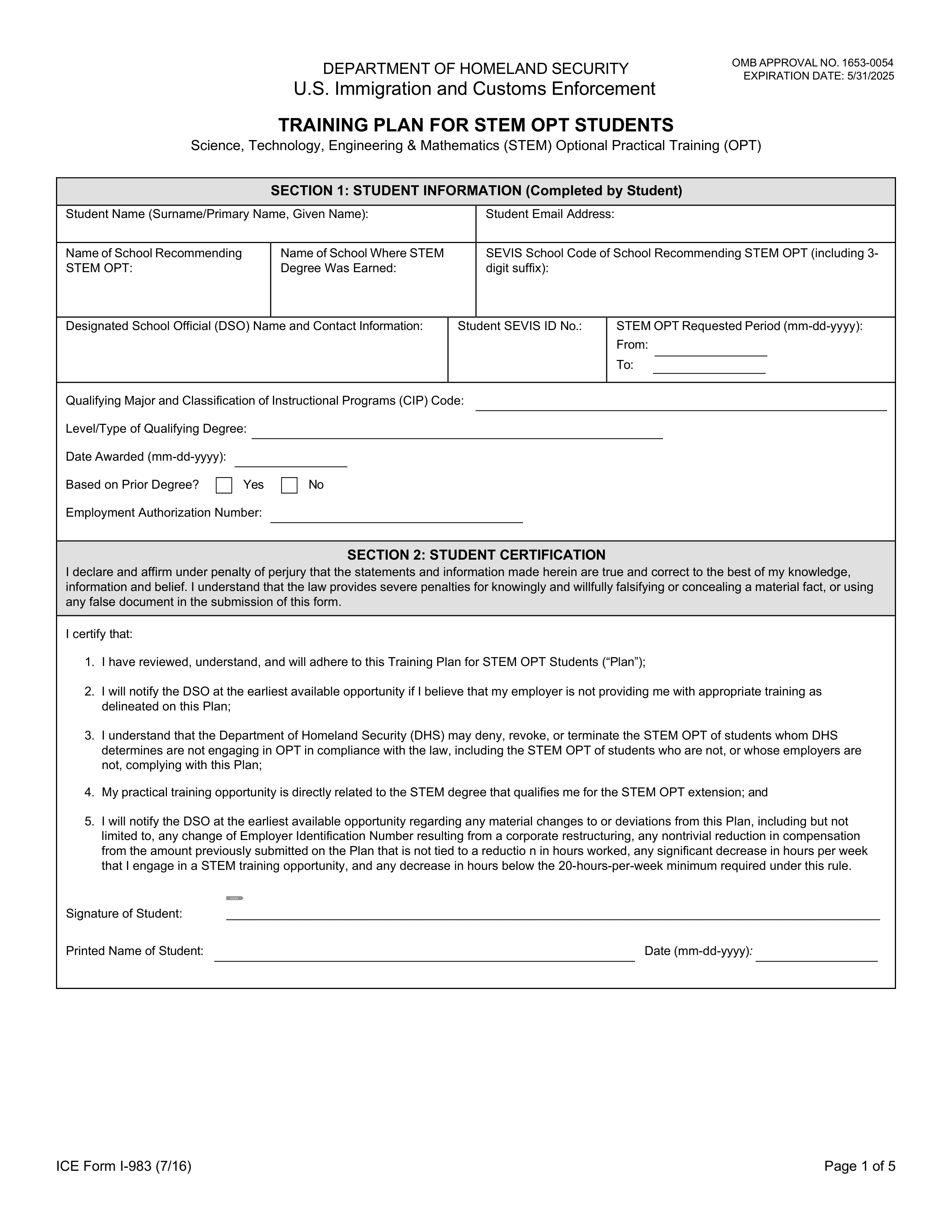

What is a 1028 form?

The form 1028 is used by employers to apply for certification of their tip income reporting procedures. It's particularly necessary for businesses in industries where tipping is common, such as restaurants and bars. By submitting this form, employers can ensure they're following the IRS's guidelines for reporting tips, which helps in maintaining accurate tax records and avoiding potential issues with tax reporting. This process is essential for both employers and employees to ensure correct tax payments and compliance.

What is a 1028 form used for?

Form 1028 is a crucial document for organizations seeking official recognition. Here's what it's used for:

- To apply for recognition of exemption under Section 501(c)(3).

- To change their status or update organizational information with the IRS.

