Introduction

AI has moved from buzzword to daily talking point, but how far has it really made its way into people’s habits at work, at school, and at home? PDF Guru analyzed recent results from Korea and compared them with Japan to understand not just who’s aware of AI, but who’s actually using it, for what, and how they feel about the road ahead. In short, awareness looks similar on the surface, yet the two markets diverge in depth of use, confidence, and the balance between work-centric and life-centric scenarios - differences that consistently tilt toward Korea’s lead.

For companies planning AI programs, training, or products, the findings offer critical insights. Korea has already moved past the “first trial” stage, showing broader experimentation and stronger motivation to learn. Japan, on the other hand, has a higher share of non-users and greater uncertainty. In both markets, lowering barriers, connecting AI to everyday results, and offering tailored learning pathways will be essential.

Key Takeaways

Broader Awareness Funnel in Korea Only 10.4% of respondents in Korea said they had “never heard of AI,” compared to 15.3% in Japan, showing that more people in Korea already recognize AI tools, creating stronger potential for future adoption.

Fewer non-users in Korea Korea has fewer never-users (34.8%) than Japan (48.6%) and more light triers (used a few times: 24.2% vs 18.0%), indicating more people in Korea have crossed the first-use threshold.

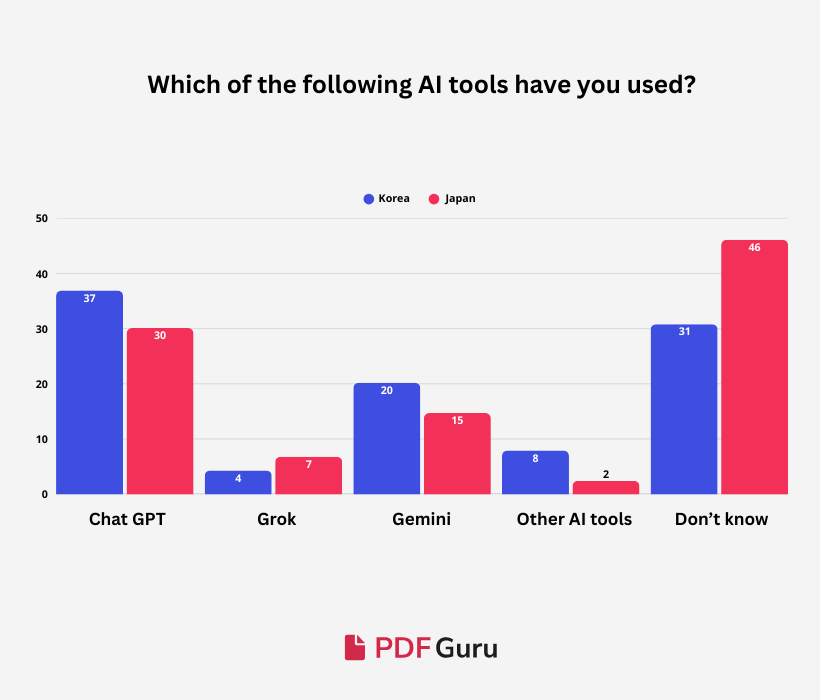

Korea leads in AI tool diversity Korea outpaces Japan on ChatGPT (36.9% vs 30.1%), Gemini (20.2% vs 14.7%), and Other tools (7.9% vs 2.4%), while Japan’s Don’t know is far higher (46.1% vs 30.8%) - a sign that Korea’s AI brand recall and exploration are further along.

