What is a W-4 Form?

The W-4 Form is crucial for anyone starting a new job or experiencing life changes affecting their tax situation. It tells your employer how much tax to withhold from your paycheck, ensuring you pay the right amount of taxes throughout the year. Filling it out correctly can prevent owing a large sum or receiving a big refund at tax time. It's important for all employees to complete and update as necessary.

What is the purpose of the W-4 Form?

The Form W-4 is essential for determining the correct amount of taxes to withhold from an employee's paycheck. Here's what it's used for:

- To adjust tax withholding to match personal financial goals.

- To update tax status after major life changes, such as marriage or the birth of a child.

How to fill out a W-4 Form?

- Enter your information:

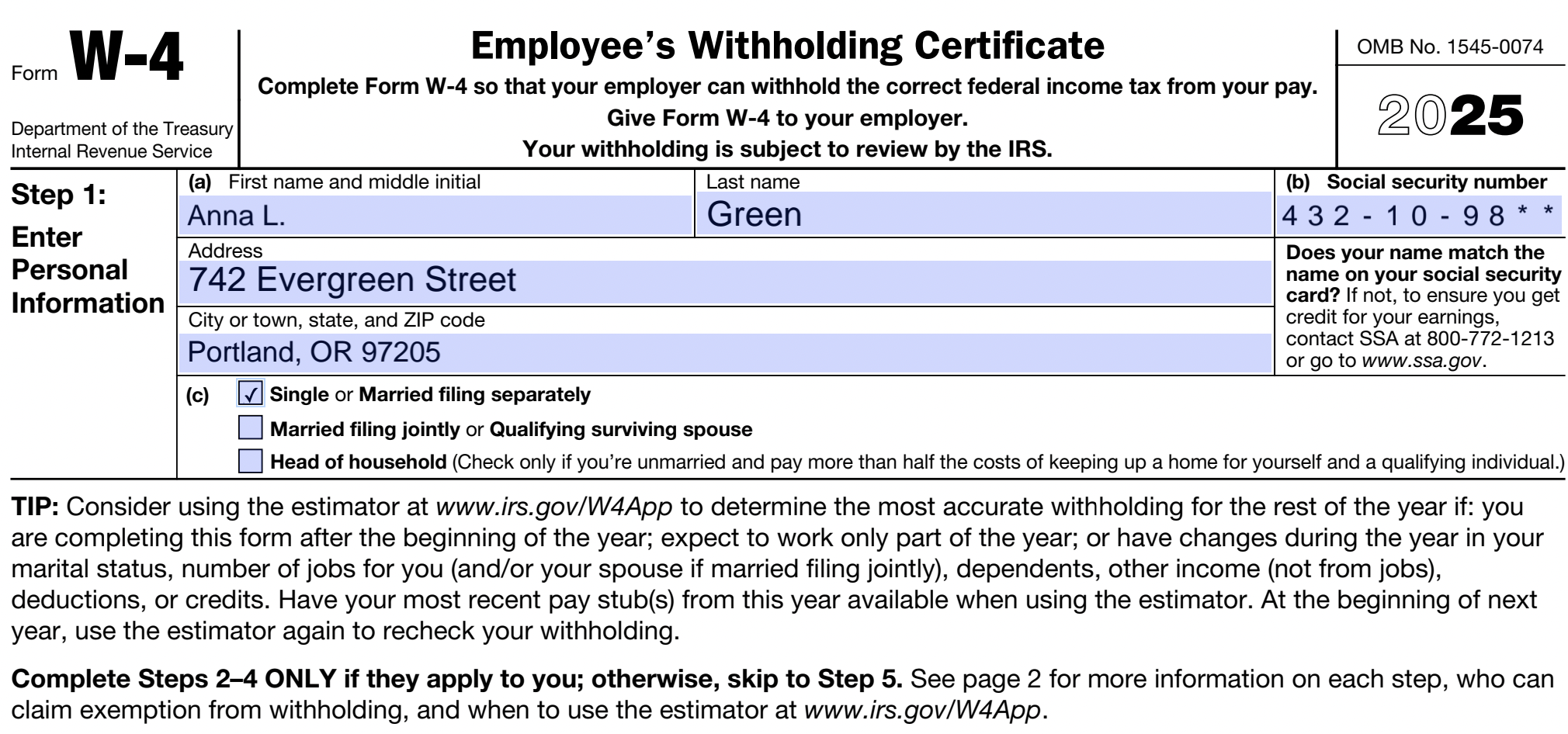

Step 1(a-b): Enter your full name, address, and Social Security number exactly as they appear on your social security card.

Step 1(c): Check the specific box for your filing status (e.g., Single, Married filing jointly, Head of household) to determine your standard deduction.

- Complete adjustments:

Step 2 (multiple jobs): Complete this only if you have more than one job or your spouse works. You can check the box if there are only two jobs with similar pay.

