What is an 843 form?

Form 843 is used for individuals who need to request a refund or ask for an abatement of certain taxes, interest, penalties, fees, and additions to tax. This form is particularly needed if you believe you've been incorrectly charged or overpaid on your taxes. It's essential for correcting errors related to tax payments and ensuring you're not paying more than what you owe.

What is an 843 form used for?

Form 843 is a crucial document for taxpayers seeking specific adjustments. Here's what it's used for:

- To request a refund of certain taxes, fees, and penalties.

- To ask for an abatement of certain interest or penalties.

How to fill out an 843 form?

- 1

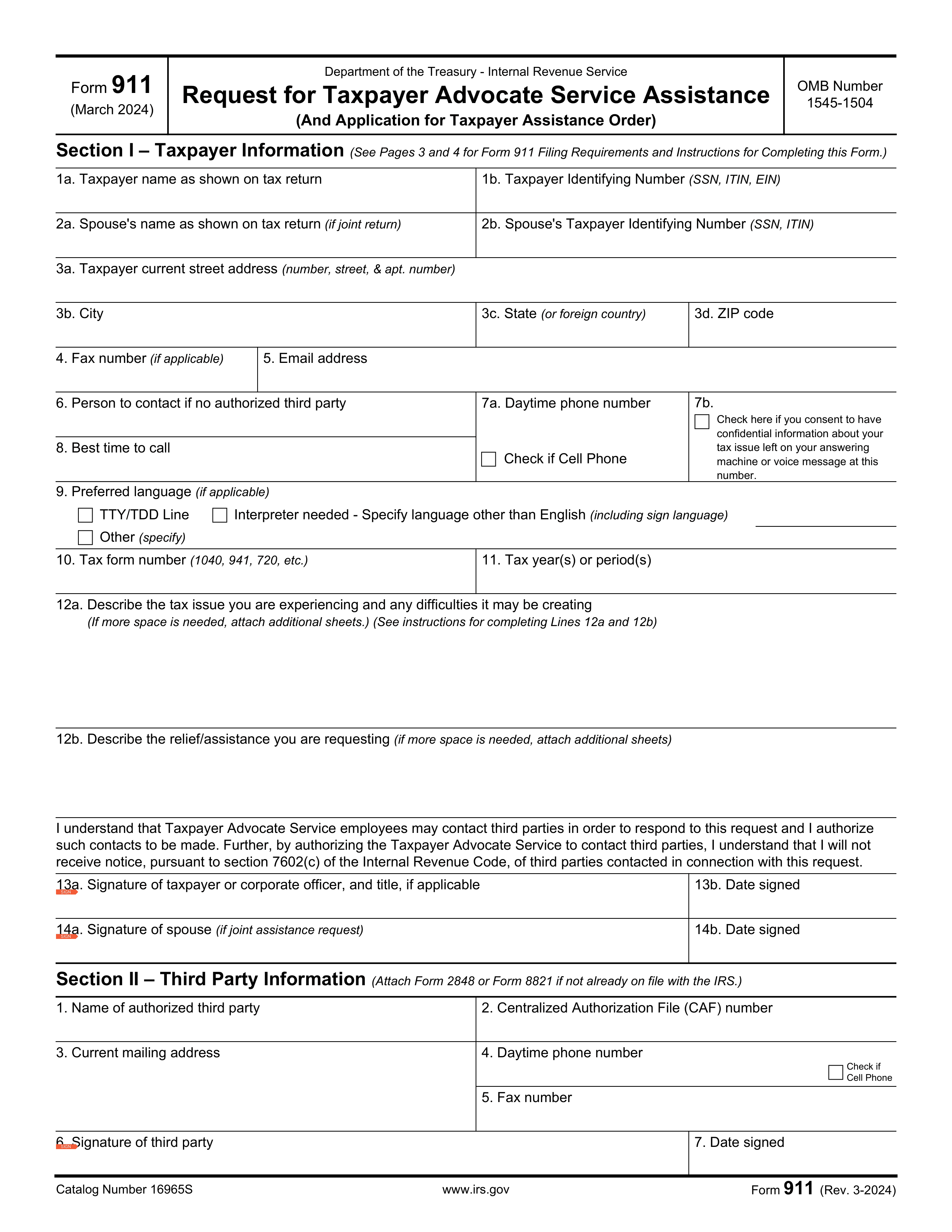

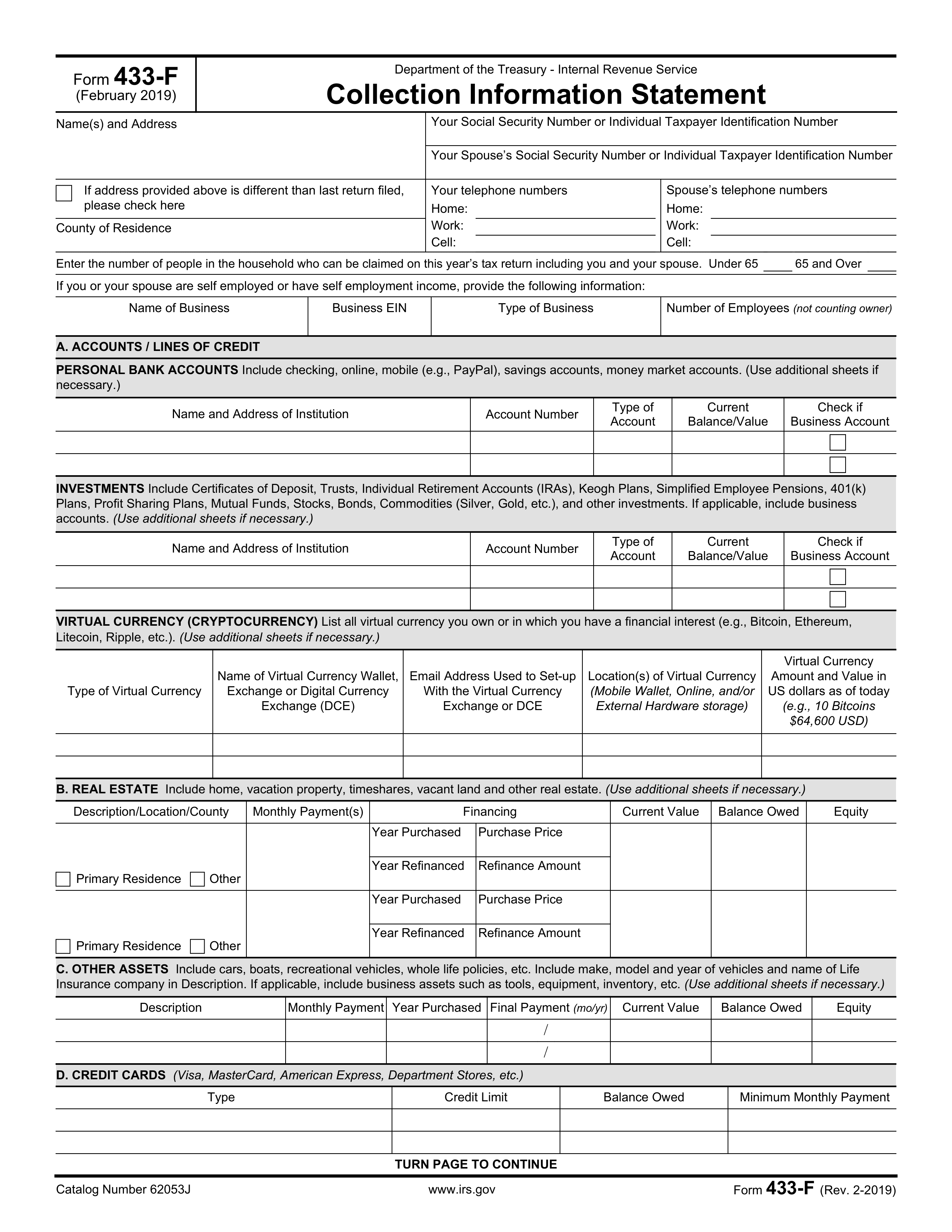

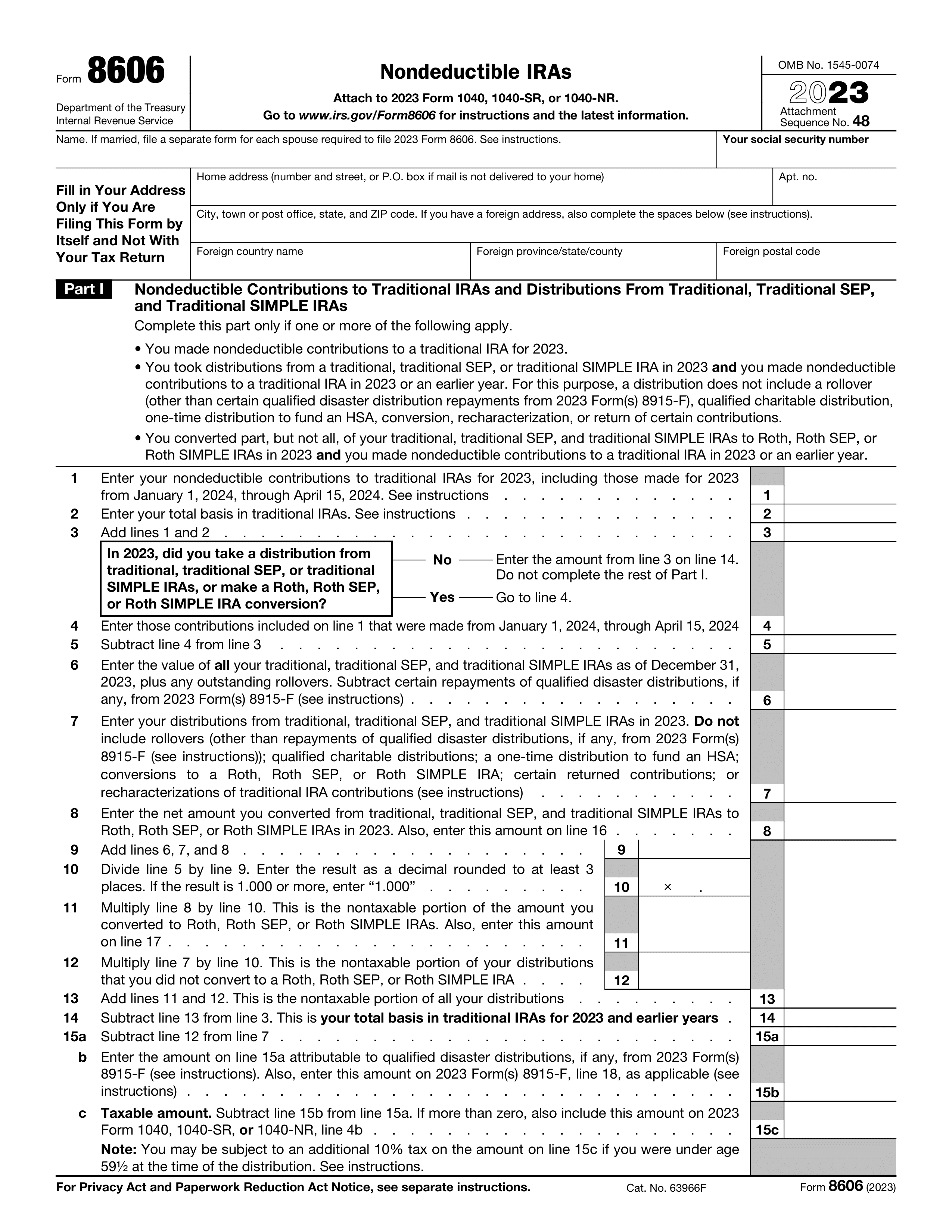

Start by entering your personal information, including your name, address, and Social Security number.

- 2

Specify the tax period and the type of tax the form is addressing.

- 3