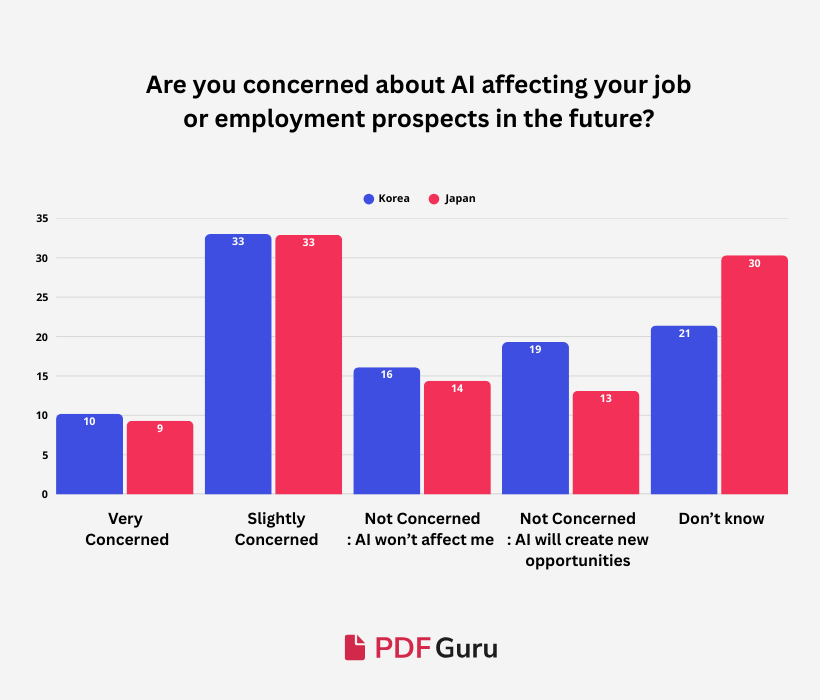

Koreans are more optimistic about AI’s impact 35.4% of Koreans said AI would bring no harm or even create new opportunities, compared to 27.5% of Japanese respondents.

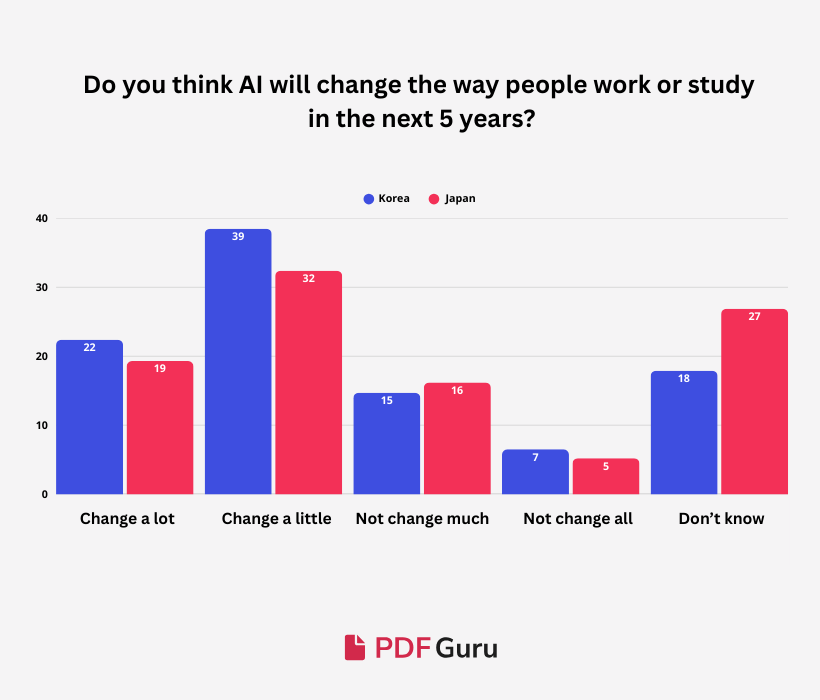

More openness to change in Korea When asked about the next five years, 38.5% of Koreans expected at least “moderate change,” compared to only 22.4% in Japan. Japanese respondents were far more likely to say “not sure”.