Step 3 (dependents): Enter the total dollar amount for qualifying children ($2,000 each) and other dependents ($500 each).

Step 4 (optional adjustments): Enter amounts here for (a) other non-job income, (b) itemized deductions, or (c) any extra tax you want withheld per paycheck.

- Complete certification:

Step 5: Sign and date the form. It is invalid without a signature.

Who completes Form W-4?

Employees are responsible for filling out Form W-4 when they start a new job or their financial situation changes.

Employers use the completed Form W-4 to determine the correct amount of federal income tax to withhold from employees' paychecks.

When is W-4 due?

The deadline for the Form W-4 is when you start a new job or when your personal or financial situation changes.

This form helps your employer know how much federal income tax to withhold from your paycheck. It's important to submit it promptly to ensure the right tax amount is deducted.

Why do you have to fill out a W-4 when you start a new job?

Your employer needs Form W-4 to determine how much federal income tax to withhold from your paychecks. The information you provide, like your filing status, number of dependents, and additional income, helps calculate the correct withholding amount. Without it, your employer can't properly withhold taxes, which could result in owing money at tax time or getting a smaller refund than expected.

When is a W-4 Form not required?

Some individuals might not need to complete a Form W-4. For instance, if you are self-employed, the Form W-4 is not applicable to you since your tax situation is handled differently, often through estimated tax payments.

Additionally, if you are not earning income, you do not need to worry about filling out this form. This includes people without employment or those who do not have taxable income.

How to get a blank W-4 Form

To get a blank W-4 Form, fillable and ready to download, simply visit our platform where the template is pre-loaded in our editor, allowing you to fill it out and download it for your needs. Remember, our website helps with filling out and downloading the form, but not with submitting it.

How to sign a W-4 Form online

To sign the W-4 Form online, use PDF Guru's simple electronic signature feature. But first, complete all required fields on the editable W-4 Form template.

Then, select the option to add your signature. Follow official guidelines to create and place your signature where needed on the form.

How to file a W-4 Form

The W-4 Form can be submitted to your employer electronically or through paper. It informs them how much tax to withhold from your paycheck.

You cannot file the W-4 directly with the IRS. Instead, give it to your employer, who will use it to determine withholding amounts.

W-4 variations & other related tax forms

Special versions (not for standard wages):

- Form W-4P: For retirees. Use this to set tax withholding on monthly pension or annuity payments.

