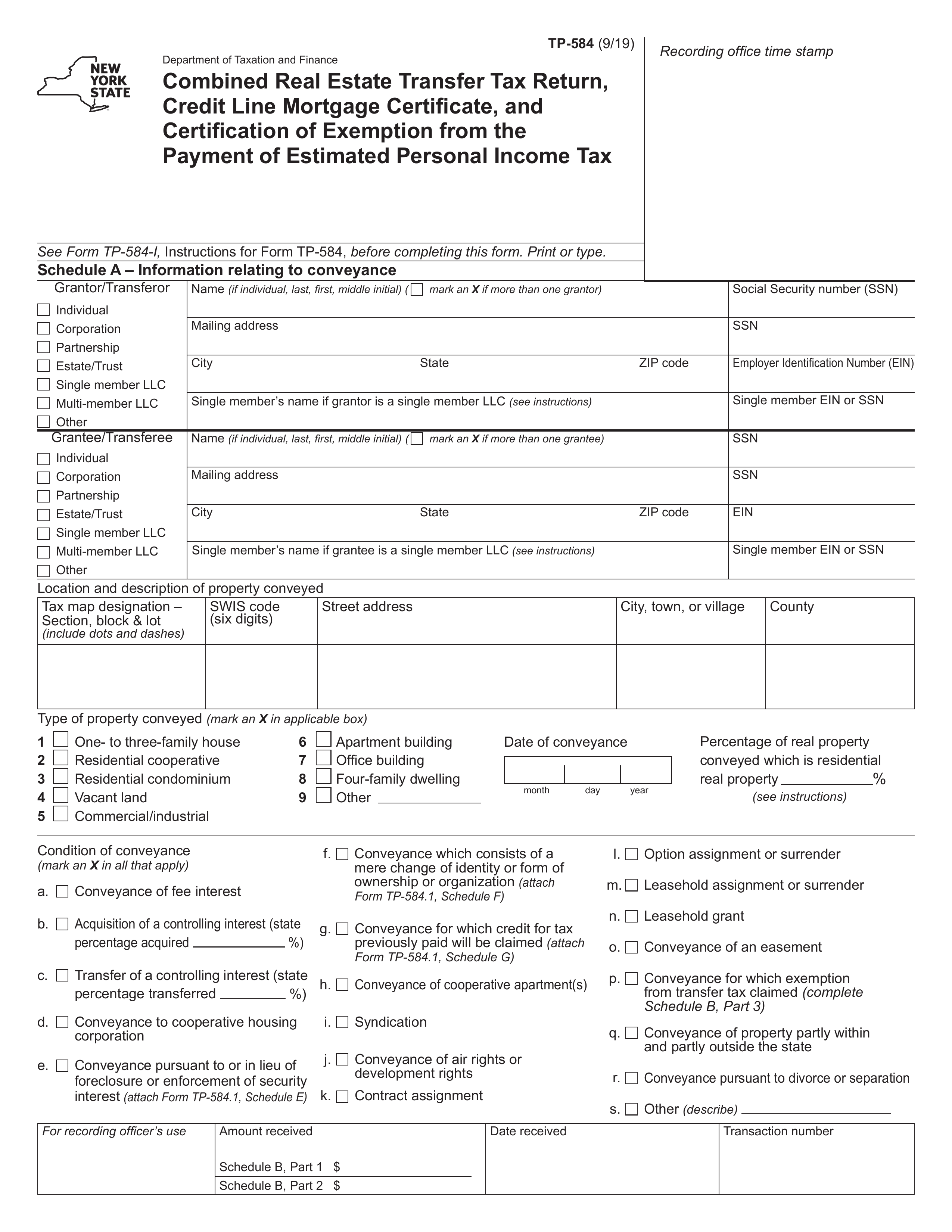

What is Form RP-5217?

Form RP-5217, known as the Real Property Transfer Report, is essential for documenting real property transfers in New York State. This form captures important details to ensure compliance with state tax laws and maintain accurate property records. It's necessary not just for sales, but also for changes in ownership, such as those resulting from marriage or divorce. Properly completing this form helps avoid errors in local and state records, which can impact future real estate tax assessments.

What is Form RP-5217 used for?

Form RP-5217 is essential for property transactions in New York. Here's what it does:

- Reporting Property Transfers: Records information about real property transfers for tax assessment.

- Compliance with Tax Laws: Ensures compliance with New York State tax regulations.

- Maintaining Property Records: Helps keep accurate records of property transfers for county officers.

- Supporting Deeds: Provides documentation to support deeds and any corrections.

How to fill out Form RP-5217?

- 1

Enter the property location, buyer name, and other required details in the appropriate fields.

- 2

Follow the step-by-step instructions found in Form RP-5217-PDF-INS.

- 3

Save the form after each update, as the barcode at the bottom changes.

- 4

Print the completed form on 8 ½ x 14-inch legal size paper.

- 5

Verify that all information is complete and accurate before submission.

Who is required to fill out Form RP-5217?

The buyer and seller are responsible for completing Form RP-5217. The buyer needs to sign, date, and provide their mailing address, while the seller must also sign and date their section. A person with Power of Attorney can sign if one party is unable to do so.

After completion, the county clerk uses the form to document real property transfers. It is filed with the deed, and a copy is required when submitting the RP-5217NYC form.

When is Form RP-5217 not required?

Form RP-5217 is not required for transactions such as purchasing individual cemetery plots, co-op transfers, right-of-ways, easements, sales of mineral rights, lease agreements, will preparation, license agreements, mortgage refinancing, and tax sale certificates or option-to-buy. For property sales in Staten Island, use Form RP-5217-NYC instead.

When is Form RP-5217 due?

The deadline for Form RP-5217 is on or before the 15th day of each month. For best practices, the state encourages more frequent mailings. Make sure to complete the form accurately, paying special attention to items C1-C4, which require SWIS codes and book/page identifiers.

How to get a blank Form RP-5217?

To get a blank Form RP-5217, simply visit our website. The New York State Department of Taxation and Finance issues this form, and we have a blank version pre-loaded in our editor for you to fill out. Remember, our platform helps with filling and downloading but not filing forms.

How to sign Form RP-5217?

To sign Form RP-5217, you need to provide an original handwritten signature, as photocopies, facsimiles, and electronic signatures are not permitted. If you cannot sign, a representative with Power of Attorney may sign on your behalf, but you must present a copy of the Power of Attorney at the time of filing. After completing the form using PDF Guru, remember to download it for your records and check for any latest updates before submission.

Where to file Form RP-5217?

Form RP-5217, Real Property Transfer Report, must be filed at the county clerk's office where your property is located.

You can submit the form either by mail or in person. For NYC properties outside Staten Island, use ACRIS; for Staten Island, use Form RP-5217-NYC.