What is a 3921 form?

Form 3921 is used for reporting exercises of incentive stock options (ISOs) to the IRS. If you've been given the option to buy company stock at a discount, and you've taken that offer, this form helps document the transaction. It's essential for employees who've exercised their stock options to fill out this form to ensure proper tax reporting and compliance with IRS rules.

What is a 3921 form used for?

Form 3921 is a crucial document for reporting specific tax information. It serves to:

- To report a transfer of stock to an individual who exercised an incentive stock option.

- To provide the IRS with details of stock option exercises.

- To help individuals accurately report income from stock options on their tax return.

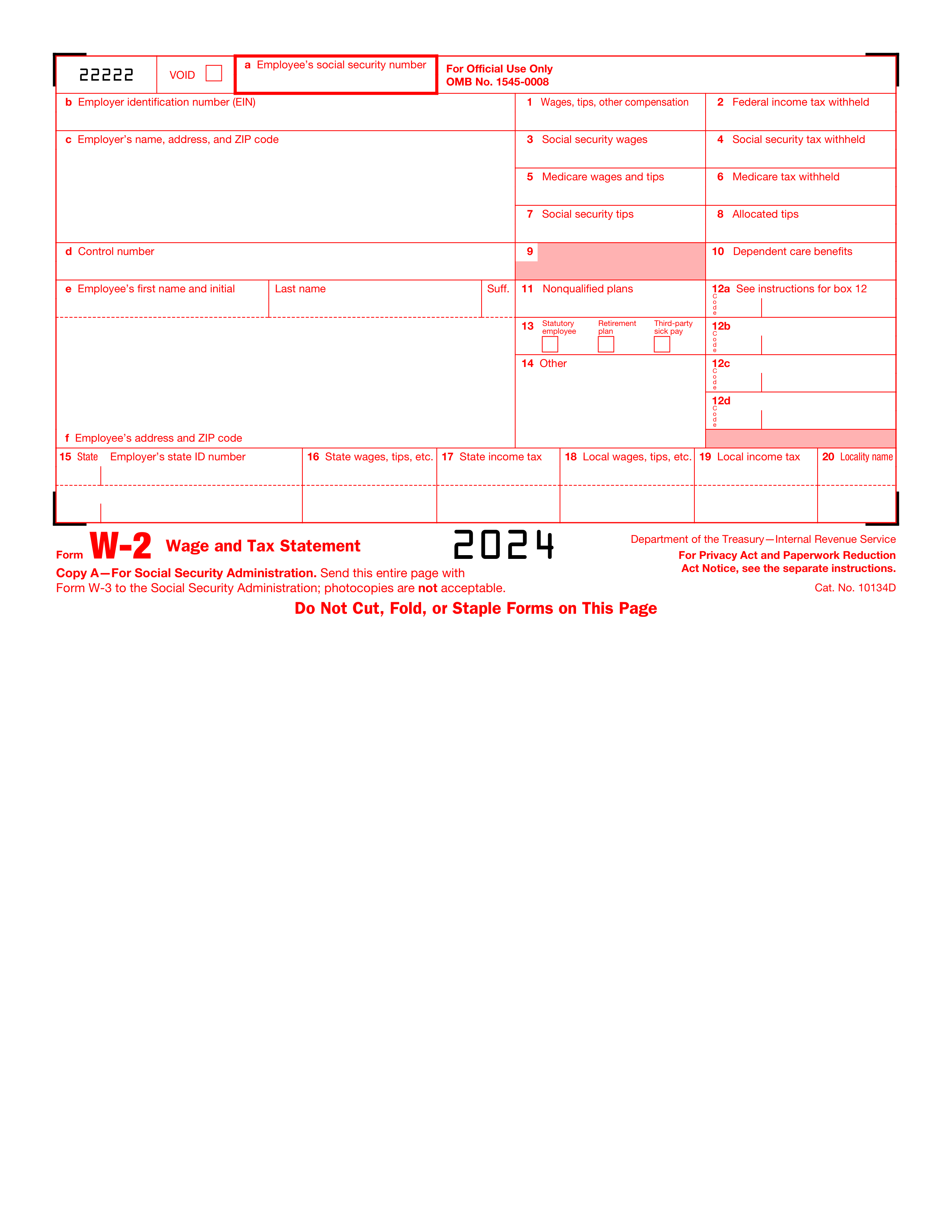

How to fill out a 3921 form?

- 1

Start by entering your personal information, including your name, address, and Social Security Number.

- 2

Input the employer’s name, address, and EIN (Employer Identification Number).

- 3

Fill in the exercise date of the stock option.

- 4

Specify the fair market value of the stock on the exercise date.

- 5

Enter the exercise price per share.

- 6

Once all fields are completed, review the form for accuracy.

- 7

Create a simple electronic signature if the form accepts it, then download your document.

Who is required to fill out Form 3921?

Form 3921 is primarily filled out by corporations when an employee exercises an incentive stock option (ISO).

The IRS and the employee who exercised the option use Form 3921 to ensure proper reporting and tax treatment of ISOs.

When is a 3921 form not required?

Certain individuals might not need to fill out Form 3921. This includes those who have not participated in an incentive stock option (ISO) plan during the tax year.

If your employer does not offer ISOs or if you have not exercised any ISOs in the reporting period, you are not required to complete Form 3921.

When is a 3921 form due?

The deadline for Form 3921 is January 31, 2025, for notifying employees about incentive stock option exercises in 2024. You must file the form with the IRS by February 28, 2025, if mailed, or by March 31, 2025, if filed electronically. If you have 10 or more forms, electronic filing is required.

How to get a blank 3921 form?

To get a blank Form 3921, visit our platform where the template is already loaded in our editor, making it ready for you to fill out. Remember, our website helps you fill out and download the form, but we don't assist in filing it.

How to sign 3921 form online?

To sign Form 3921 online, PDF Guru offers a tool for creating simple electronic signatures. Begin by filling out the required fields on the form.

Once completed, use the PDF Guru editor to add your electronic signature. This final step ensures your Form 3921 is signed and ready for download.

Where to file a 3921?

Form 3921 is used for reporting exercises of incentive stock options. It can be sent by mail to the IRS.

This form cannot be submitted online. It must be completed and mailed in paper format.