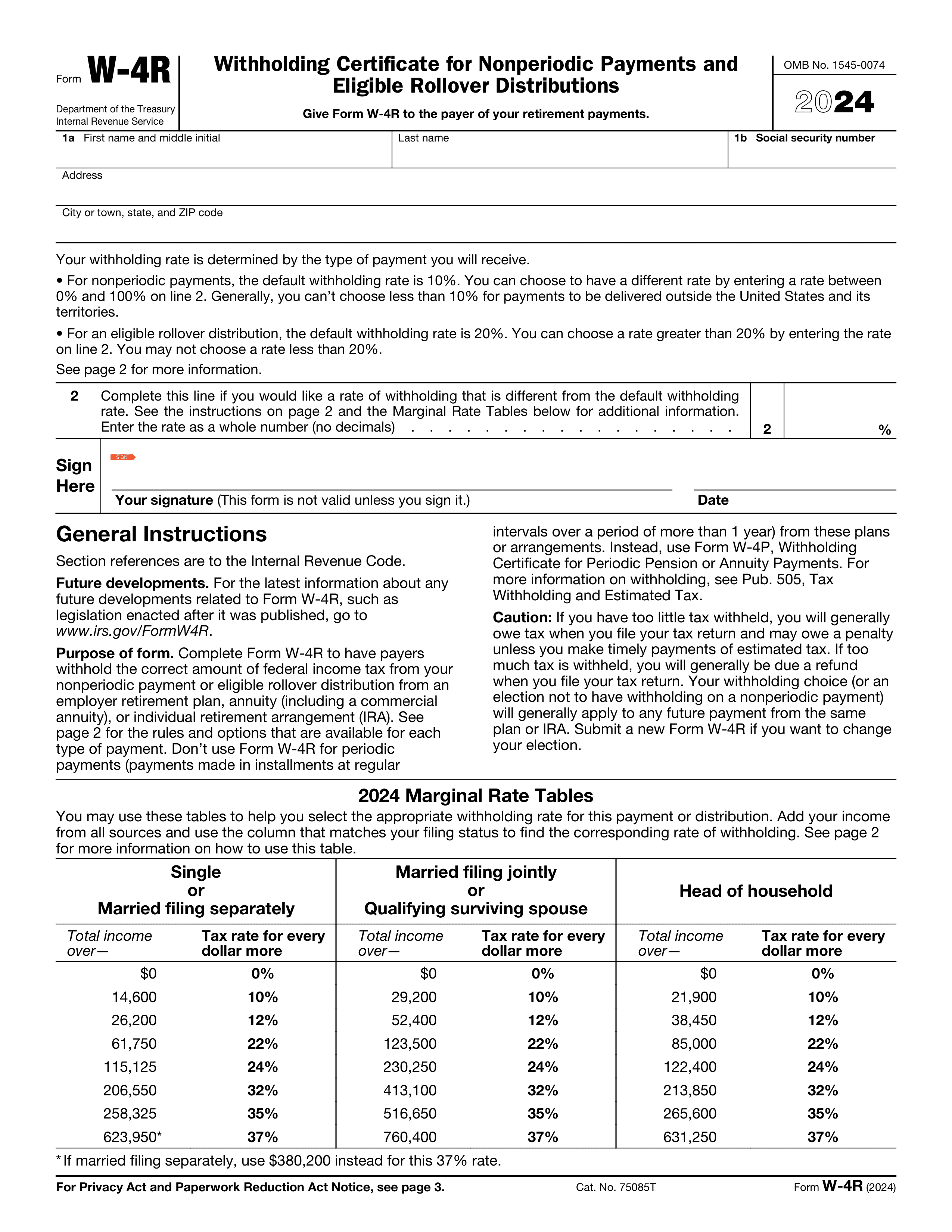

- Form W-4R: For one-time payouts. Use this if you cash out a retirement account or take a lump-sum distribution.

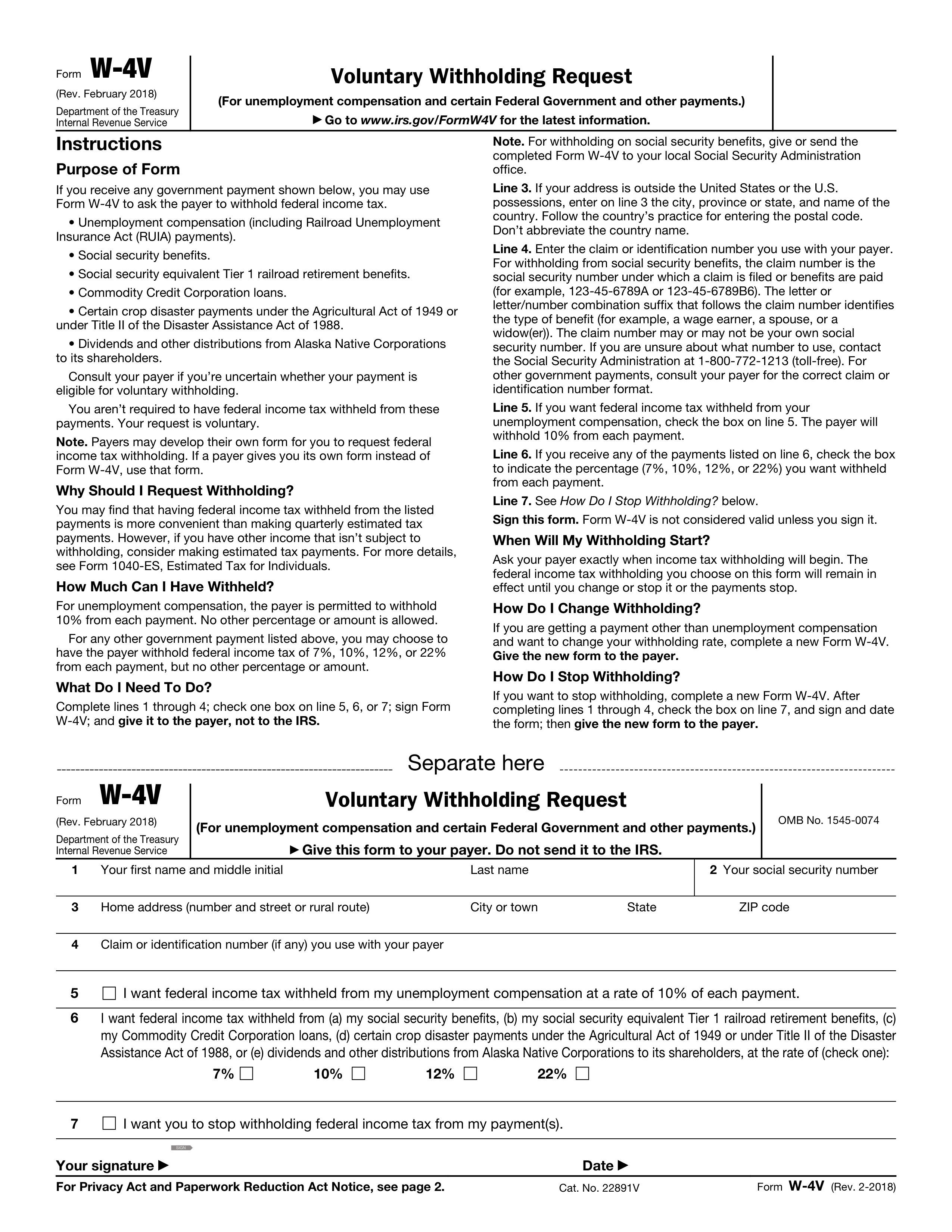

- Form W-4V: For government benefits. Use this to voluntarily withhold taxes from Social Security or unemployment checks.

