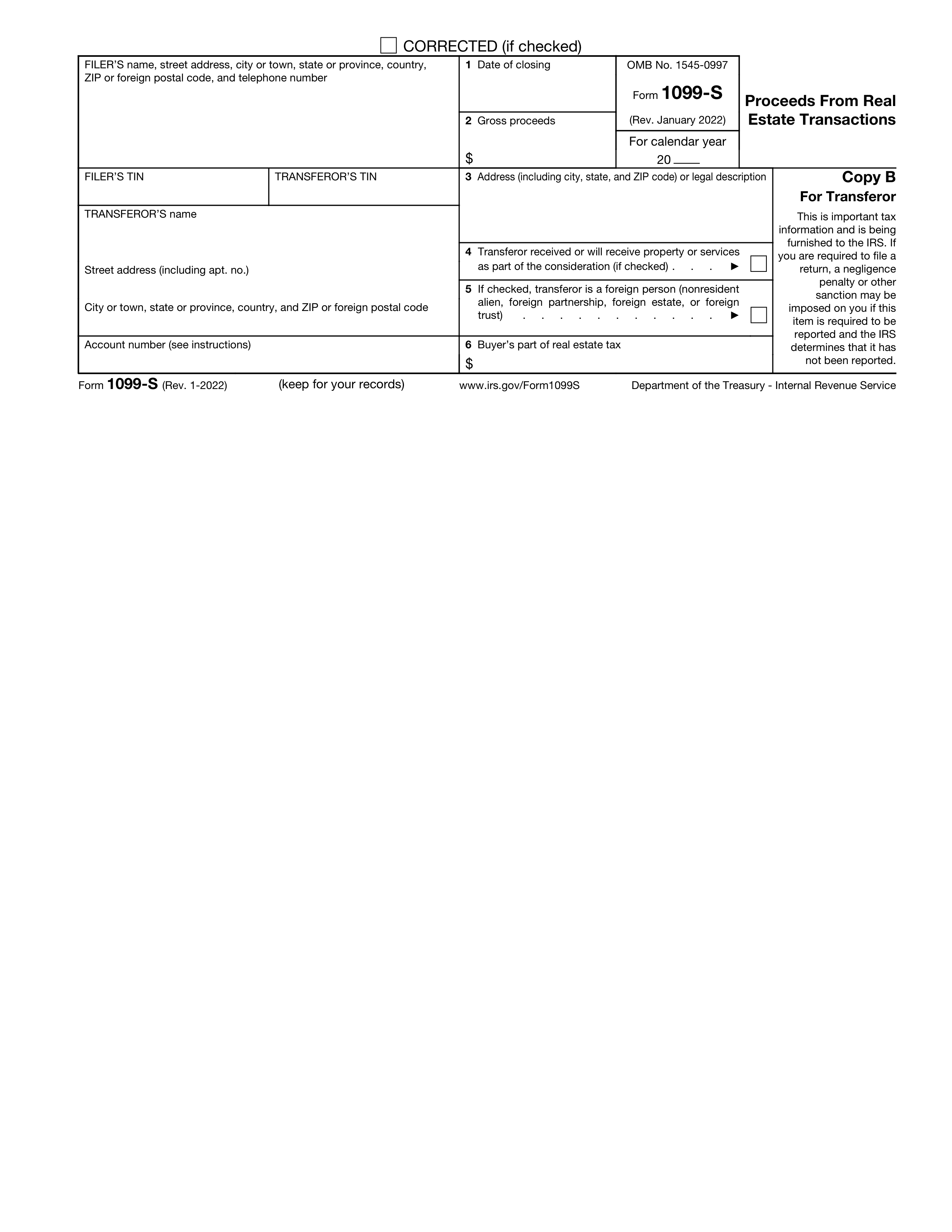

What is Form 1099-Q?

The Form 1099-Q is used to report payments from qualified education programs. It's needed by individuals who receive distributions from a Coverdell Education Savings Account or 529 Plan. The form helps track the money used for educational expenses, ensuring it's spent appropriately. If you've received or made payments from these education savings accounts, filling out this form is essential for your tax records.

What is Form 1099-Q used for?

Form 1099-Q is a crucial document for reporting specific financial transactions. Here's what it's used for:

- To report payments from qualified education programs.

- To detail distributions from Coverdell ESAs.

- To track withdrawals for educational expenses.

How to fill out Form 1099-Q?

- 1

Start by entering the payer's name, address, and TIN (Taxpayer Identification Number) in the designated fields.

- 2

Fill in the recipient's name, address, and TIN.

- 3

In the boxes provided, input the total distribution amount in box 1.

- 4

Specify the earnings part of the distribution in box 2.

- 5

In box 3, note the basis in the distribution (the amount contributed to the account).

- 6

Indicate the type of distribution received by checking the appropriate box in box 6.

- 7

Review all information for accuracy before proceeding with submission according to IRS guidelines.

Who is required to fill out Form 1099-Q?

The responsibility for filling out Form 1099-Q falls on the shoulders of the plan administrators or issuers of a 529 plan or Coverdell ESA.

After completion, the recipient of the distribution uses Form 1099-Q to report the payment on their taxes, ensuring compliance.

When is Form 1099-Q not required?

Not everyone needs to worry about filling out a Form 1099-Q. Specifically, individuals who are not involved in the distribution or management of qualified education programs will find this form irrelevant to their tax situation.

For example, if you have not received any payments from a qualified tuition program or Coverdell ESA during the tax year, you will not need to fill out a Form 1099-Q. This form is targeted towards specific financial transactions related to education expenses, so if these situations do not apply to you, filling out this form is not necessary.

When is Form 1099-Q due?

The deadline for Form 1099-Q is January 31st following the year in which the payments were made.

This form is crucial for reporting any payments from qualified education programs. Ensuring it's submitted by this date helps maintain compliance with IRS requirements.

How to get a blank Form 1099-Q?

To get a blank form 1099-Q, issued by IRS, visit our platform where the template is pre-loaded in our editor. You can start filling it out right away without needing to download the template from anywhere else. Remember, our website helps you fill out and download the form, but not submit it.

Do you need to sign Form 1099-Q?

Form 1099-Q, based on official guidelines, does not typically need a signature. It's important to review the latest instructions to confirm.

Always verify the most current requirements for Form 1099-Q. Updates might change filing expectations, so staying informed is crucial.

Where to file Form 1099-Q?

If you are filing fewer than 10 information returns, you may file on paper. Use the official scannable IRS form and mail it to the IRS at the address specified in the General Instructions for Certain Information Returns, which varies by your location.

If you are filing 10 or more information returns, you must file electronically using an IRS-authorized e-file provider or the IRS FIRE system.