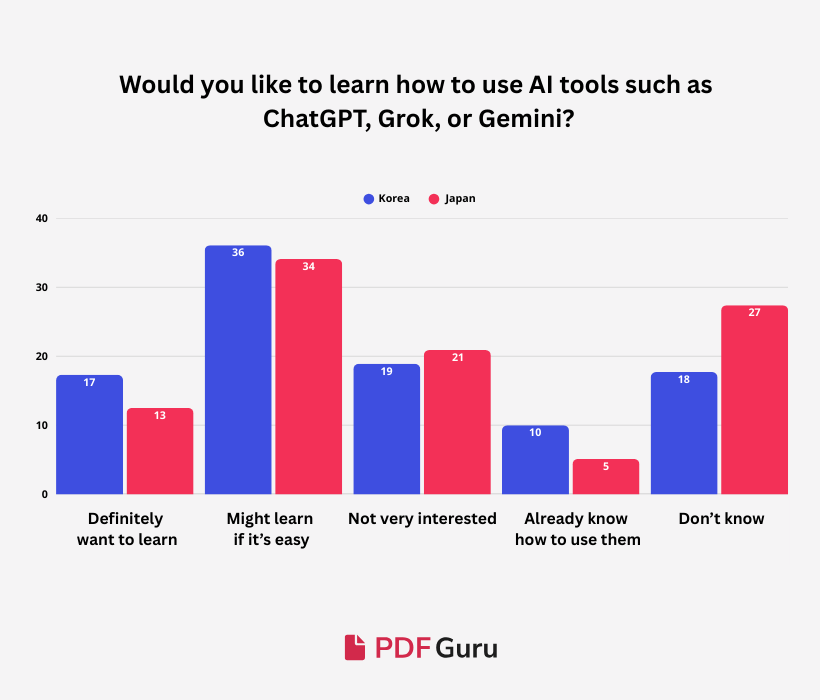

Stronger willingness to learn in Korea More Koreans said they “definitely want to learn” (17.3% vs 12.5%) or “already know how to use AI” (10.0% vs 5.1%). Meanwhile, “not sure” was much higher in Japan (27.4% vs 17.7%).

