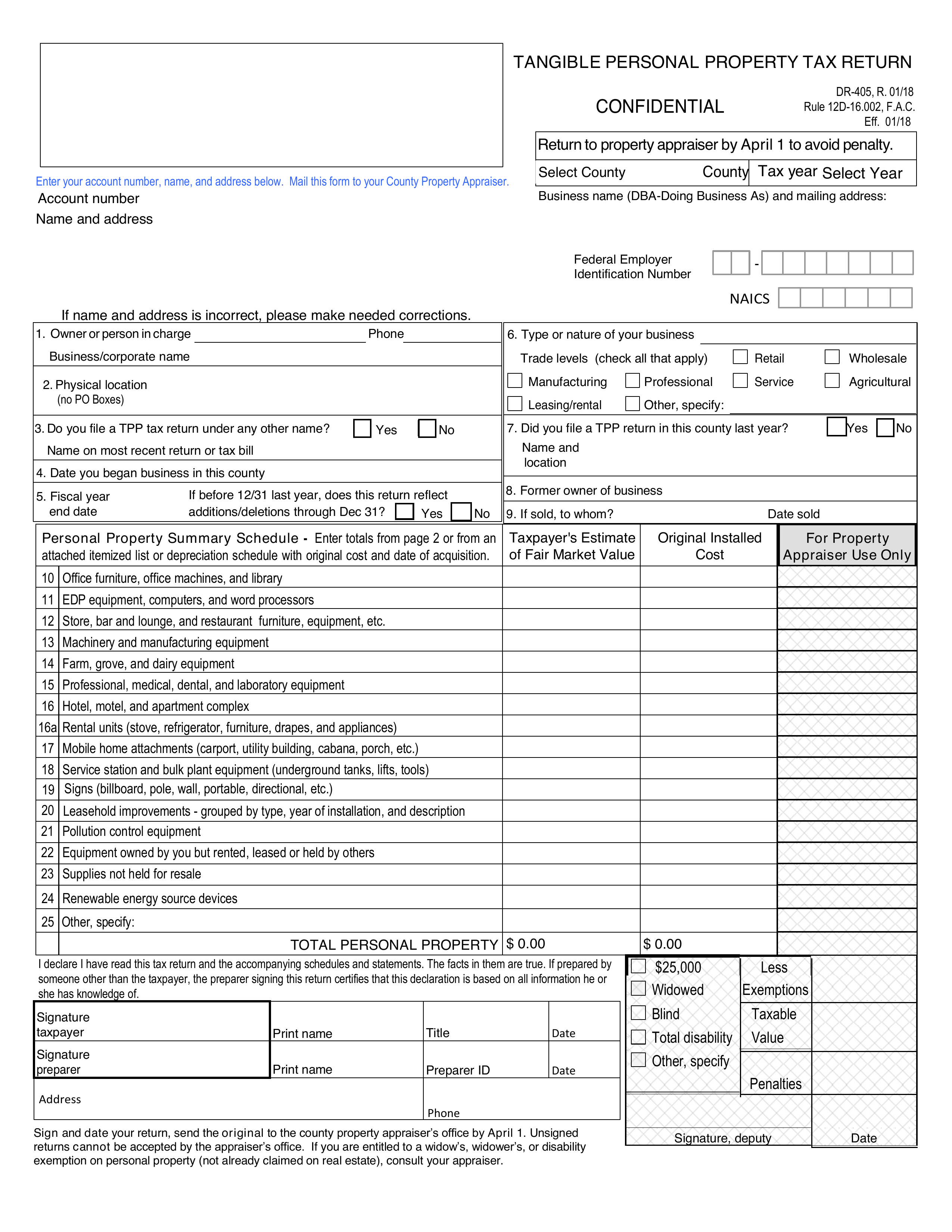

What is Form DR-501?

Form DR-501 is the Florida Homestead Exemption Application. Its purpose is to help homeowners in Florida reduce their property taxes on their primary residence. By filing this form, you can qualify for a tax exemption that lowers the assessed value of your home, resulting in potential savings. This exemption is important because it makes homeownership more affordable and encourages stability in communities. Completing this form accurately ensures you receive the benefits you deserve as a homeowner.

What is Form DR-501 used for?

Form DR-501 is the Florida Homestead Exemption Application used to apply for tax exemptions on your primary residence:

- to reduce property taxes.

- to qualify for additional exemptions.

- to protect your home from creditors.

