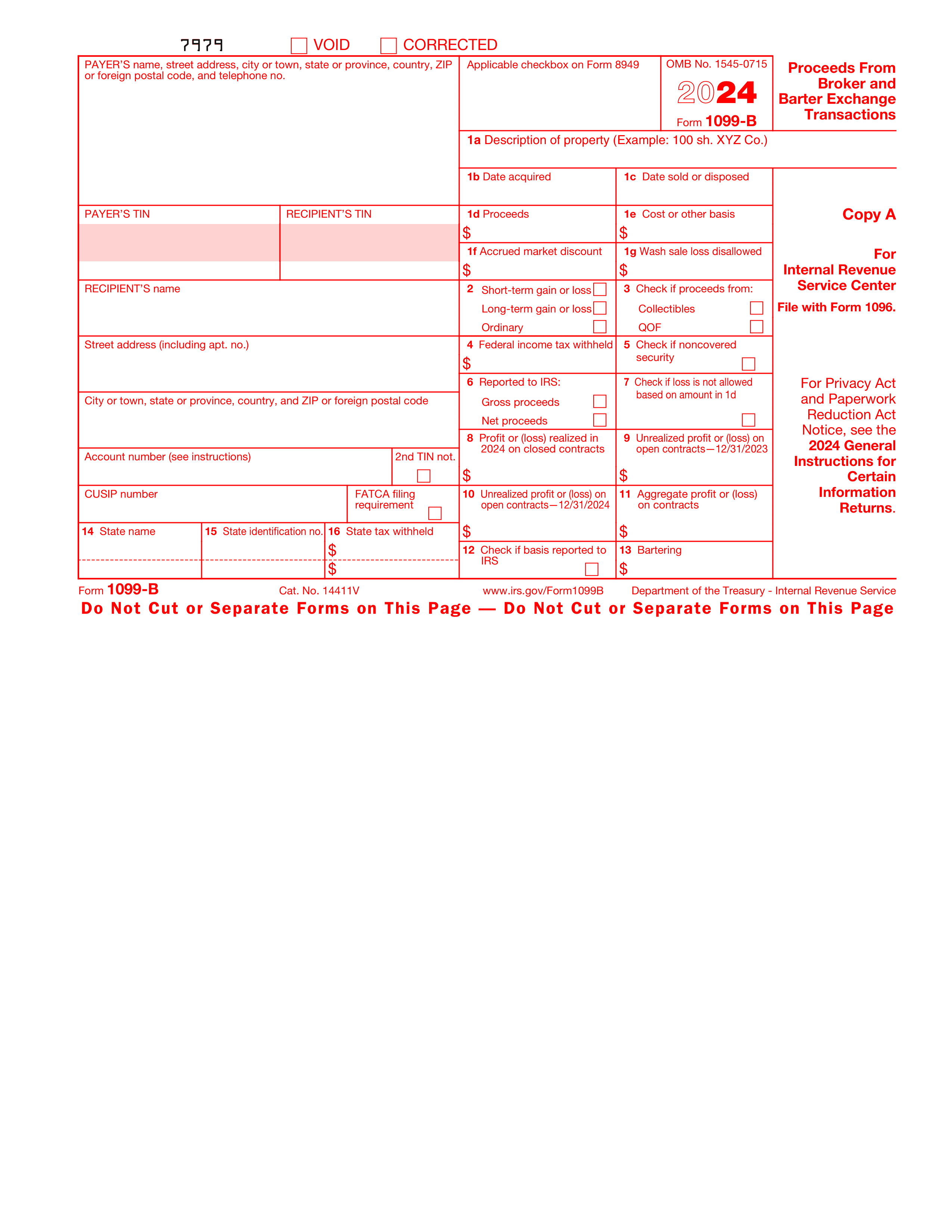

What is Form 1099-S?

The Form 1099-S is essential for reporting real estate transactions. It's used by those who have sold or transferred real estate to disclose the sale to the IRS. This includes details like the selling price and the date of the transaction. It's crucial for tax purposes, ensuring sellers accurately report their potential capital gains or losses. Real estate agents, closing agents, and property sellers need to fill out this form to comply with tax laws.

What is Form 1099-S used for?

Form 1099-S is essential for reporting real estate transactions. Here's what it's used for:

- To report proceeds from real estate transactions.

- To inform the IRS of the sale or exchange of property.

- To document transactions for investment property.

How to fill out Form 1099-S?

- 1

Start by entering the seller's information in the designated sections, including name, address, and TIN (Taxpayer Identification Number).

- 2

In the next section, fill in the buyer's information, such as name and address.

- 3

Specify the closing date of the real estate transaction.

- 4

Input the gross proceeds from the sale in the appropriate field.

- 5

If applicable, fill in the section regarding the property's location, including address or legal description.

- 6

Lastly, report any real estate tax paid on the property for the current year.

- 7

Review the form for accuracy before submitting it according to the IRS guidelines for submission.

Who is required to fill out Form 1099-S?

Real estate transaction parties, like title companies, attorneys, and real estate agents, are responsible for filling out Form 1099-S.

The IRS and the person who sold the property use Form 1099-S to report the sale and ensure taxes are correctly reported.

When is Form 1099-S not required?

Not everyone needs to fill out a Form 1099-S. For instance, individuals who are transferring property as a gift or inheritance may not require this form.

Moreover, if you're selling your primary residence and the gains do not exceed the IRS exclusion limit, you might not need to submit a Form 1099-S. It's important for sellers to understand these exceptions to avoid unnecessary paperwork.

When is Form 1099-S due?

The deadline for Form 1099-S is February 28 if submitting by paper, or March 31 if submitting electronically to the IRS. Also, you must furnish Form 1099-S to recipients by February 18.

This form is used to report proceeds from real estate transactions. Meeting the submission deadlines ensures compliance with IRS requirements, helping avoid potential penalties.

How to get a blank Form 1099-S?

To get a blank form 1099-S, issued by IRS, visit our platform where the template is pre-loaded in our editor, allowing you to start filling it out right away before downloading it for your use. Remember, our website helps with creating and downloading the form, but not with submitting it.

Do you need to sign Form 1099-S?

Form 1099-S typically does not need a signature. Always verify with the latest official guidelines.

Updates may change requirements. Double-check to ensure compliance.

Where to file Form 1099-S?

Form 1099-S can be submitted online through the IRS FIRE system. This method requires an account setup first.

Alternatively, it can also be sent by mail to the IRS, following their specific mailing instructions for tax documents.