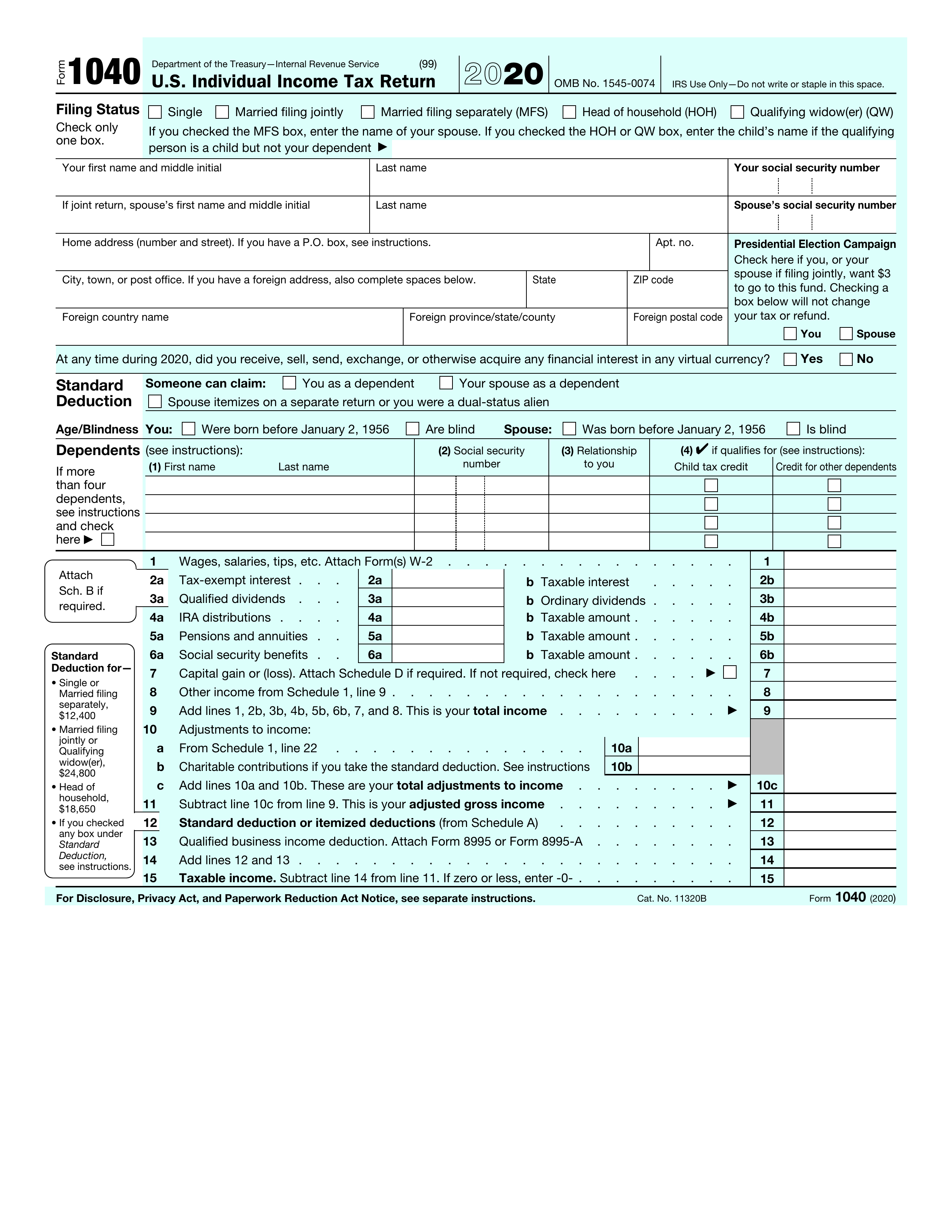

What is Form 1040?

Form 1040 is the primary document that U.S. residents use to file their personal federal income tax returns for 2023. This form assists in calculating your total taxable income, determining the taxes you owe, or revealing if you will receive a refund. It plays a vital role in accurately reporting income, deductions, and credits, helping the federal government gather revenue for public services. Most taxpayers must file Form 1040 to comply with tax laws and avoid any potential penalties.

What is the 2023 version of Form 1040 used for?

You may need to complete Form 1040 for the year 2023 if you want to:

- Report income from various sources

- Claim tax credits or deductions

- Calculate your tax refund or amount owed

- Update your filing status or personal information

How to fill out Form 1040?

- 1

Gather all necessary income and financial documents.

- 2

Choose the correct form (1040 or 1040-SR if born before 1959).

- 3

Fill out personal information including name, address, and Social Security Number.

- 4

Enter income, adjustments, deductions, and credits as instructed line-by-line.

- 5

Complete any required additional schedules based on your tax situation.

- 6

Review all entries for accuracy before downloading.

Who is required to fill out Form 1040 for 2023?

Individuals who missed the 2022 tax deadline, filed incorrectly, or had their original return lost by the IRS are required to fill out Form 1040 for 2023. This helps correct past filings and minimize penalties. Always ensure the correct year's form is used.

When should you file Form 1040 for the tax year 2023?

The 2023 version of Form 1040 is due on April 15, 2024. If you request an extension, your new deadline will be October 15, 2024. Filing after these dates can lead to penalties and interest, but you can still submit late returns to reduce extra charges. Remember, while you can extend your filing date, you must pay any owed taxes by April 15 to avoid penalties.

How to get a blank Form 1040 for the year 2023?

To get a blank Form 1040 for the year 2023, visit our website. The Internal Revenue Service (IRS) issues this form. Our platform automatically loads a blank version for you, so no separate download is needed. Remember, PDF Guru aids in filling and downloading but not filing forms.

How do I sign Form 1040 for 2023?

To sign the 2023 Form 1040, you can use a handwritten signature, a simple electronic signature (like a typed name or scanned signature), or a digital signature. Remember to check the latest updates from the IRS to ensure compliance with their e-signature rules. With PDF Guru, you can fill out the form, create a simple electronic signature, and download your completed document. However, submission and sharing options are not available through our platform.

Where to file Form 1040 for the year 2023?

For your 2023 Form 1040 submission, you can file online using IRS Free File or authorized e-file providers. Access these options on the IRS website.

If you prefer mailing your return, send the completed form to the IRS service center for your state. Make sure to check IRS instructions for the correct address based on your location.