What is Schedule O from Form 990?

Schedule O is an important part of Form 990 or 990-EZ that provides additional information about an organization’s activities, governance, and financials. It helps the IRS understand the organization's mission, structure, and operations in more detail. Organizations must complete this form to clarify any information reported on their main tax forms, ensuring transparency and compliance with federal regulations. This form is crucial for non-profits to maintain their tax-exempt status and for the public to understand how donations are used.

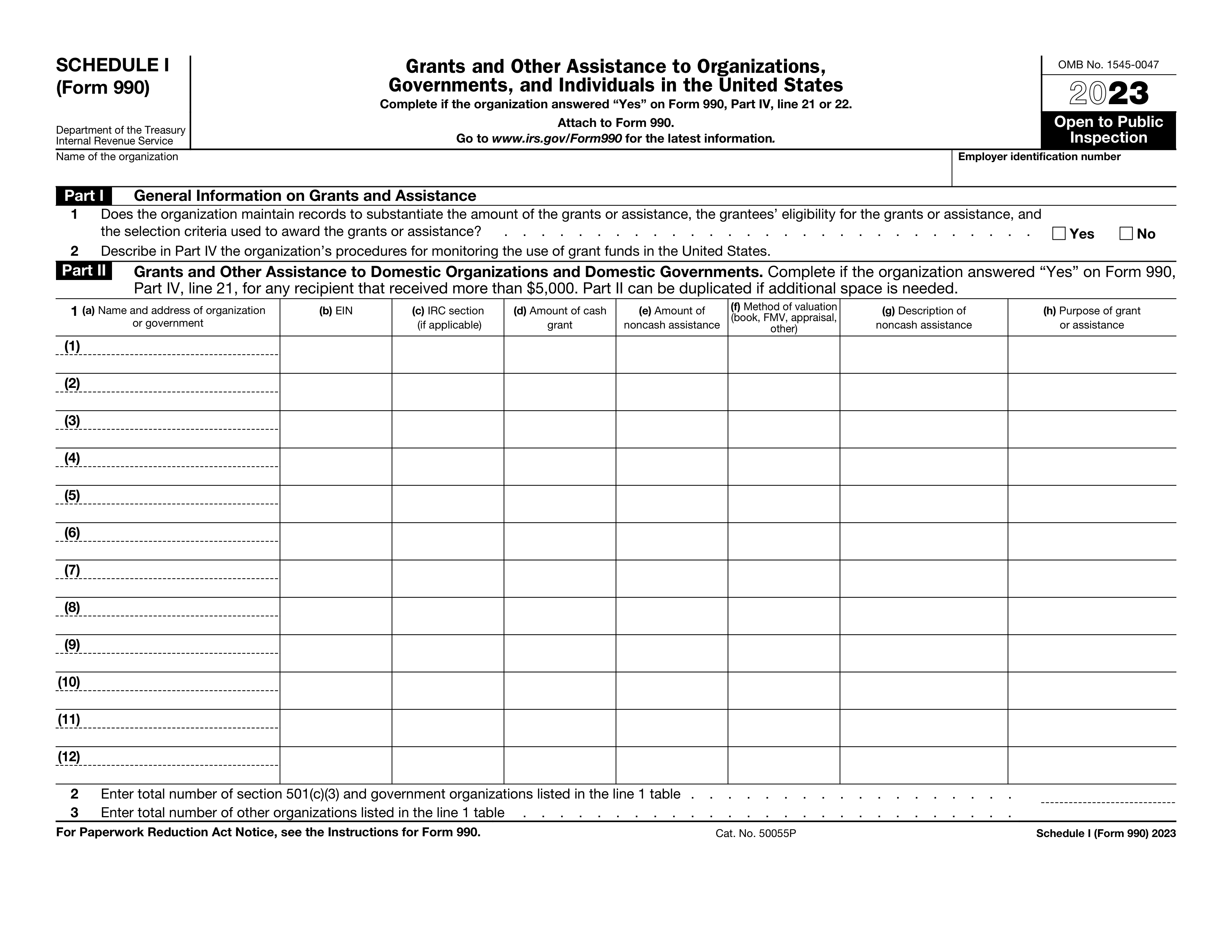

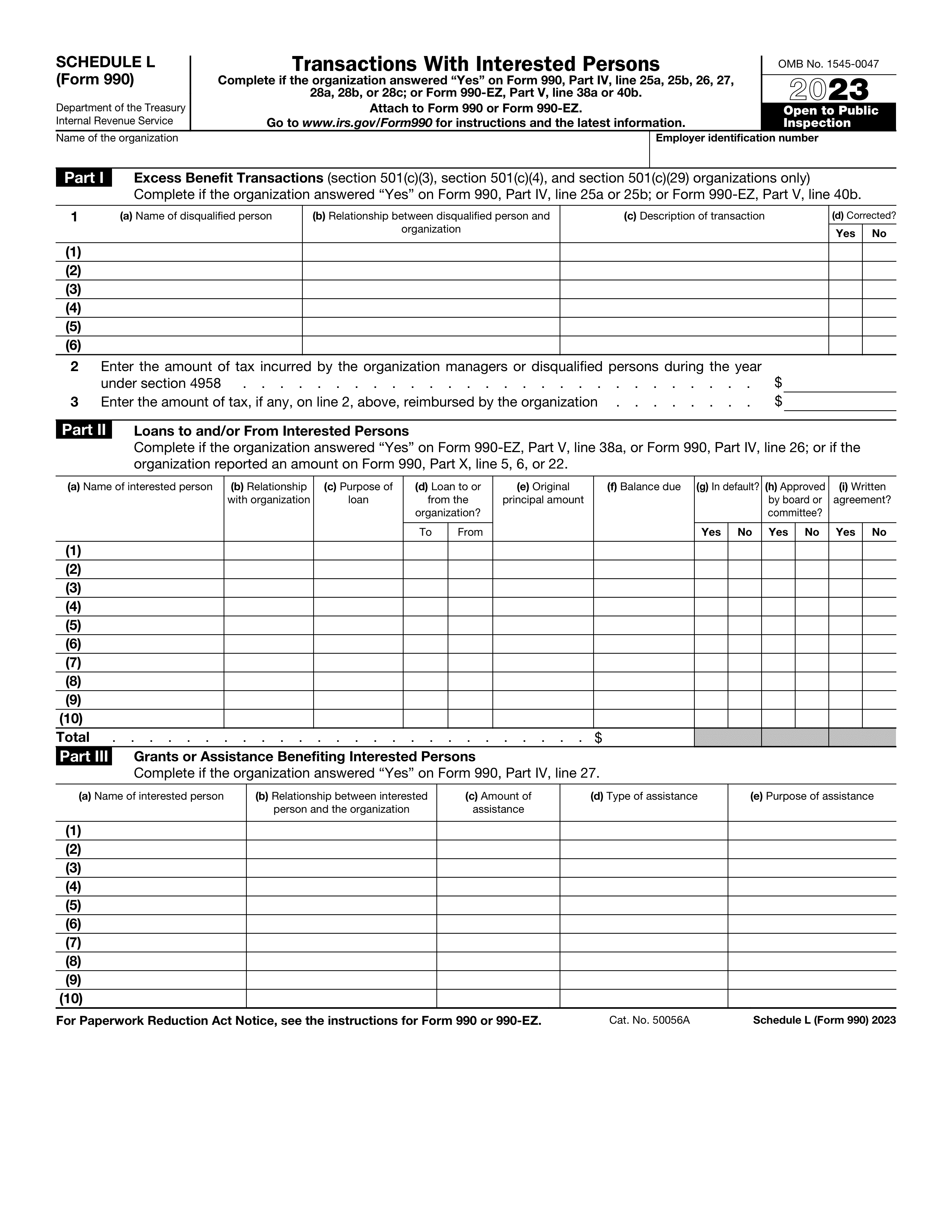

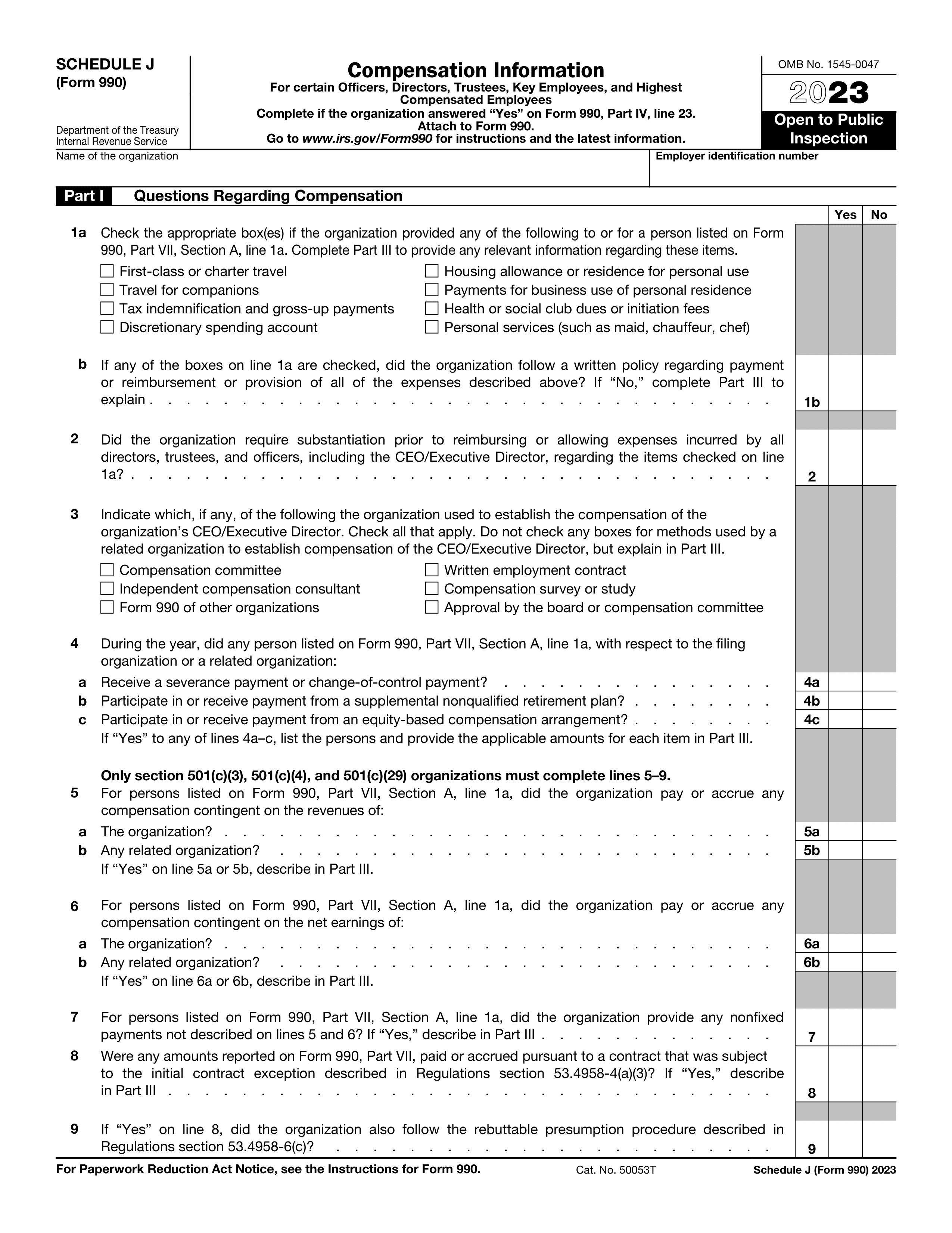

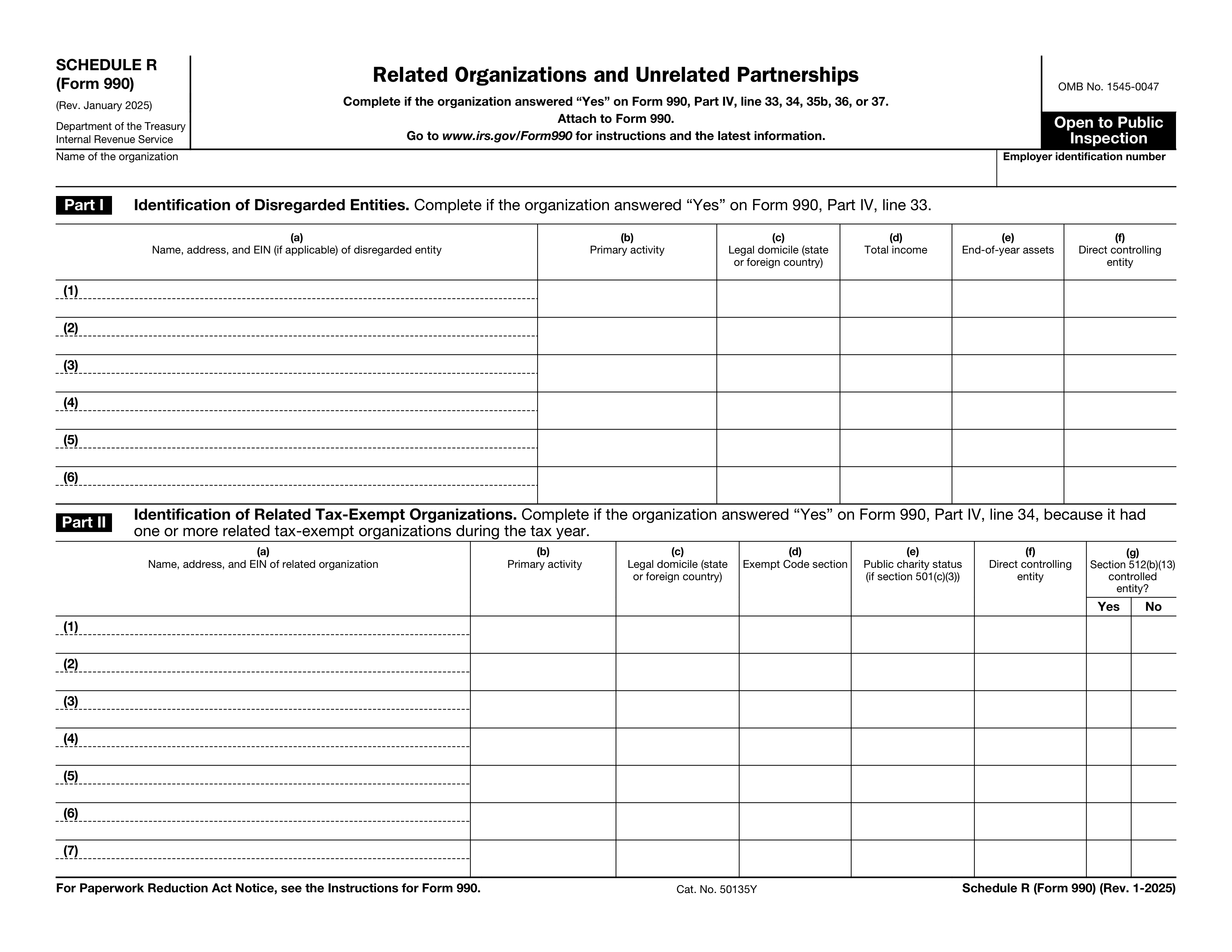

What is Form Schedule O used for?

Schedule O provides additional information for organizations filing Form 990 or 990-EZ:

- to explain the organization's mission and activities.

- to detail any changes in governance or structure.

- to clarify financial information or reporting discrepancies.

How to fill out Schedule O?

- 1

Read the instructions for Schedule O.

- 2

Gather necessary information about your organization’s mission, activities, and any additional details needed.

- 3

Complete the sections by providing clear and accurate descriptions.

- 4

Review your entries for completeness and accuracy.

- 5

Check for any specific formatting requirements outlined in the instructions.

Who is required to fill out Schedule O (Form 990)?

Nonprofit organizations, including charities, are responsible for completing Schedule O for reporting. This form is used to provide additional information to the IRS about the organization’s activities.

After completion, the IRS, state agencies, and donors review the form for compliance and transparency.

When is Form Schedule O not required?

Organizations do not need to file Schedule O if they are not required to submit Form 990 or Form 990-EZ. This includes smaller nonprofits with gross receipts under $200,000 or total assets under $500,000. Additionally, private foundations typically do not file this schedule unless they have specific reporting circumstances.

If an organization qualifies for the Form 990-N (e-Postcard), there is no requirement to submit Schedule O.

When is Schedule O (Form 990) due?

The deadline for Schedule O is the same as the due date for the main Form 990 or 990-EZ. For most organizations, this is the 15th day of the 5th month after the end of their fiscal year.

If your organization operates on a calendar year, this means the form is due on May 15. Always check for any specific extensions or changes to deadlines that may apply.

How to get a blank Schedule O?

To access a blank Schedule O, simply visit our platform where the form is pre-loaded and ready for you to fill out.

Alternatively, Schedule O is available for download from the IRS website.

Do you need to sign Schedule O (Form 990)?

According to official IRS guidelines, Schedule O does not require a signature. However, it's always wise to check the IRS website for any updates. Staying informed helps minimize the risk of misinformation.

Where to file Schedule O?

Schedule O must be filed with the IRS alongside Form 990 or Form 990-EZ.

You can submit Schedule O by mail or electronically through authorized e-file providers. Be sure to check the IRS guidelines for complete instructions.