What is Form 8396?

Form 8396, Mortgage Interest Credit, allows eligible homeowners to claim a tax credit based on the mortgage interest they paid. This form is important because it can reduce the amount of federal income tax you owe, potentially saving you money. To qualify, you must meet specific criteria, such as having a low-income mortgage. The credit helps make homeownership more affordable and encourages people to invest in their homes. Filling out this form correctly ensures you receive the financial benefits you deserve.

What is Form 8396 used for?

Form 8396 helps eligible taxpayers claim a credit for mortgage interest paid. Here’s what it’s used for:

- to claim a credit for mortgage interest.

- to reduce tax liability.

- to support affordable housing initiatives.

How to fill out Form 8396?

- 1

Open Form 8396 in the PDF editor.

- 2

Fill in your name, address, and Social Security number in the personal information section.

- 3

Complete the mortgage interest credit section with the amount of mortgage interest paid.

- 4

Calculate your credit using the instructions provided on the form.

- 5

Review all entries to ensure accuracy.

- 6

Download the filled form for your records.

- 7

Submit the form with your tax return as instructed.

Who is required to fill out Form 8396?

Form 8396 must be completed by individuals issued a qualified Mortgage Credit Certificate (MCC) by a state or local agency. Homeowners involved in a qualified mortgage credit certificate program should also fill out this form.

This form is used by lower-to moderate-income individuals who received an MCC linked to a new mortgage for their primary residence.

When is Form 8396 not required?

If you do not have a qualified Mortgage Credit Certificate, you do not need to fill out Form 8396. Homeowners who only use the standard mortgage interest deduction on Schedule A also do not need this form.

Additionally, if you claim mortgage interest on a home that is not your primary residence, or if you are claiming credits from federal programs like Homestead Staff Exemption Certificates or those issued by the FHA, VA, or Farmers Home Administration, Form 8396 is not required.

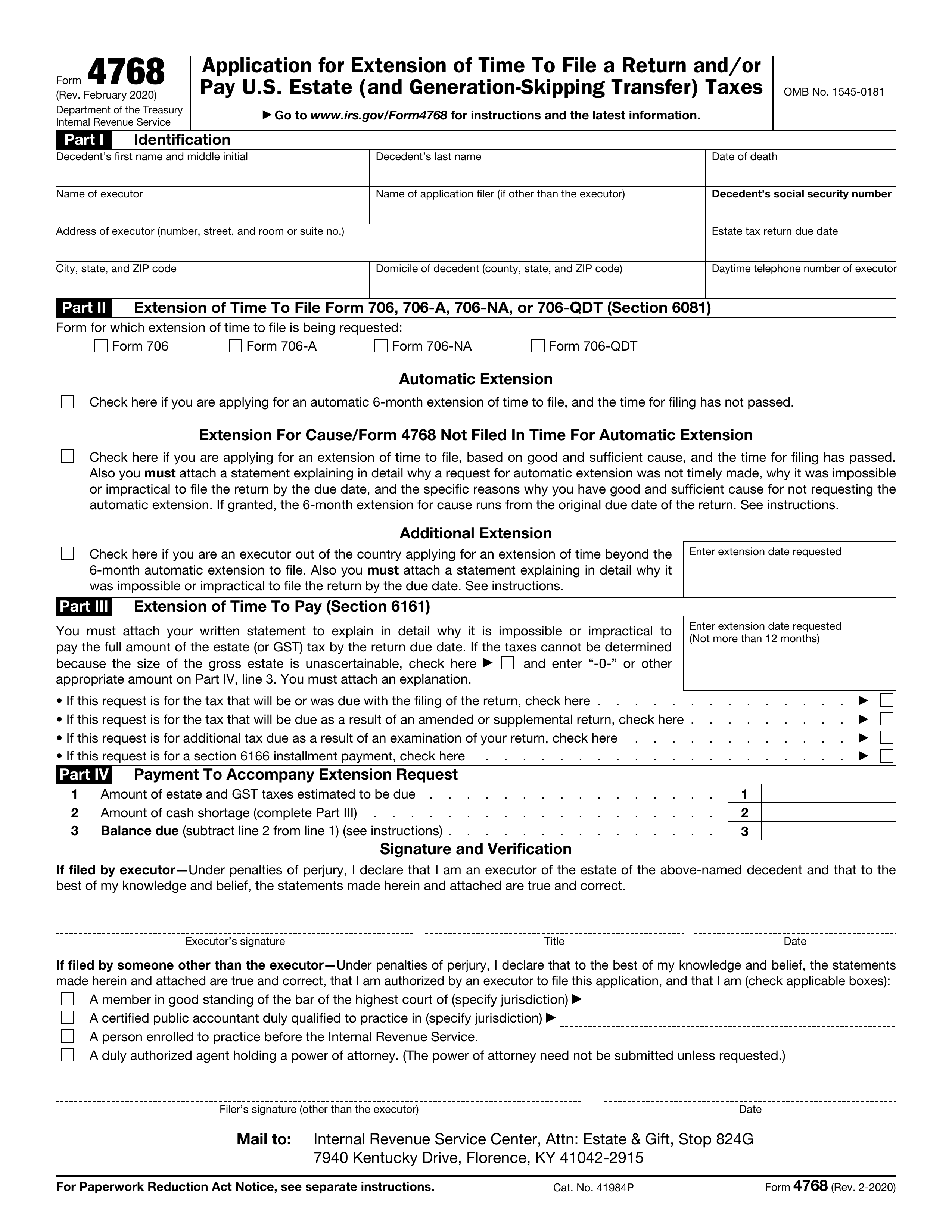

When is Form 8396 due?

