What is an IRC Section 7216 form?

Section 7216 is crucial for protecting taxpayer information. It authorizes tax professionals to disclose tax return information to third parties for specific purposes, such as preparing a loan application or assisting with an audit. This form ensures that sensitive data is only shared with authorized individuals, safeguarding taxpayer privacy. It is essential for maintaining confidentiality and complying with IRS regulations. Make sure to accurately fill out and file Section 7216 whenever sensitive tax information needs to be disclosed.

What is Section 7216 used for?

Section 7216 is a crucial IRS document that guides tax preparers on the use and disclosure of tax return information.

- To provide clear instructions on how tax return information may be disclosed or used by tax preparers.

- To ensure tax preparers understand the rules and guidelines for privacy, confidentiality, and disclosure.

- To outline consequences for tax preparers who fail to comply with these regulations.

- To serve as a reference for tax preparers when dealing with sensitive client information.

- To help tax preparers maintain a high level of professional ethics and conduct.

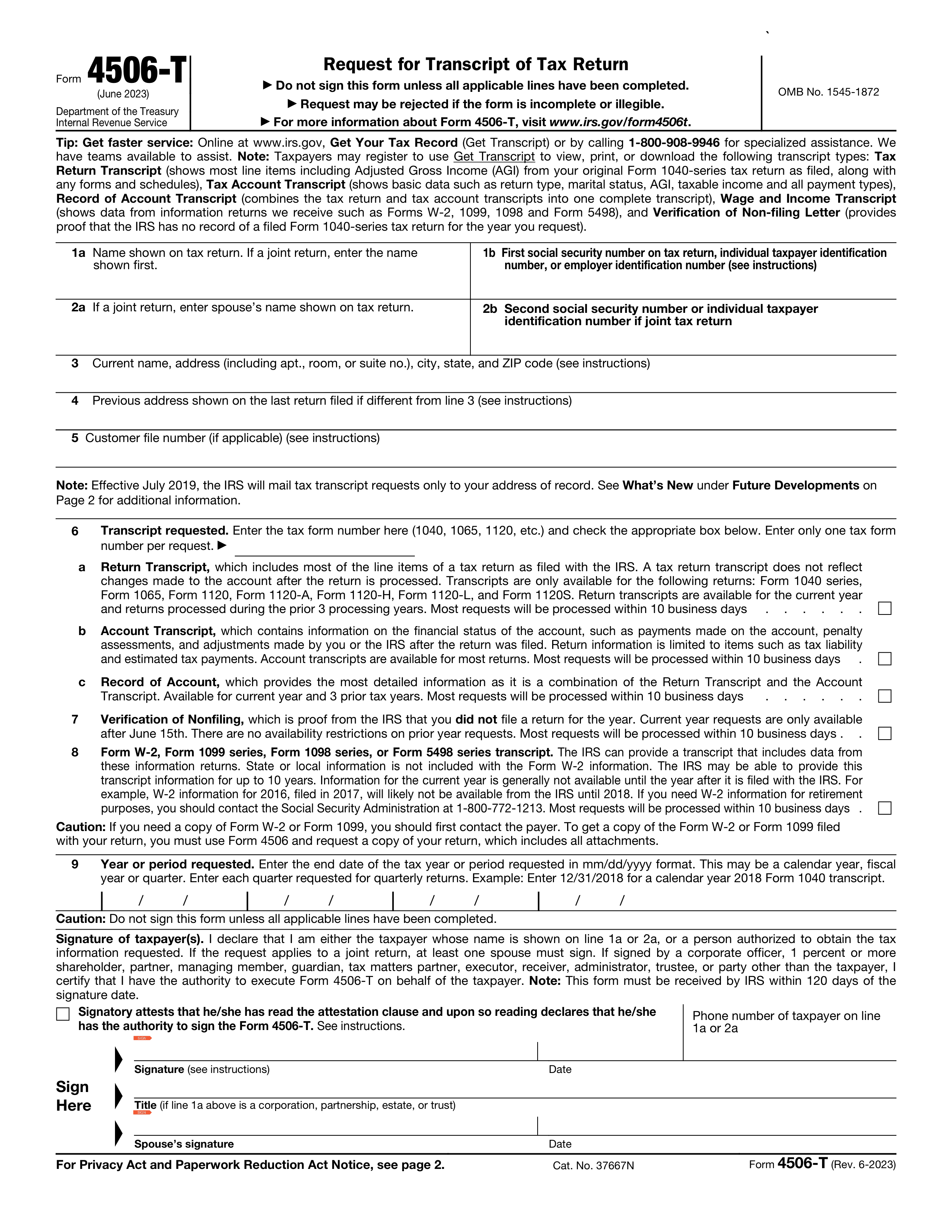

How to fill out Section 7216?

- 1

Start by entering your personal information, like name, address, and tax identification number, in the appropriate fields.

- 2

Provide specific details about your tax data disclosure, including the purpose and the duration for which the data will be disclosed.

- 3

Check the box if you consent to your tax return information being disclosed to a third party.

- 4

Create an electronic signature by typing your name in the signature field and adding the date.

- 5

Download your completed Section 7216 form and print it out.

- 6

Mail your form to the IRS according to their guidelines.

Who is required to fill out Section 7216?

Tax professionals who handle sensitive taxpayer information are required to fill out Section 7216. This form is crucial for obtaining consent from taxpayers before disclosing or using their tax return information for purposes other than preparing a tax return.

After the form is filled out, it's primarily used by the IRS and the taxpayer. The IRS monitors compliance with Section 7216 regulations, while the taxpayer keeps a copy for their records.

When is Section 7216 not required?

Form 7216 is not a requirement for individuals who are managing their own tax information and not sharing it with a third party. If you're handling your taxes personally and not using the services of a tax preparer or an accountant, this form is not necessary for you.

Those who do not disclose their tax information for purposes other than tax preparation or filing also do not need to fill out this form. It's specifically for situations where tax information is shared with third parties for non-tax-related services.

When is Section 7216 due?

The deadline for Section 7216 is typically by January 31st of each year.

This form is used by tax preparers to obtain consent from their clients before using or disclosing their tax return information for purposes other than preparing the return. It's important to submit it on time to comply with IRS regulations and ensure the confidentiality of taxpayer information.

How to get a blank Section 7216?

To get a blank Section 7216, visit our platform where we have the template pre-loaded in our editor, ready for you to fill out. You don't need to download the template from anywhere else, making it convenient to start working on your form right away. Remember, our website helps you fill out and download the form, but we don't assist in submitting it.

How to sign Section 7216 online?

To sign Section 7216 online, start by visiting PDF Guru. After filling out the necessary fields, you can create a simple electronic signature.

Once your form is complete, select the option to add a signature. PDF Guru guides you through the process, ensuring your form is ready to download.

Where to file Section 7216?

Section 7216 can be submitted online, offering a convenient method for users to complete the process.

Additionally, it is possible to send Section 7216 through the mail, catering to those who prefer or require a paper-based option.