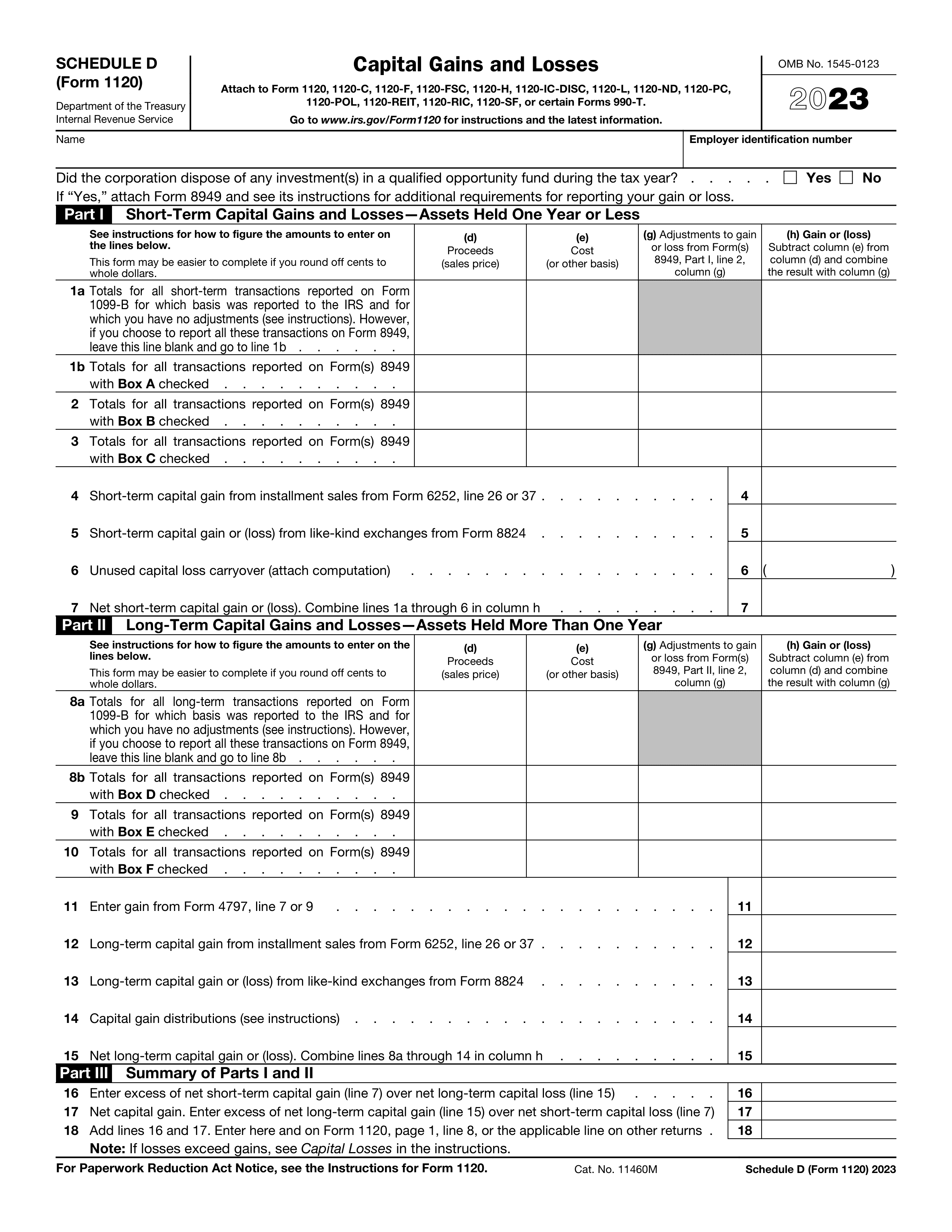

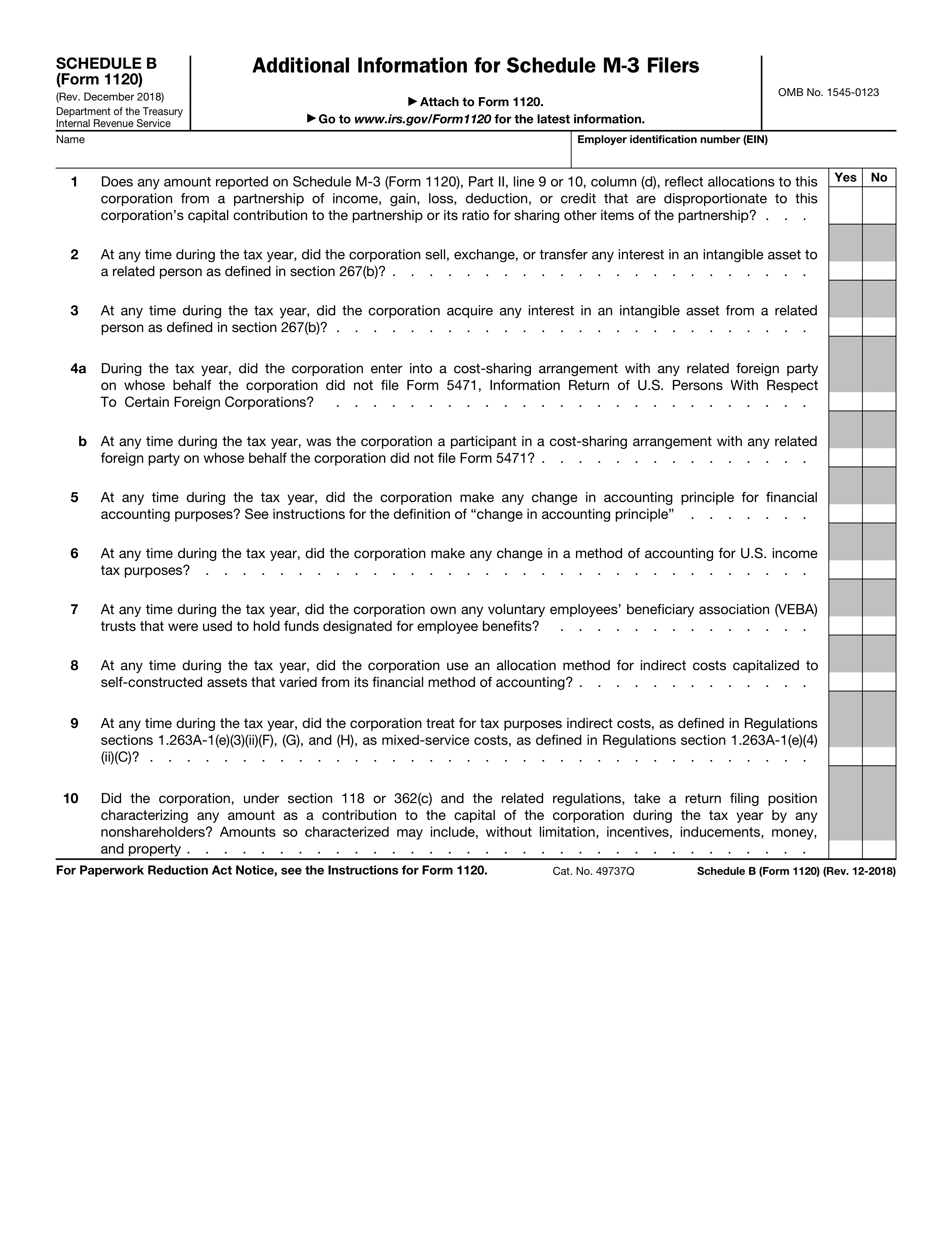

What is Schedule M-3 Form 1120?

Schedule M-3 (Form 1120) is a tax form used by corporations with total assets of $10 million or more. Its purpose is to reconcile financial statements with the corporation's taxable income. This form provides detailed information about differences between financial accounting and tax reporting. It helps the IRS understand a corporation's financial situation and ensures compliance with tax laws. Properly completing Schedule M-3 is crucial for accurate tax reporting and avoiding potential penalties.

What is Schedule M-3 Form 1120 used for?

Form Schedule M-3 (Form 1120) is used by corporations to reconcile their net income or loss. This form is essential for larger corporations for the following reasons:

- to provide detailed financial information.

- to align financial statements with tax returns.

- to enhance transparency for the IRS.

- to report differences in accounting methods.

How to fill out Schedule M-3 Form 1120?

- 1

Review the instructions for Schedule M-3 available on the IRS website.

- 2

Gather your financial statements and relevant tax documents.

- 3

Complete Part I by reporting total income, deductions, and net income.

- 4

Fill out Part II with adjustments to reconcile book income with taxable income.

- 5

Double-check all entries for accuracy and completeness.

- 6

Attach any required supporting documentation as specified in the instructions.

Who is required to fill out Schedule M-3 Form 1120?

Corporations with total assets of $10 million or more complete Schedule M-3 for tax reporting. This form is important for reconciling financial statements and tax returns.

Tax professionals and the IRS use the completed form to verify reported income and ensure compliance.