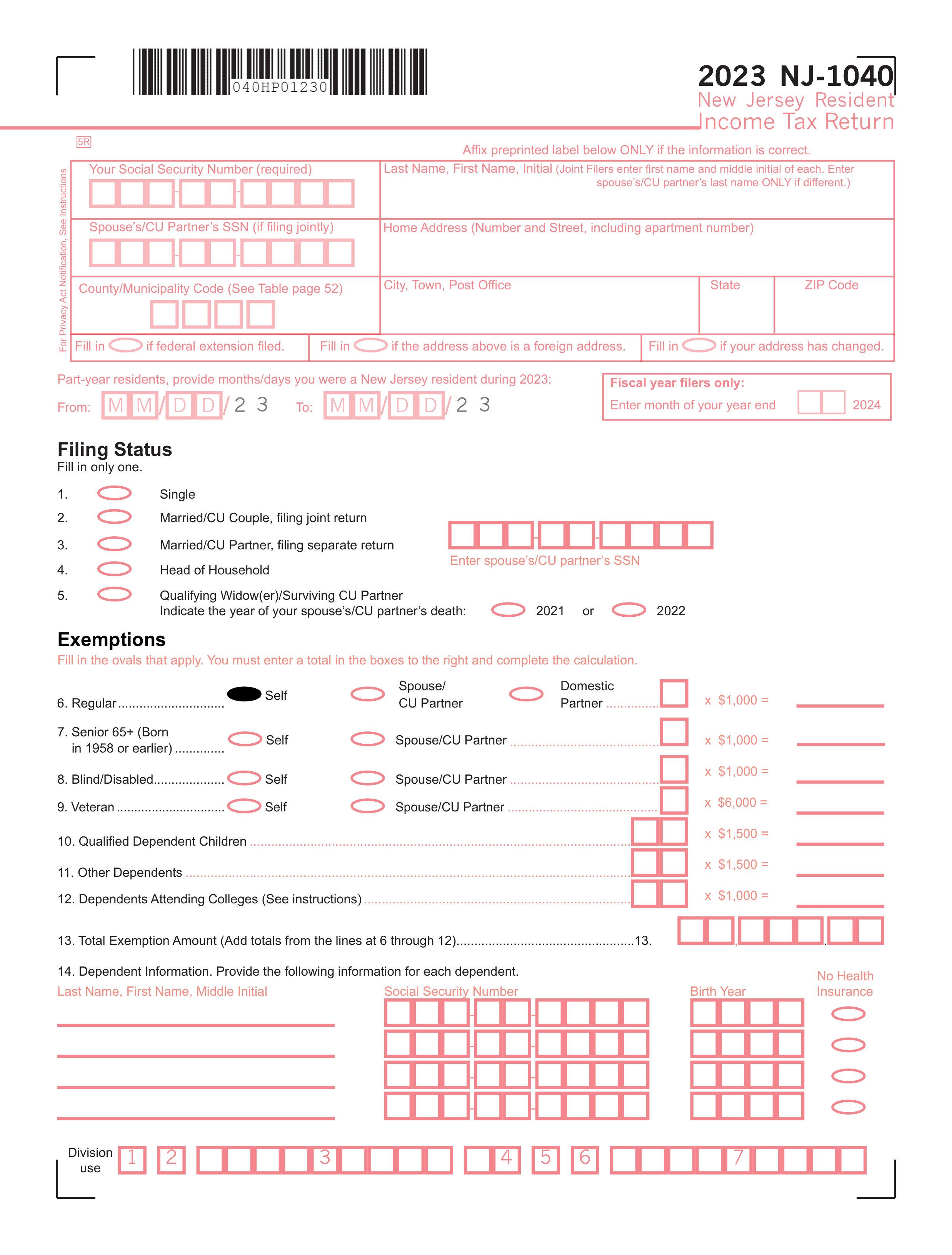

How to fill out a 1028 form?

- 1

Start by entering your personal information, including your full name, address, and Social Security number.

- 2

Fill in your employment details, ensuring accuracy in dates and company names.

- 3

Calculate and enter your income and deductions as specified in the form's instructions.

- 4

Review the entire form for any errors or missing information.

- 5

Create a simple electronic signature if the form accepts it.

- 6

Click Done to prepare your document for download.

- 7

Enter your email and select a subscription plan to download your completed document.