Survey Methods

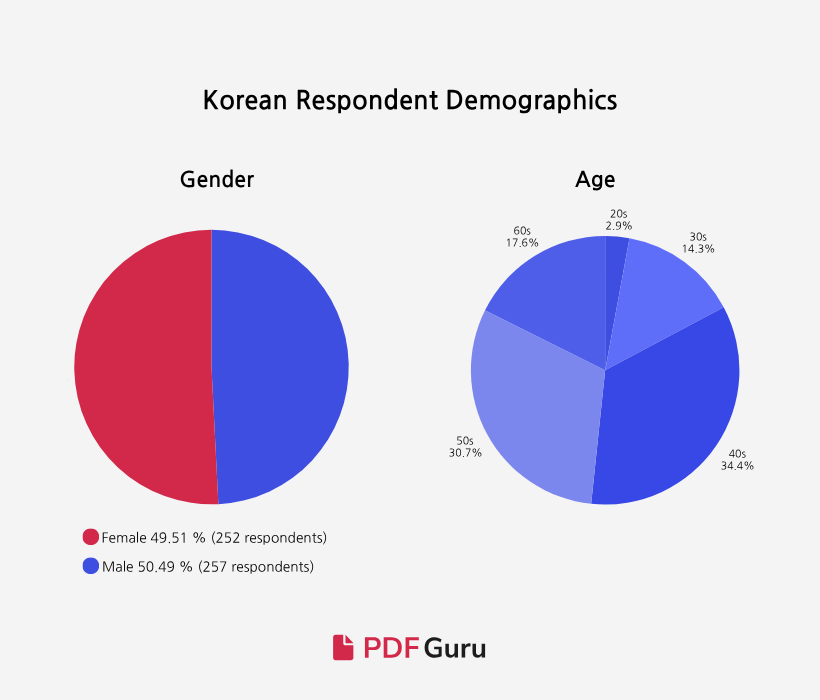

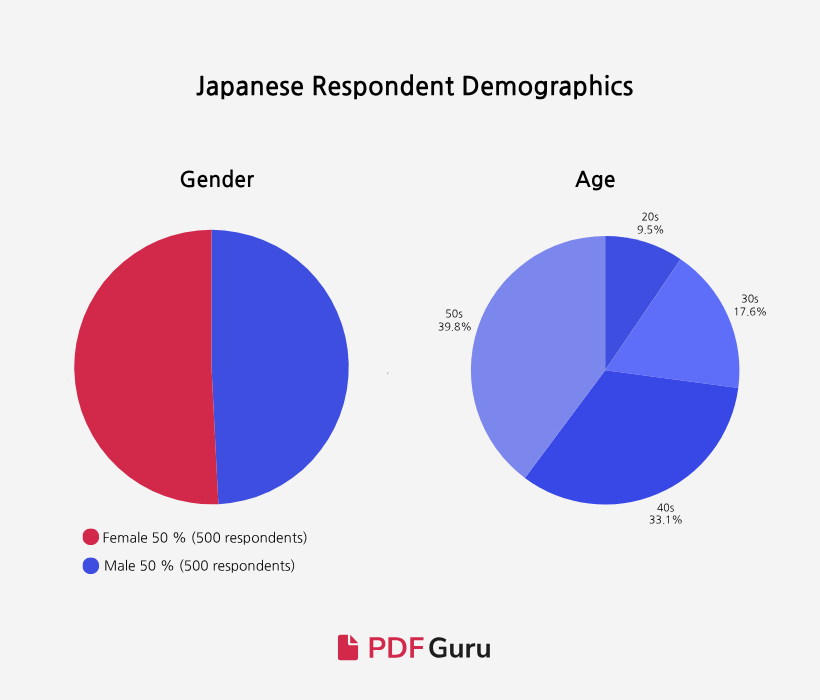

PDF Guru partnered with two online survey firms - Tillion Pro in Korea and Freeasy24 in Japan. It was carried out online from August 13-14, 2025, targeting 500 respondents in Korea and 1,000 in Japan. A total of seven questions covered AI awareness, usage, purposes, concerns about job impact, expectations for future change, and willingness to learn. The Korean results were directly compared with the Japanese survey conducted in the same year.

Results

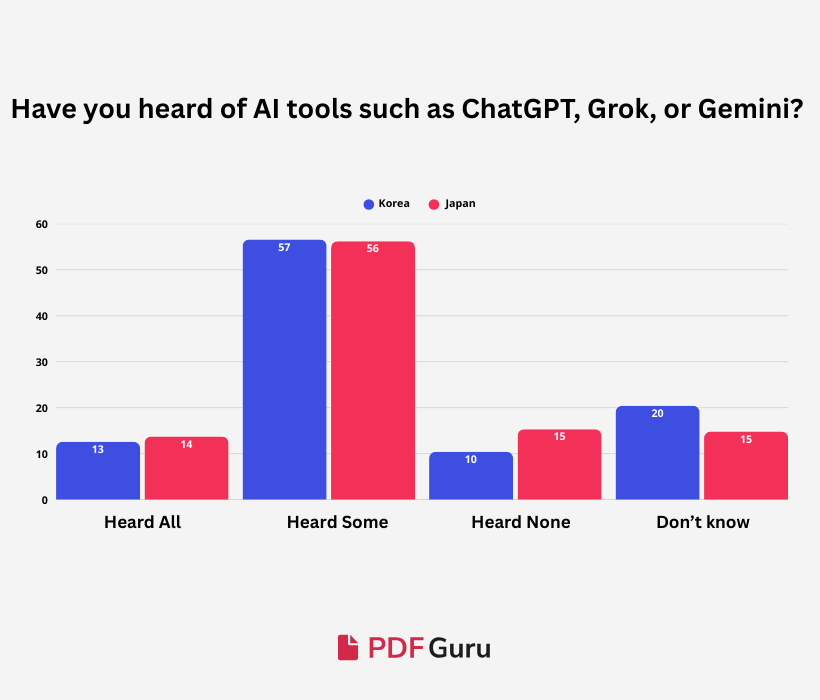

Q1. Have you heard of AI tools such as ChatGPT, Grok, or Gemini?

The data show that Korea has a smaller completely unaware segment than Japan (10.4% vs. 15.3%). The share of “have heard some” is nearly identical in both markets (56.6% vs. 56.2%), while Japan is slightly higher on “heard all” (13.7% vs. 12.6%) and Korea records a somewhat larger “don’t know” (20.4% vs. 14.8%).

Taken together, this means that fewer people in Korea are entirely outside the awareness funnel, providing a broader base for future adoption.

