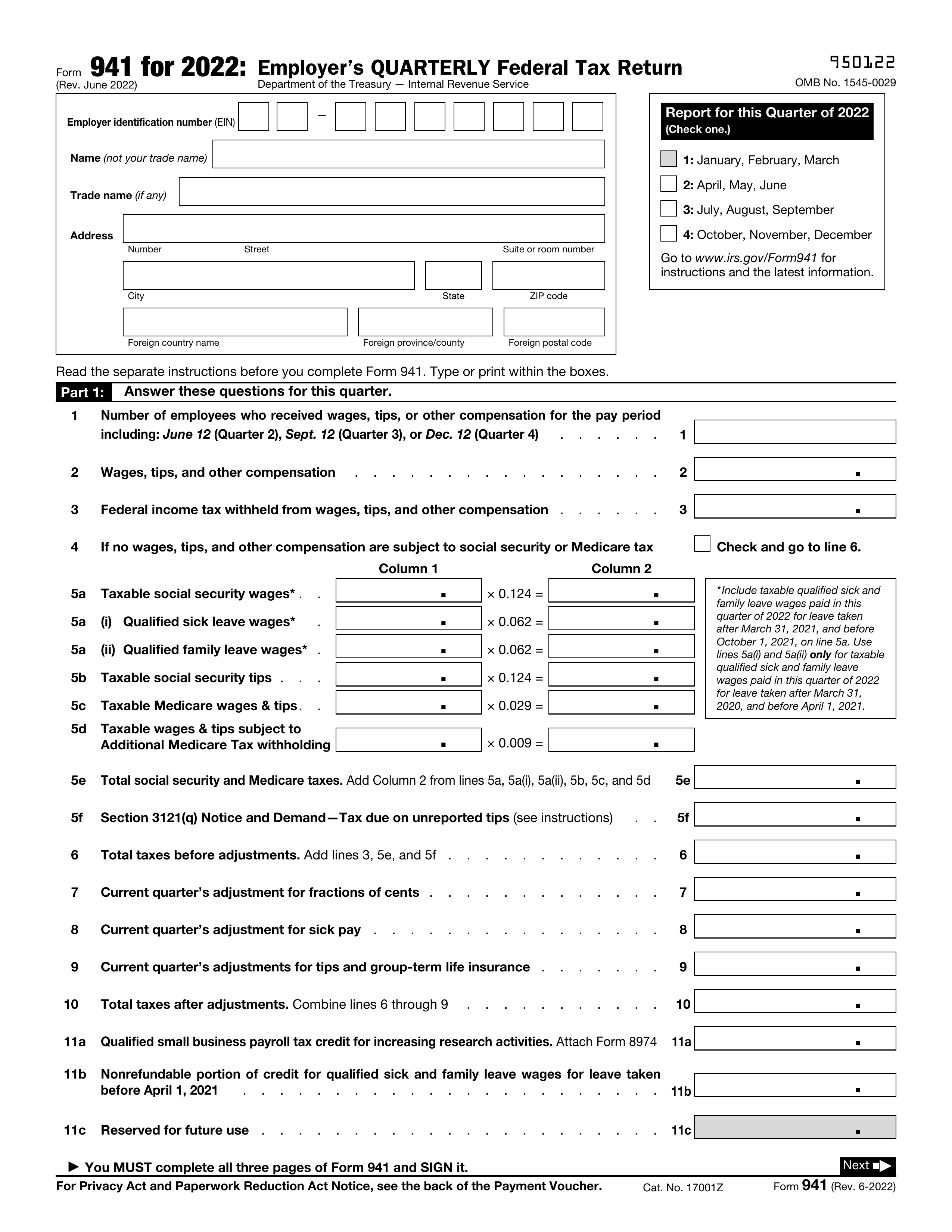

What is Form 941?

Form 941, known as the Employer's Quarterly Federal Tax Return, is essential for employers to report and pay federal income tax, as well as Social Security and Medicare taxes withheld from employee paychecks each quarter. This form also accounts for the employer's own contributions to Social Security and Medicare taxes. Most businesses with employees are required to file Form 941 four times a year, even if no wages were paid during a quarter. Properly completing this form helps maintain compliance with federal tax laws, prevents penalties, and ensures employees’ taxes are accurately credited.

What is the 2021 version of Form 941 used for?

You may need to complete Form 941 for the year 2021 for the following reasons:

- Filing or correcting returns for missed or amended tax quarters.

- Responding to IRS notices about original or corrected filings.

- Reconstructing payroll tax records or verifying past liabilities.

- Meeting IRS requirements for late returns (up to 2 years prior).

- Ensuring the correct form version to avoid processing delays.

How to fill out Form 941?

- 1

Enter your legal business name, address, and valid EIN at the top.

- 2

Report the number of employees paid during the pay period on Line 1.

- 3

Enter total wages, tips, and other compensation for the quarter on Line 2.

- 4

Report federal income tax withheld from employee wages on Line 3.

- 5

Calculate and enter Social Security and Medicare taxes on Lines 5–10.

- 6

Include applicable tax credits on Lines 11a–11c.

- 7

Complete all required pages with accurate data.

Who is required to fill out Form 941 for 2021?

Employers who paid wages during the second quarter of 2021 may need to fill out Form 941 for that year if they missed the original deadline, are correcting previous submissions, or received IRS notices regarding their reporting obligations.

When should you file Form 941 for 2021?

If you are filing the 2021 version of Form 941 now, the due dates for each quarter are as follows: April 30 for Q1, July 31 for Q2, October 31 for Q3, and January 31 for Q4 of the previous year. Late filings are accepted, but penalties may apply. If a due date lands on a weekend or holiday, the form is due the next business day.

How to get a blank Form 941 for the year 2021?

To obtain a blank Form 941 for 2021, visit our website. The Internal Revenue Service (IRS) provides this form, and our platform will automatically load a blank version for you—no separate download is necessary. Remember, PDF Guru aids in filling and downloading but not filing forms.

How to sign Form 941?

To complete the 2021 IRS Form 941, you can create an electronic signature using PDF Guru, but remember that a handwritten signature is also valid. The signature must be on page 3 and meet IRS standards, which include typed names, scanned handwritten signatures, or those made with a stylus. While PDF Guru allows you to fill out and download the form, please check for the latest updates and submit your completed form directly to the IRS, as our platform does not support submission.

Where to file Form 941 for the year 2021?

To file the 2021 Form 941 now, consider using the IRS e-file system for quicker processing. This method streamlines your submission and reduces wait times.

If you prefer to mail your form, ensure you check the correct IRS address based on your business location and whether you're sending a payment. Different centers handle returns with and without payments, so accuracy is crucial.