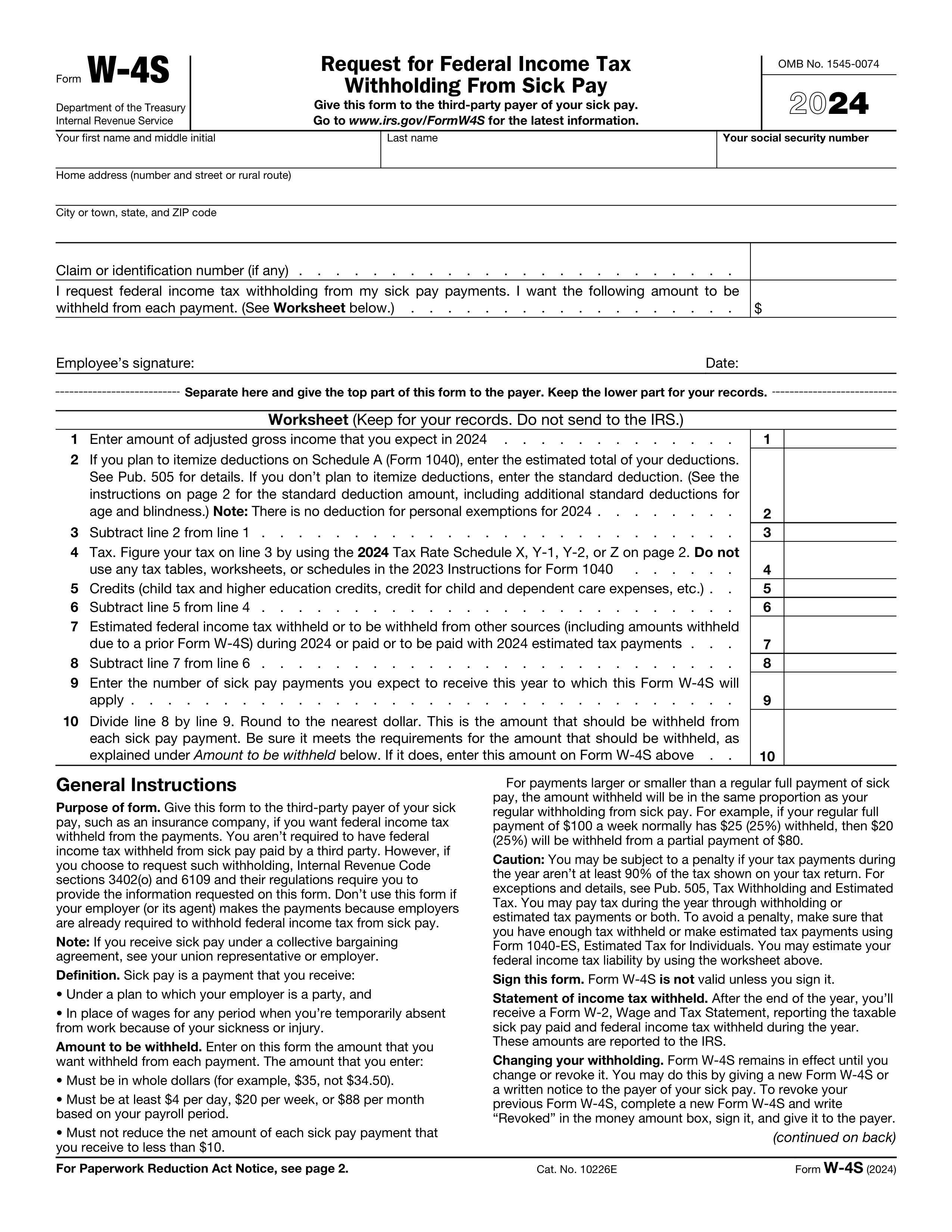

- Form W-4S: For sick pay. Use this if a third-party insurance company (not your employer) pays your sick leave.

Required for new hires:

- Form I-9: For identity verification. Proves you are allowed to work in the U.S. You must show physical ID (like a Passport or Driver's License) to complete it.

- State W-4: For state taxes. If you live in a state with income tax (like CA, NY, IL), you will likely fill out a state withholding certificate (e.g., DE-4 in California) at the same time.