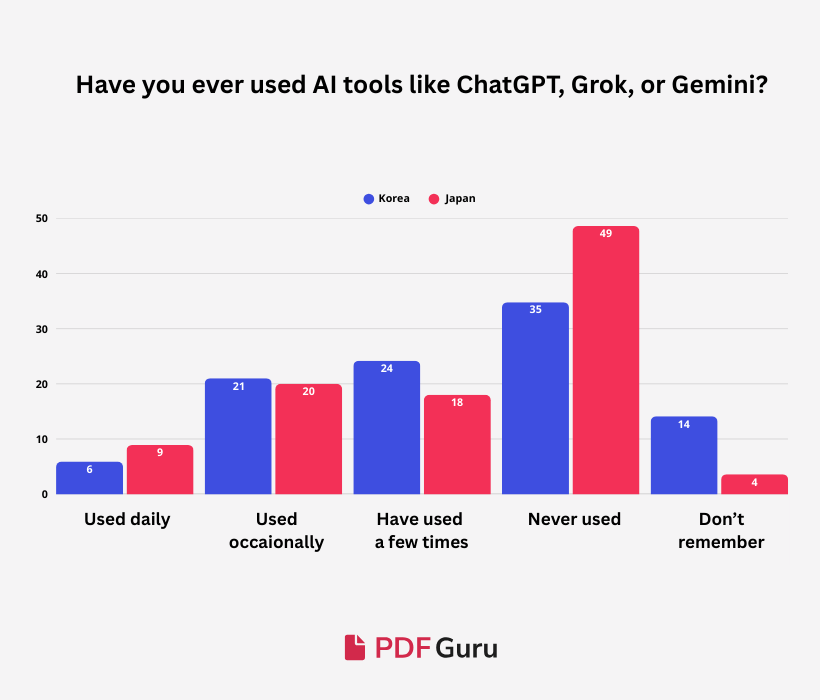

Q2. Have you ever used AI tools like ChatGPT, Grok, or Gemini?

The data show that daily use is broadly similar across markets, with Japan holding only a small, non-significant edge (8.9% vs 5.9%). Occasional use is about the same (≈21% in both). Korea is higher on “used a few times” (24.2% vs 18.0%), indicating a broader trial layer. Japan’s non-user cohort is larger (48.6% vs 34.8%), while Korea’s “don’t remember” is higher (14.1% vs 3.6%), suggesting shallow exposure rather than non-use.

Overall, Japan has more never-users despite a similar daily core, whereas Korea shows wider first-time and occasional engagement, pointing to onboarding in Japan and habit-building in Korea.

Q3. Which of the AI tools have you used?

Our data show a clear lead for ChatGPT (36.9% in Korea vs 30.1% in Japan). Korea is also ahead of Gemini (20.2% vs 14.7%) and Other AI tools (7.9% vs 2.4%), signaling broader multiple AI tool experimentation in Korea. Japan’s relative bright spot is Grok (6.8% vs 4.3%), yet the defining feature of the Japanese results is the outsized “Don’t know” at 46.1% compared with 30.8% in Korea, which suppresses the shares of named tools and points to a top-of-funnel awareness gap.

Korea appears to be a market where ChatGPT leads, while a wider tool portfolio is actively in play. In contrast, Japan shows a niche lift for Grok alongside a large group without firm preferences. This suggests that awareness building and first-use onboarding will move the Japanese numbers more than brand switching alone.

