What is Form 8829?

Form 8829 is designed for individuals who use part of their home for business purposes. It helps you calculate the amount of home expenses you can deduct on your tax return, such as mortgage interest, insurance, utilities, repairs, and depreciation. If you're self-employed and have a home office that you regularly and exclusively use for business, filling out Form 8829 can lower your tax bill by allowing you to claim these deductions.

What is Form 8829 used for?

Form 8829 is essential for calculating the allowable expenses for business use of your home. Here are its key uses:

- To determine the deductible amount for home office expenses.

- To allocate expenses between personal and business use.

How to fill out Form 8829?

- 1

Start with Part I to calculate the percentage of your home used for business.

- 2

In Part II, list your direct and indirect expenses.

- 3

Part III requires you to determine the depreciation of your home.

- 4

Complete Part IV to carry over any unallowed expenses to the next year.

- 5

Submit the completed form with your tax return following IRS guidelines.

Who is required to fill out Form 8829?

Form 8829 is filled out by individuals who run a business from their home, allowing them to claim expenses for business use of the home.

The IRS uses this form to assess the legitimacy of the home office deductions claimed by the taxpayer.

When is Form 8829 not required?

Form 8829 is not required for individuals who do not use part of their home for business purposes. If you are an employee and your employer reimburses you for business use of your home, you do not need to complete Form 8829.

When is Form 8829 due?

The deadline for Form 8829 is the same as your personal tax return, typically April 15th. If you file for an extension for your tax return (using Form 4868), the deadline for Form 8829 is also extended, usually to October 15.

Remember to check for any updates in case of extensions or changes in filing dates.

How to get a blank Form 8829?

To get a blank Form 8829, issued by IRS, simply visit our platform where the template is pre-loaded in our editor. You can start filling it out right away without needing to download the template from anywhere else. Remember, our website helps you fill out and download the form, but not file it.

Do you need to sign Form 8829?

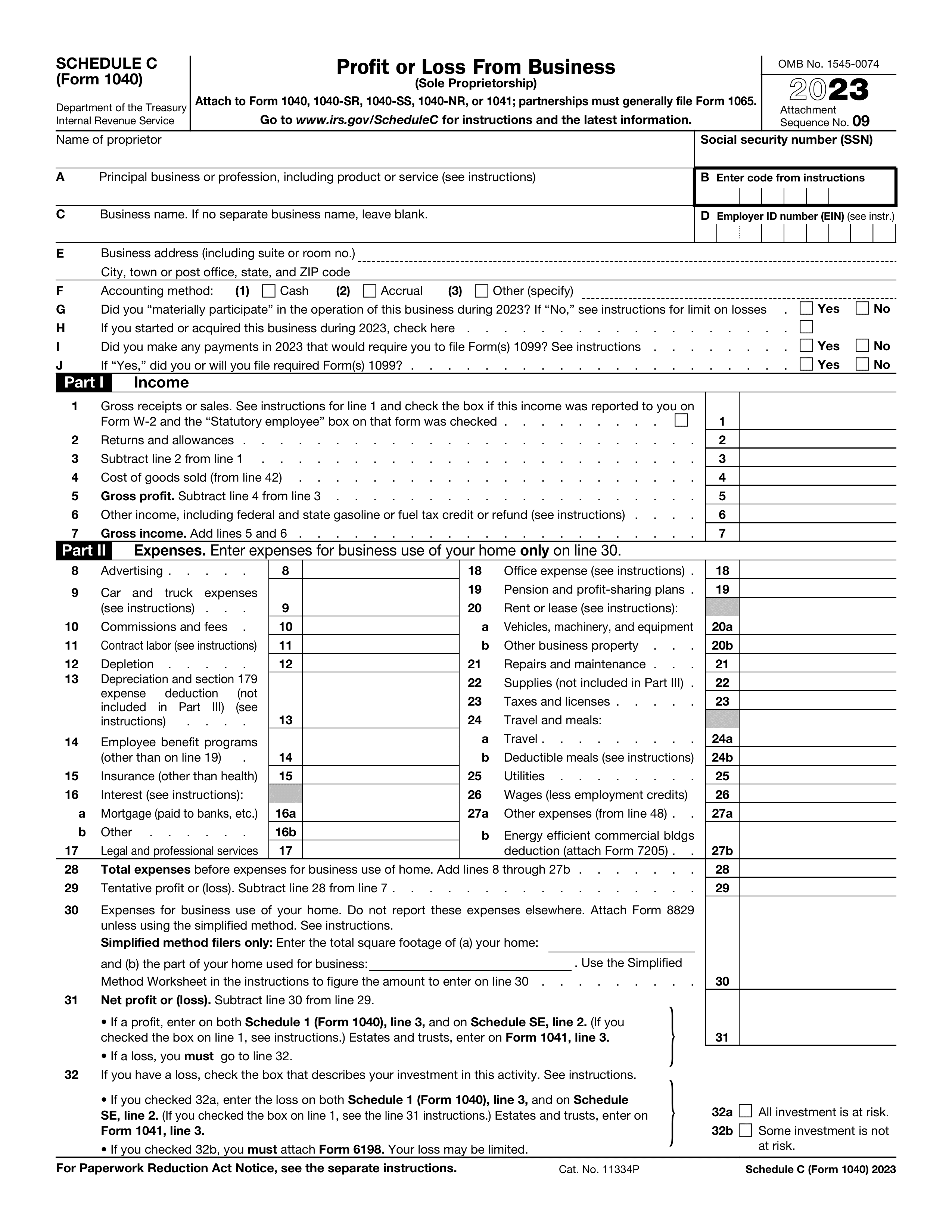

Form 8829 does not require a signature and is attached to your Schedule C (Form 1040) when you file your tax return. However, it's important to verify with the latest guidelines.

Always refer to the most recent instructions for Form 8829 to ensure accuracy. Changes can occur that may affect your tax filing.

Where to file Form 8829?

Submit your completed Form 1040, with Schedule C and Form 8829 attached, to the IRS by the tax return due date (typically April 15, unless you have an extension).

You can file electronically using IRS e-file or mail your paper return to the IRS address provided in the Form 1040 instructions.