When is Schedule M-3 Form 1120 not required?

Schedule M-3 Form 1120 is not required for corporations with total assets under $10 million. Additionally, if a corporation is filing a consolidated return, it must only complete the form for the parent corporation. Corporations that are exempt from filing Form 1120 due to specific criteria also do not need to submit Schedule M-3. Always verify your corporation's eligibility with official IRS guidelines.

When is Schedule M-3 Form 1120 due?

The deadline for Schedule M-3 Form 1120 is the same as the due date for the corporation's income tax return. For most corporations, this is the 15th day of the fourth month after the end of their tax year. If the tax year ends on December 31, the due date would be April 15 of the following year.

If the due date falls on a weekend or holiday, it is pushed to the next business day. Corporations can also request an extension, but they must file Form 7004 to do so.

How to get a blank Schedule M-3 Form 1120?

To access a blank Schedule M-3 Form 1120, visit our platform. The form is pre-loaded in our editor, allowing you to fill it out directly. Once completed, you can download the form for your records.

Do you need to sign Schedule M-3 Form 1120?

The Schedule M-3 Form 1120, which reconciles net income for corporations with significant assets, does not require a signature. However, it's crucial to confirm this with the IRS.

Always check for recent updates regarding tax forms. Rules can change, and staying informed helps minimize any potential issues.

Where to file Schedule M-3 Form 1120?

Schedule M-3 Form 1120 can be filed electronically if the corporation files its Form 1120 electronically as well.

Alternatively, it can be mailed to the appropriate IRS address specified in the form instructions. Always check the guidelines for updates.