What is Form 1139?

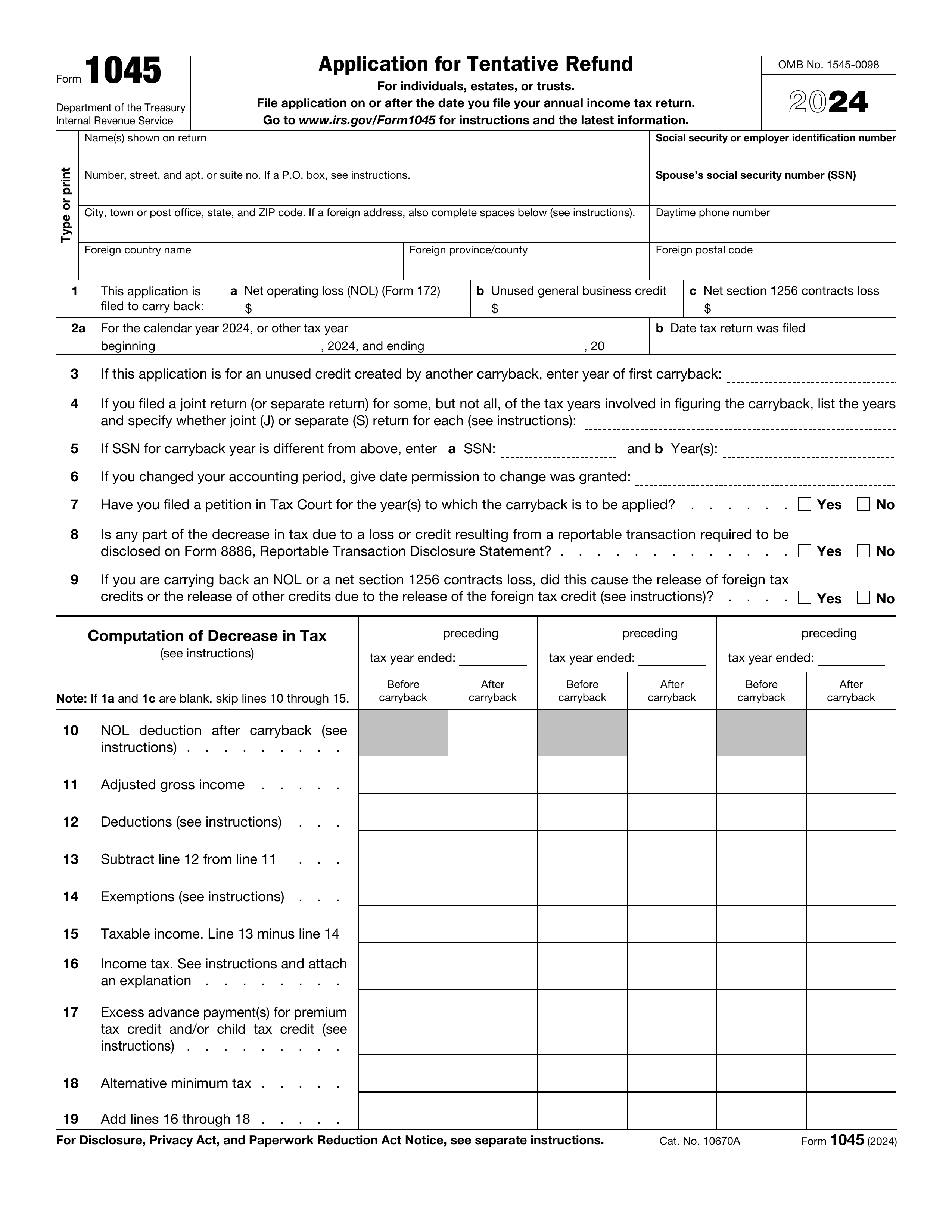

Form 1139, Corporation Application for Tentative Refund, is important for corporations that overpaid taxes. This form allows businesses to apply for a quick refund based on certain tax adjustments, like net operating losses. By filing Form 1139, companies can receive their money back faster instead of waiting for the next tax return. This can help improve cash flow and provide funds for operations or investments. Understanding and using this form can be crucial for a corporation’s financial health.

What is Form 1139 used for?

Form 1139, Corporation Application for Tentative Refund, is used by corporations to claim a refund of taxes. Here’s what it helps with:

- to apply for a refund based on certain tax credits.

- to adjust tax liabilities from previous years.

- to expedite the refund process.

How to fill out Form 1139?

- 1

Review the instructions provided by the IRS for Form 1139 to ensure you understand the requirements.

- 2

Fill in the corporation’s name, address, and Employer Identification Number (EIN) accurately.

- 3

Complete the applicable sections regarding the overpayment and the refund requested.

- 4

Check all figures for accuracy to prevent processing delays.

- 5

Sign the form as required and verify with official sources for the latest signature guidelines.

Who is required to fill out Form 1139?

Corporations eligible for a tentative refund must complete Form 1139 for tax purposes. This includes those claiming a refund due to a net operating loss or credit carryback.

Afterward, the IRS processes the form to issue refunds to qualifying corporations based on their claims.

When is Form 1139 not required?

If your corporation does not have any unused credits or losses from prior tax years, you don't need to file Form 1139. Additionally, if your business is not expecting to claim a tentative refund for any reason, this form is unnecessary.

Corporations that have not incurred any net operating losses or carrybacks also do not require this form. Always review your tax situation to confirm your filing needs.

When is Form 1139 due?

The deadline for Form I-690 is not specified, as it depends on the specific circumstances and the processing time by USCIS. However, it is recommended to file as soon as possible after determining your eligibility and gathering necessary documentation. You can check the USCIS website for the most current information on filing procedures and timelines.

How to get a blank Form 1139?

To get a blank Form 1139, Corporation Application for Tentative Refund, simply visit our website. The IRS issues this form, and we have a blank version ready for you to fill out. Remember, our platform allows you to download the completed form, but not file it.

How to sign Form 1139?

To sign Form 1139, Corporation Application for Tentative Refund, using PDF Guru, start by clicking on the "Fill Form" option. Once the blank form loads in the PDF editor, complete the necessary fields, including the signature area. After filling out the form, you can create a simple electronic signature if the form allows.

After adding your electronic signature, click "Done" to download the completed form. Always check the official IRS guidelines for specific signature requirements related to Form 1139 before submitting.

Where to file Form 1139?

Form 1139 can be filed by mail or electronically. For electronic filing, use IRS e-file options available for certain corporations.

If filing by mail, send the completed form to the designated IRS address listed in the instructions. Always check for the latest guidelines.