In the sections provided, describe the reason for your claim and the exact amount you believe you are owed.

- 4

Sign the form with an electronic signature if this form accepts it.

- 5

Review your entries to ensure accuracy before downloading the document.

Who is required to fill out Form 843?

Individual taxpayers and businesses responsible for taxes fill out Form 843 to request tax abatements or refunds for specific reasons.

The IRS uses this form to review and process claims for adjustments or refunds, ensuring proper tax management.

When is an 843 form not required?

Form 843 is not required for individuals who are correcting errors on their tax returns related to calculations or those who need to amend a previously filed tax return. Instead, they should use Form 1040X.

Businesses or entities looking to adjust partnership items should not use Form 843. They are directed to follow procedures outlined for specific partnership adjustments.

When is an 843 form due?

The deadline for Form 843 varies as it depends on the specific tax issue and claim you are addressing. Generally, you should submit Form 843 within 3 years from the date you filed your original tax return or within 2 years from the date you paid the tax, whichever is later.

This timeframe is crucial for ensuring your submission is considered timely.

How to get a blank 843 form?

To get a blank form 843, visit our platform where the form is pre-loaded in our editor, ready for you to fill out. Our website supports you in creating and downloading the completed form, ensuring you have what you need without the hassle of filing it.

How to sign 843 form online?

To sign Form 843 on PDF Guru, first complete the required fields. After finishing, look for the signature option.

PDF Guru supports simple electronic signatures. Select this feature to add your signature to Form 843 before downloading.

Where to file an 843?

Form 843 is used for specific tax claims. It can be submitted by mail as per IRS guidelines.

Online submission for Form 843 is not available; mailing is the only option.