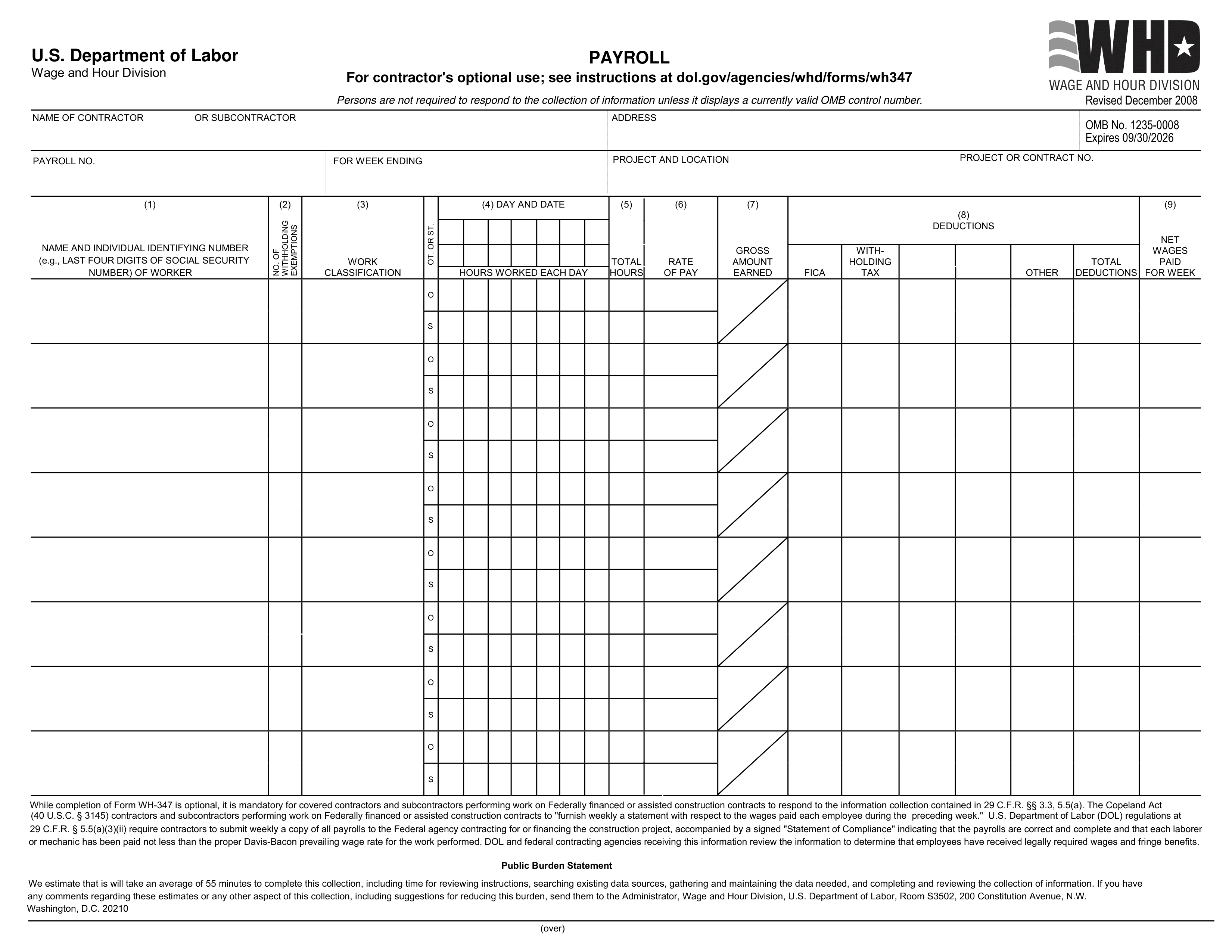

Who is required to fill out Form 1028?

Employers seeking to establish or ensure their workers' eligibility for a simplified employee pension (SEP) plan must fill out Form 1028.

After submission, the IRS uses Form 1028 to assess and approve the SEP plan, ensuring it meets federal requirements for tax benefits.

When is a 1028 form not required?

Not everyone needs to complete Form 1028. If you're not involved in applying for certain tax-exempt statuses, this form might not be relevant to your situation.

Individuals and businesses that are not seeking recognition of exemption under the specific sections of the tax code addressed by Form 1028 will not require it. It's important to assess your specific circumstances or consult with a professional to understand if this form applies to you.

When is a 1028 form due?

The deadline for Form 1028 is dependent on the specific circumstances under which it is being submitted. It's important to refer to the official IRS instructions or consult with a tax professional for your unique situation.