The deadline for Form 8396 is April 15th for most taxpayers, or October 15th if you file for an extension. This form must be included with your federal income tax return for the year you are claiming the credit.

Remember, a new Form 8396 needs to be filed for each tax year in which you want to claim the mortgage interest credit. Make sure to keep track of these deadlines to avoid any issues with your tax filings.

How to get a blank Form 8396?

To get a blank Form 8396, you can find it pre-loaded in our editor on our website. You can fill it out and download it directly from our platform.

This form is issued by the Internal Revenue Service (IRS).

How to sign Form 8396 online?

To sign Form 8396 using PDF Guru, first, load the blank version of the form in the PDF editor by clicking "Fill Form." Fill out all necessary fields carefully, ensuring accuracy. After completing the form, you can create a simple electronic signature.

Once you have added your signature, click "Done" to download the filled form. Always consult official sources for specific signature requirements before submission to ensure compliance with IRS regulations.

Where to file Form 8396?

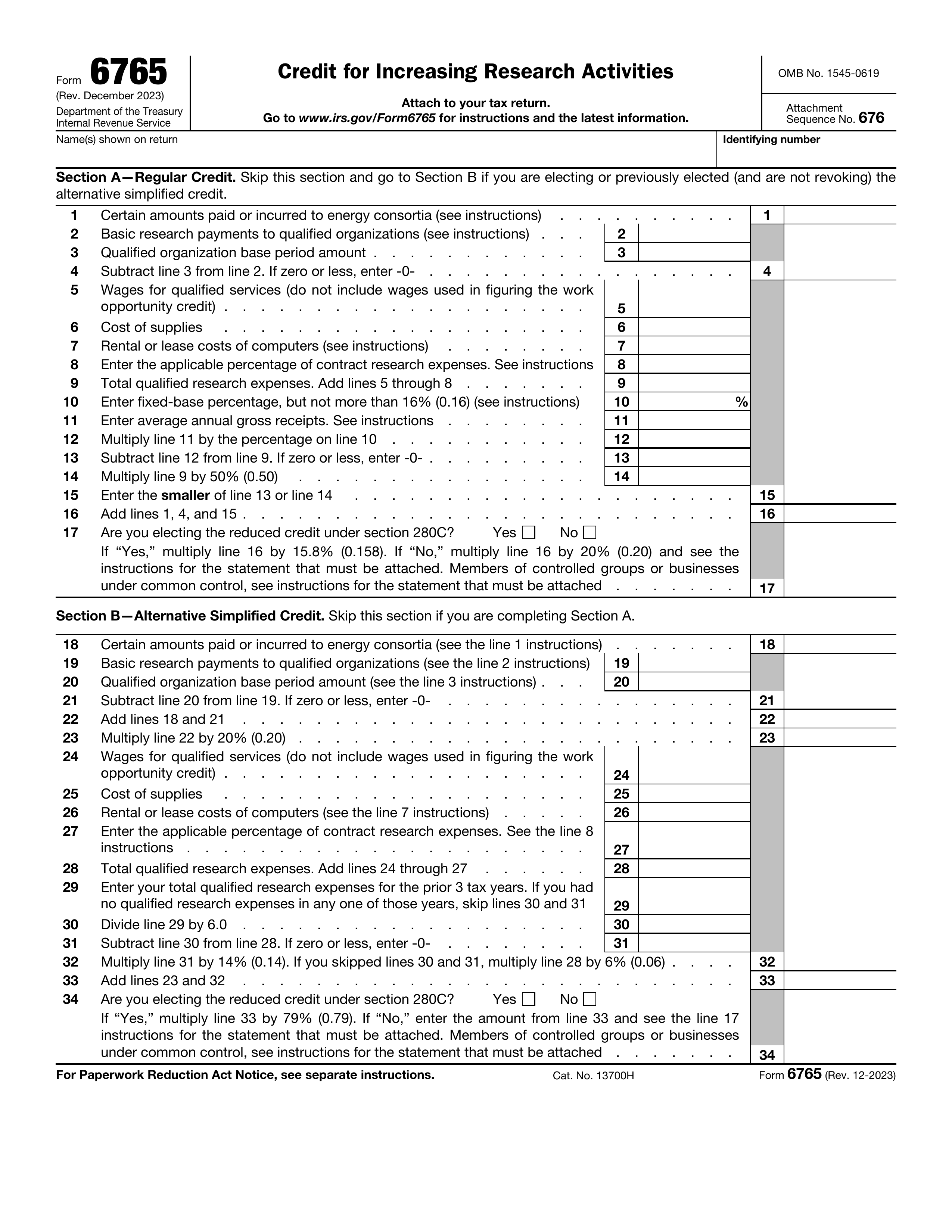

Form 6765 must be submitted to the Internal Revenue Service (IRS).

Submission methods: mail, in-person or electronic.