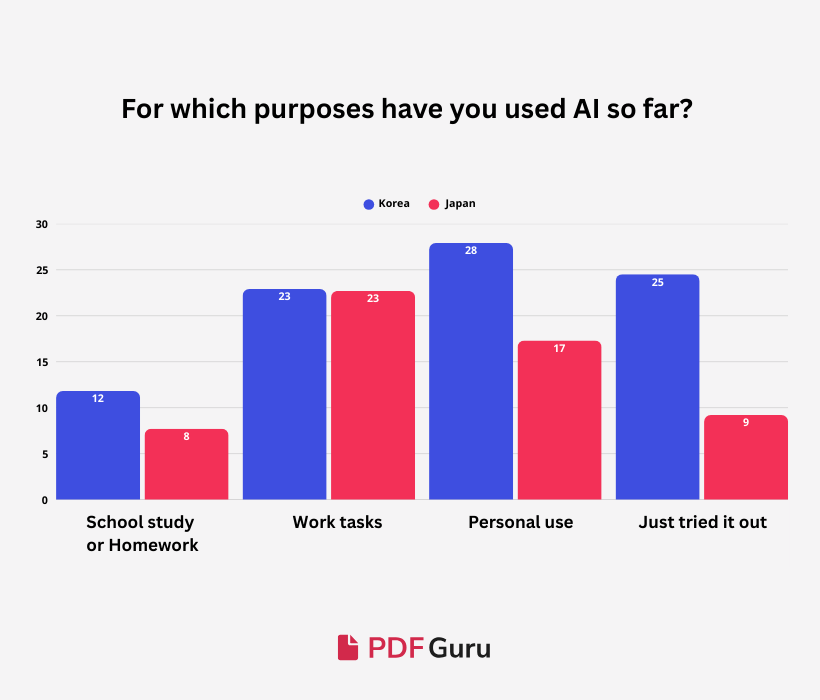

Q4. For which purposes have you used AI so far?

Work usage is the largest category and essentially identical across markets (Korea 22.9% vs. Japan 22.7%). The widest gaps are in personal use (27.9% vs. 17.3%) and “just tried” (24.5% vs. 9.2%), where Korea is markedly higher. Study is also higher in Korea (11.8% vs. 7.7%), though the difference is smaller than for personal or trial use.

To summarize, Korea looks like a market where AI is explored more casually and woven into everyday routines, not just tied to formal tasks. Japan, by contrast, shows a tighter concentration around purposeful, non-experimental usage outside of work.

Practically, that points to low-friction trials, everyday utility nudges for Japan, and habit-building, outcome-linked workflows to convert Korean experimentation into repeat use. Tools like PDF Guru’s AI PDF summarizer can support this trend by helping users quickly extract key insights from documents for study or personal learning.

Q5. Are you concerned about AI affecting your job or employment prospects in the future?

The data show that overall concern levels are broadly similar in both markets, with “very” and “slightly concerned” responses effectively on par. Where they diverge is direction: Korea records a larger optimistic camp, those expecting no impact or new opportunities, while Japan has a noticeably bigger “don’t know” segment (about 30% in Japan vs just over 20% in Korea).

This points to Korea being closer to conversion from curiosity to commitment, whereas Japan benefits more from clear guidance and low-risk, work-anchored pathways before sentiment turns positive.

Q6. Do you think AI will change the way people in Japan and Korea work or study in the next 5 years?

In Korea, 38.5% expect moderate change and 22.4% expect significant change, while 21.2% expect little or none and 17.9% are unsure. In Japan, the shares are lower for moderate and significant change (32.4% and 19.3%) and higher for uncertainty (26.9% vs. 17.9% in Korea).

Overall, both countries anticipate noticeable but not radical change. Koreans are more likely than Japanese to expect such change, while Japanese respondents are more likely to be unsure.

For Korea in particular, the higher expectation of change can be an opportunity. Institutions and companies may leverage this readiness by providing clear processes, everyday use cases, and hands-on training to guide users from awareness into practical adoption.

Q7. Would you like to learn how to use AI tools such as ChatGPT, Grok, or Gemini?

Compared with Japan, Korea shows stronger intent and familiarity with learning AI tools, while Japan shows more uncertainty. The top choice in both markets is “might learn if it’s easy” (Korea 36.1% vs. Japan 34.1%). More Koreans answered that they “definitely want to learn” (17.3% vs. 12.5%) and “already know how to use them” (10.0% vs. 5.1%), while Japan has a higher share of respondents who are “not very interested” (20.9% vs. 18.9%) and especially “don’t know” (27.4% vs. 17.7%).

The results suggest different pathways for each market. In Korea, higher shares of confident and motivated learners indicate readiness for more advanced modules. In Japan, the larger “don’t know” segment points to the need for basic awareness-building and simple first steps.

Conclusion

The survey results point to one clear pattern: South Korea is ahead of Japan in adopting AI. This is not only about awareness but also about actual use, confidence, and willingness to learn. Koreans are more ready to try tools not only for work but also for study and daily life. Japanese respondents, on the other hand, show more hesitation and more “don’t know” answers.

This creates a chance for South Korea to strengthen its position as Asia’s AI frontrunner. To build on this, Korean institutions and companies can:

Expand AI education that is practical and easy to apply

Promote examples that go beyond the workplace, including study and creative use

Help local AI brands grow so that people do not rely only on global names

In conclusion, the data point to promising momentum in Korea, though continued progress will depend on how effectively institutions and companies translate awareness into everyday use.