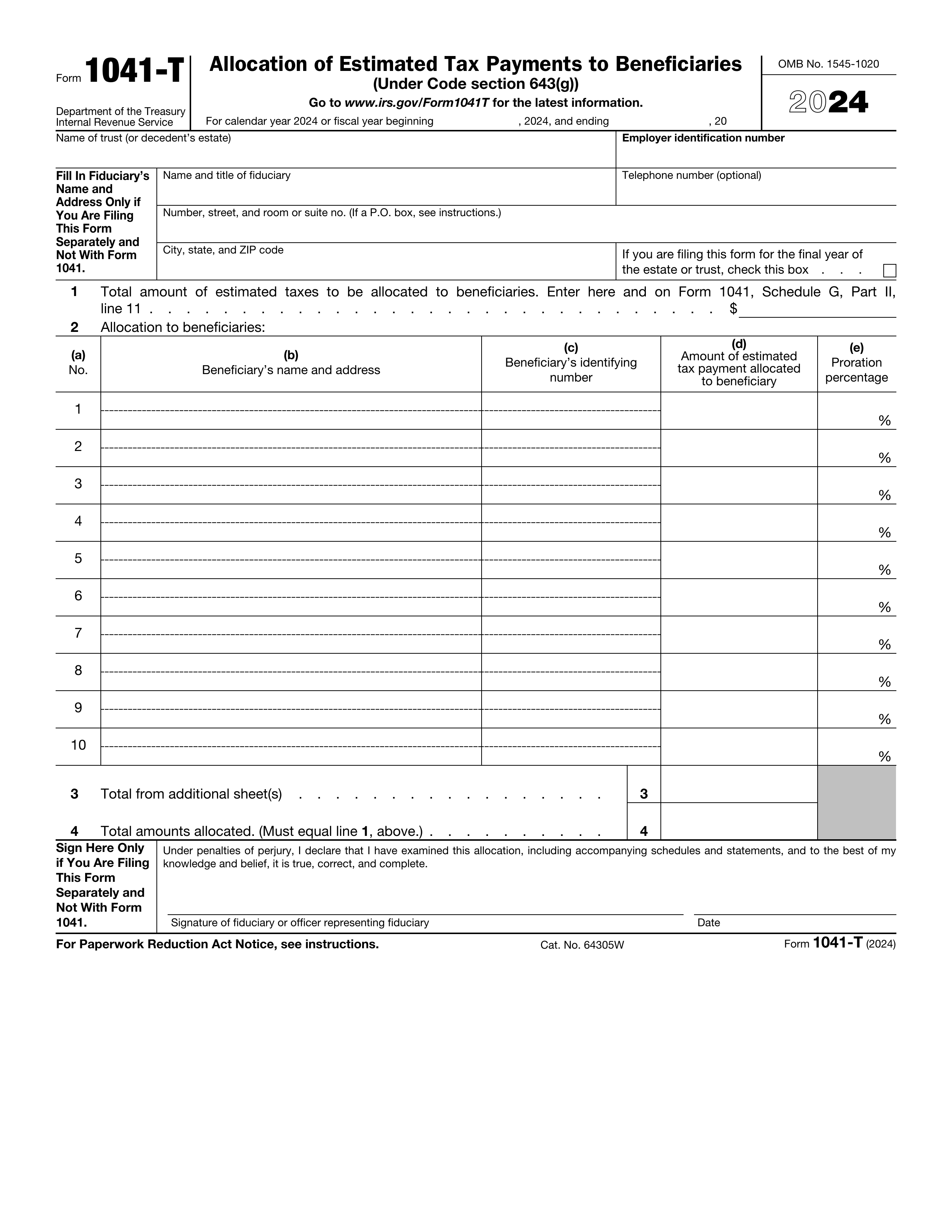

What is Form 1041-A?

Form 1041-A is used by trusts that accumulate charitable amounts. This form lets the IRS know how much of the trust's income is set aside for charity. It's important because it helps ensure that the trust meets its tax obligations while supporting charitable causes. By filing this form, trustees can provide transparency about the trust's financial activities, which is crucial for maintaining compliance with tax laws and for the proper management of charitable resources.

What is Form 1041-A used for?

Form 1041-A is used to report the accumulation of charitable amounts by trusts. Here’s what it’s for:

- to report income accumulated for charitable purposes.

- to inform the IRS about distributions to charities.

- to ensure compliance with tax regulations.

How to fill out Form 1041-A?

- 1

Gather necessary financial information for the trust, including income and deductions.

- 2

Complete the top section with the trust's name, address, and identifying number.

- 3

Fill out the income and deduction sections accurately, referring to official IRS guidelines for specifics.

- 4

Review the form for accuracy and completeness.

- 5

Consult official sources for the latest requirements regarding signatures before submitting the form.

- 6

Keep a copy of the completed form for your records.

Who is required to fill out Form 1041-A?

Form 1041-A must be completed by fiduciaries of trusts accumulating charitable amounts. This form is for reporting.

Afterward, the IRS uses the submitted form to verify compliance with tax obligations regarding charitable contributions.

When is Form 1041-A not required?

You don’t need to file Form 1041-A if the trust has no charitable amounts to report or if it is a simple trust that distributes all its income. Also, if the trust is not required to file an income tax return due to meeting specific income thresholds, then this form is unnecessary.

Additionally, if the trust is a grantor trust, where the grantor reports income on their personal tax return, Form 1041-A is not required.

When is Form 1041-A due?

The deadline for Form 1041-A is the 15th day of the fourth month after the close of the trust's taxable year. For example, if a trust's tax year ends December 31, the due date is April 15 of the following year.

How to get a blank Form 1041-A?

To get a blank Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts, visit our platform. This form is issued by the IRS. We have a pre-loaded version ready for you to fill out and download for your records.

How to sign Form 1041-A?

To sign Form 1041-A using PDF Guru, first, click on the Fill Form option. Load the blank version of the form in the PDF editor and fill out all required fields. When you reach the signature section, you can create a simple electronic signature to add to the form.

After completing the form and adding your signature, click Done to download your signed document. Remember to check the IRS guidelines for specific signature requirements to ensure compliance.

Where to file Form 1041-A?

Form 1041-A can typically be filed by mail. Ensure all required fields are completed accurately before sending it to the IRS.

Currently, this form cannot be submitted online. Always check the IRS website for the latest filing guidelines and updates.