Ensuring your documents are submitted on time is crucial to avoid any potential penalties or delays. Always check the latest guidelines directly from the IRS or seek professional advice to stay compliant.

How to get a blank 1028 form?

To get a blank form 1028, simply visit our platform where the template is pre-loaded in our editor, ready for you to fill out. Remember, our website helps you fill out and download the form, but not file it.

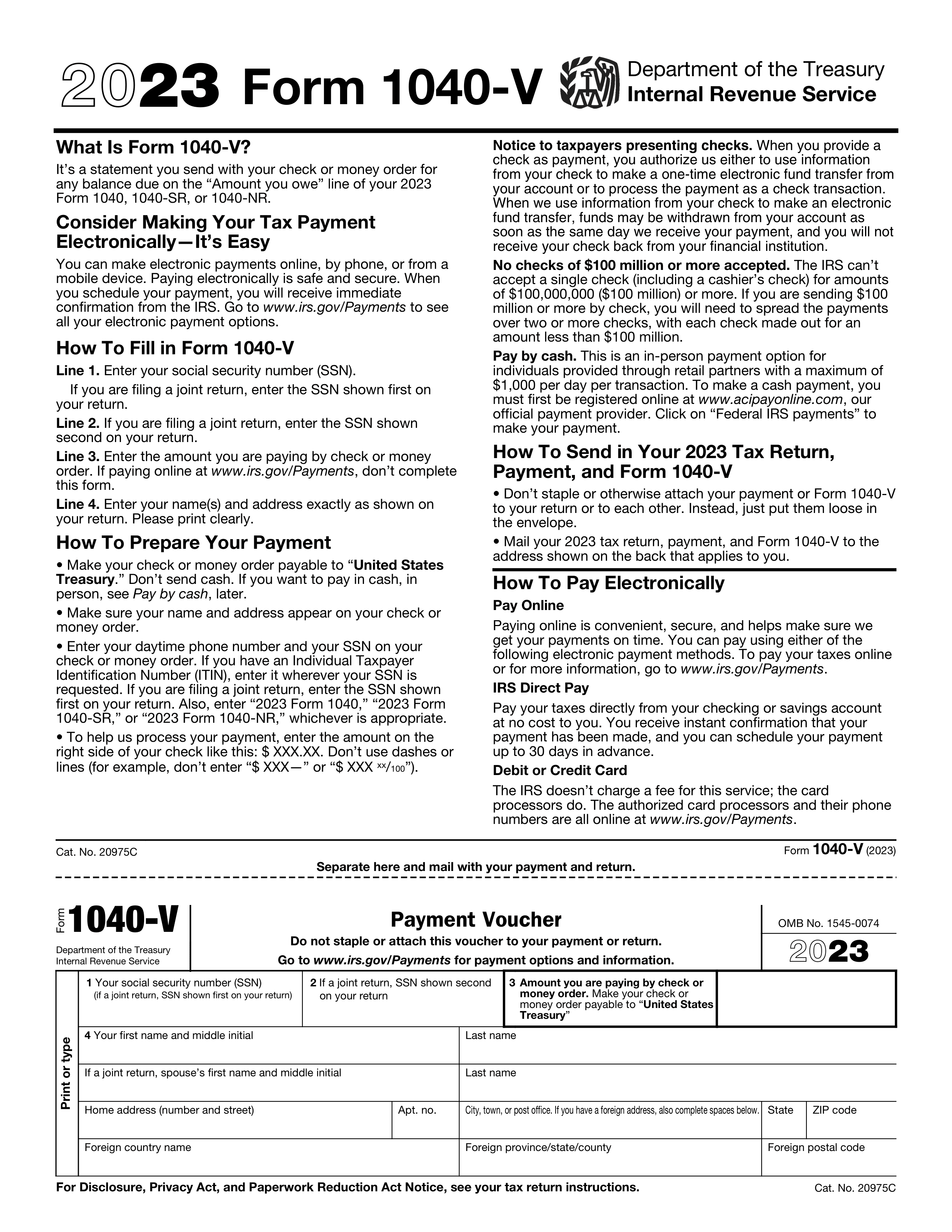

How to sign 1028 form online?

To sign Form 1028 online with PDF Guru, first, load your form in the PDF editor. Fill out the necessary information in the given fields.

Once completed, use the platform's feature to create a simple electronic signature. Add it to the designated signature area on the form, then download your document.

Where to file a 1028?

To submit form 1028, check if the IRS accepts it online. Some forms are mail-only.

If mailing, ensure you have the correct address and postage for the IRS.