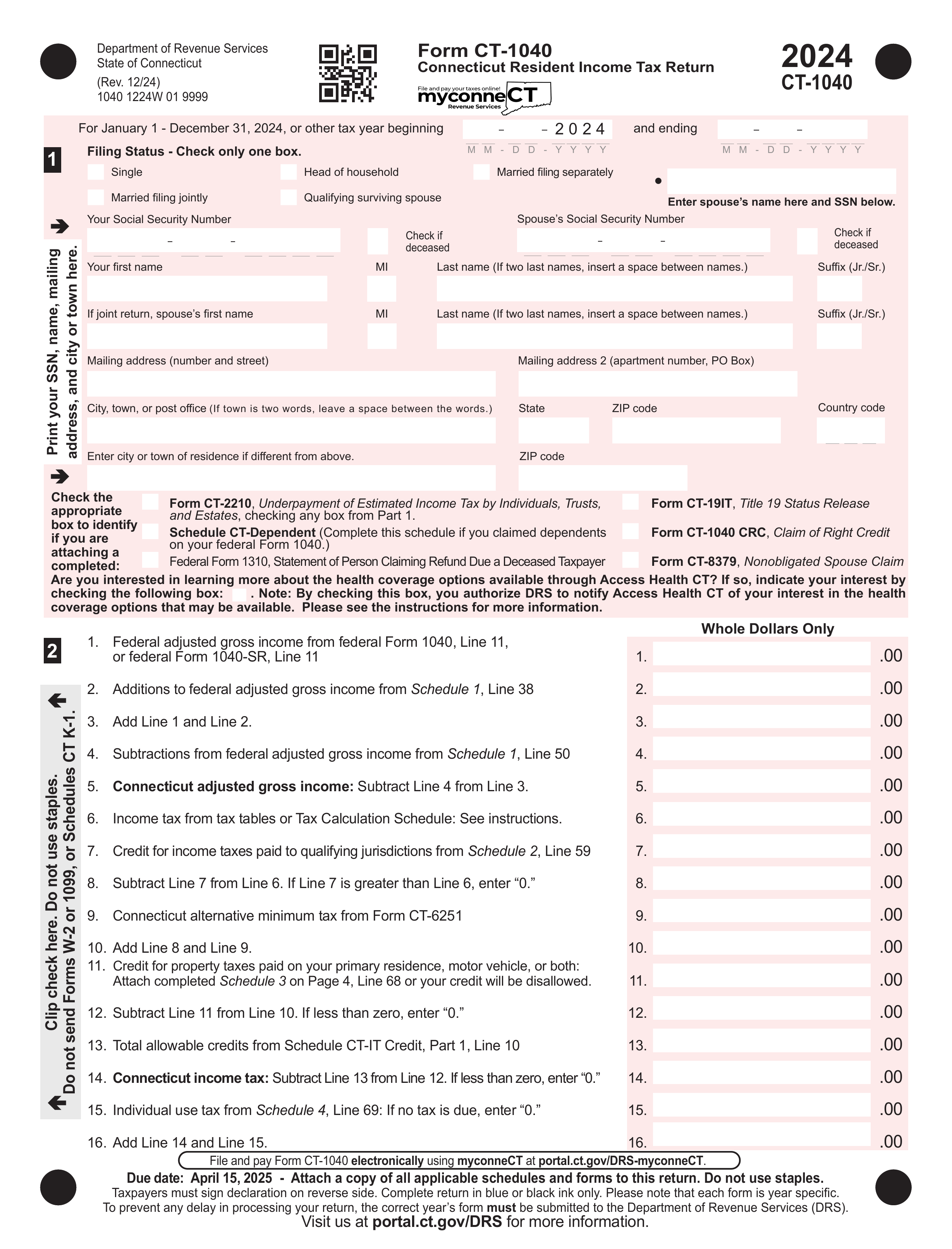

How to fill out Form DR-501?

- 1

Open Form DR-501 in the PDF editor.

- 2

Fill in your name, address, and other required information accurately.

- 3

Indicate if you are applying for a new exemption or renewing an existing one.

- 4

Attach any necessary documentation, like proof of residency.

- 5

Review all entries for accuracy.

- 6

Click Done to download the completed form.

- 7

Submit the form to your local property appraiser's office by the specified deadline.

Who is required to fill out Form DR-501?

Form DR-501 is completed by property owners claiming the Homestead Exemption in Florida. This includes new homeowners and those occupying their permanent residence as of January 1.

After filing, local property appraisers use the form to determine eligibility for tax exemptions.

When is Form DR-501 not required?

You don't need to file Form DR-501 if you already have an approved Homestead Exemption on your property. The exemption renews automatically each year unless there are changes in ownership or the property's use.

Additionally, if you don't meet the eligibility requirements—such as not owning or occupying the property as your permanent residence as of January 1—you do not need to submit this form.

When is Form DR-501 due?

The deadline to file Form DR-501 is March 1 of the year for which you are claiming the exemption. Late applications may be accepted under certain circumstances, but only up to 25 days after the mailing of the Notice of Proposed Property Taxes (TRIM Notice), typically sent in August. After this period, no applications will be accepted for that tax year.

It is recommended to file as early as possible to ensure timely processing and avoid missing the deadline. Gathering all necessary documents in advance can help make the process smoother.

How to get a blank Form DR-501?

Our platform has a pre-loaded version ready for you to fill out. After completing it, you can download the form for your records.

Form DR-501 is issued by the Florida Department of Revenue.

How to sign Form DR-501 online?

To sign form DR-501 using PDF Guru, first open the form in the PDF editor by clicking "Fill Form." Fill in the required fields accurately. Once completed, click "Done" to download the form.

Next, create a simple electronic signature within PDF Guru. Remember to consult official sources for any specific signature requirements before submitting the application.

Where to file Form DR-501?

Form DR-501 must be submitted to the local county property appraiser's office where the property is located.

Submission methods: online, mail or in-person.