What is an 8752 form?

Form 8752 is required for taxpayers who are part of a partnership or S corporation and have made the choice to report income on a fiscal year basis, instead of the calendar year. This form helps calculate the required payment for the tax year, ensuring that taxes are paid on income earned during the fiscal year. It's essential for those who need to align their tax reporting with their business's income cycle, rather than the traditional calendar year.

What is an 8752 form used for?

The Form 8752 is vital for certain taxpayers to maintain their tax benefits. Here's what it's used for:

- To calculate required payments for taxpayers electing the installment sale method.

- To report income on installment sales for those who have elected Section 453(l).

How to fill out an 8752 form?

- 1

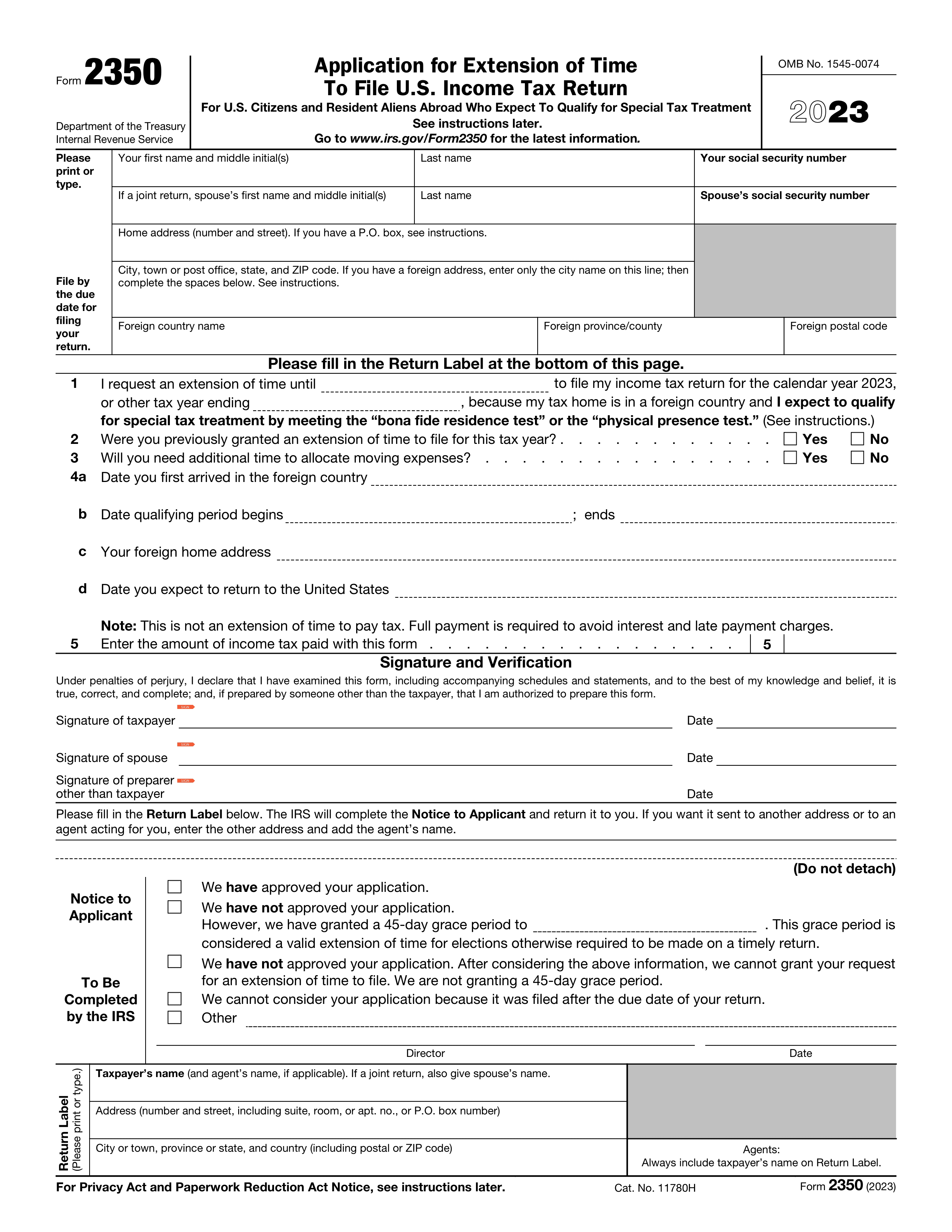

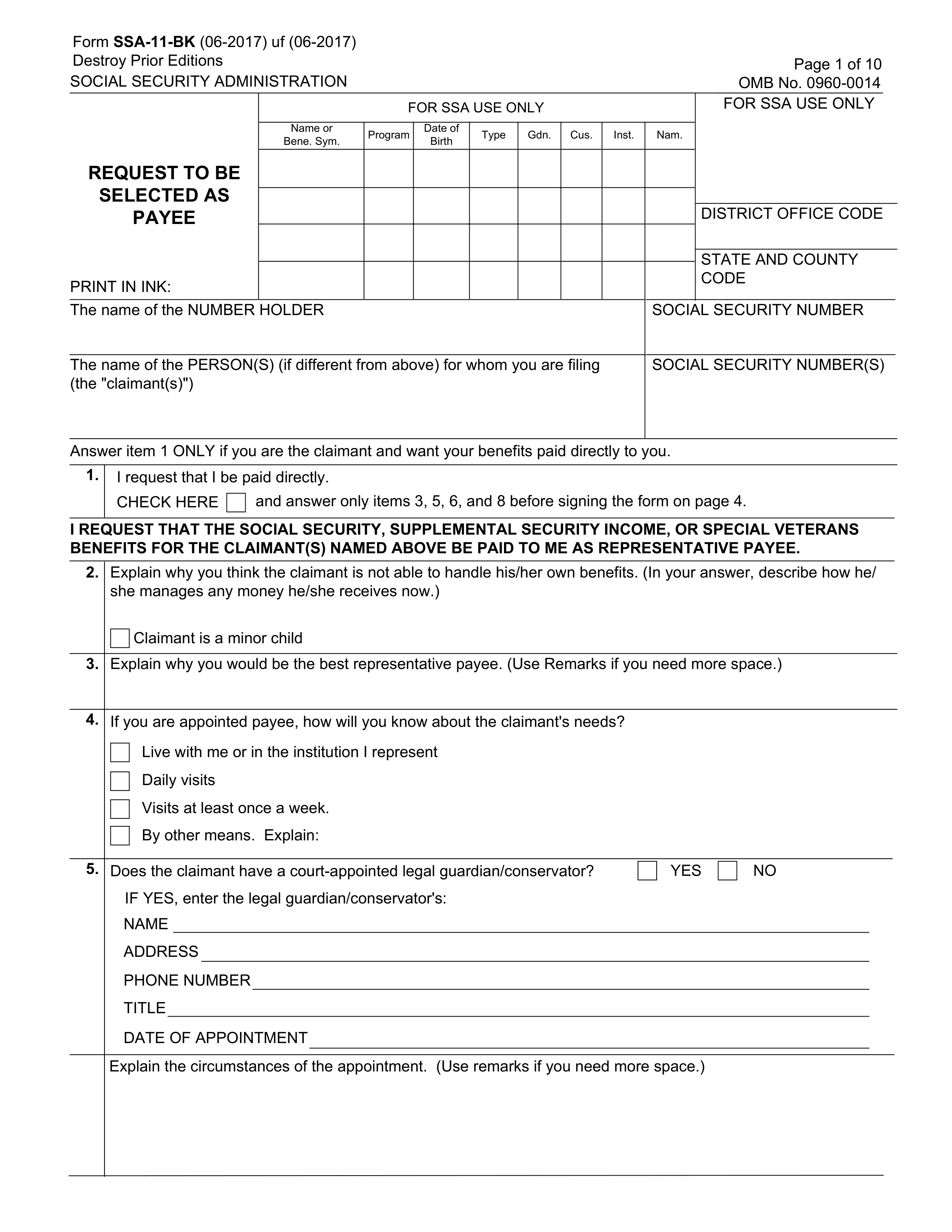

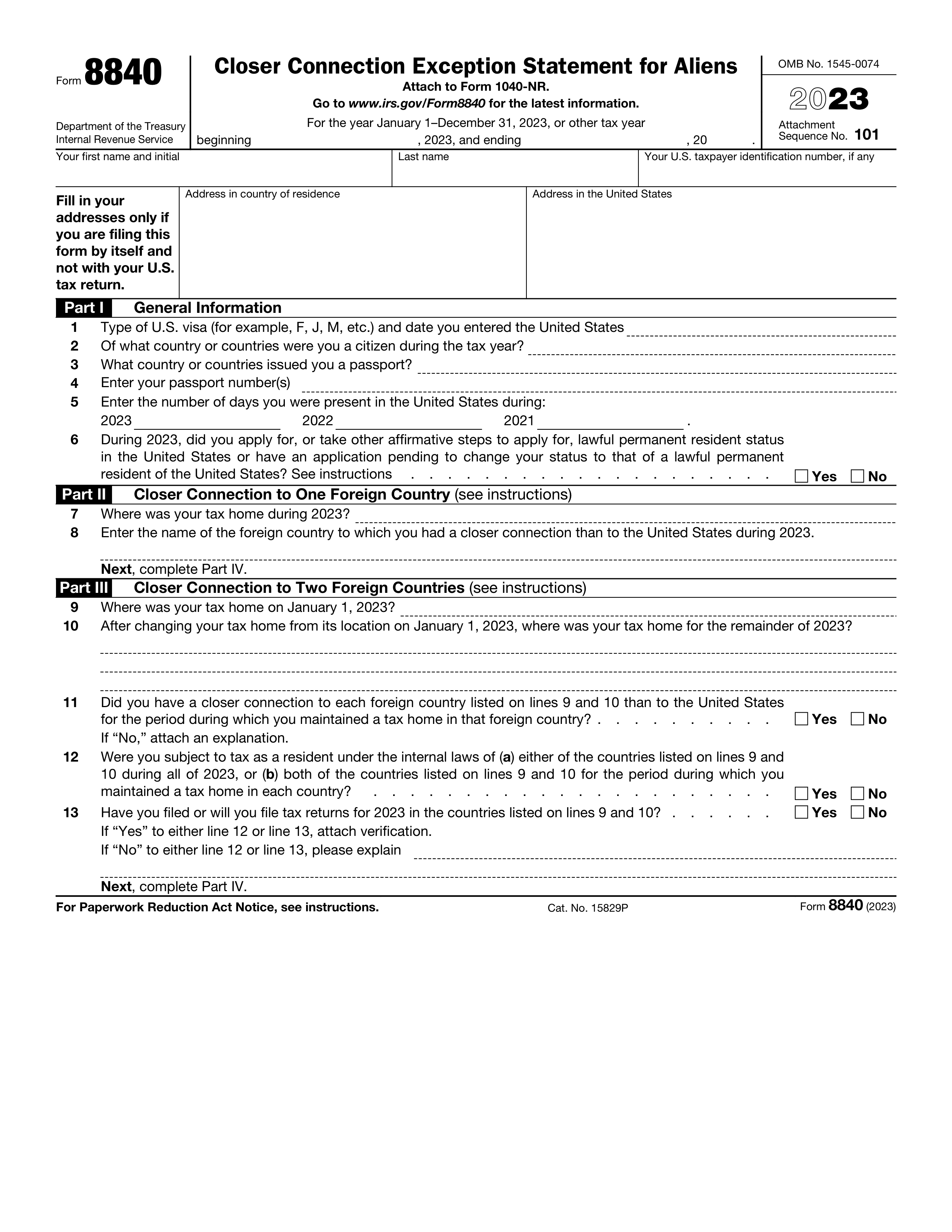

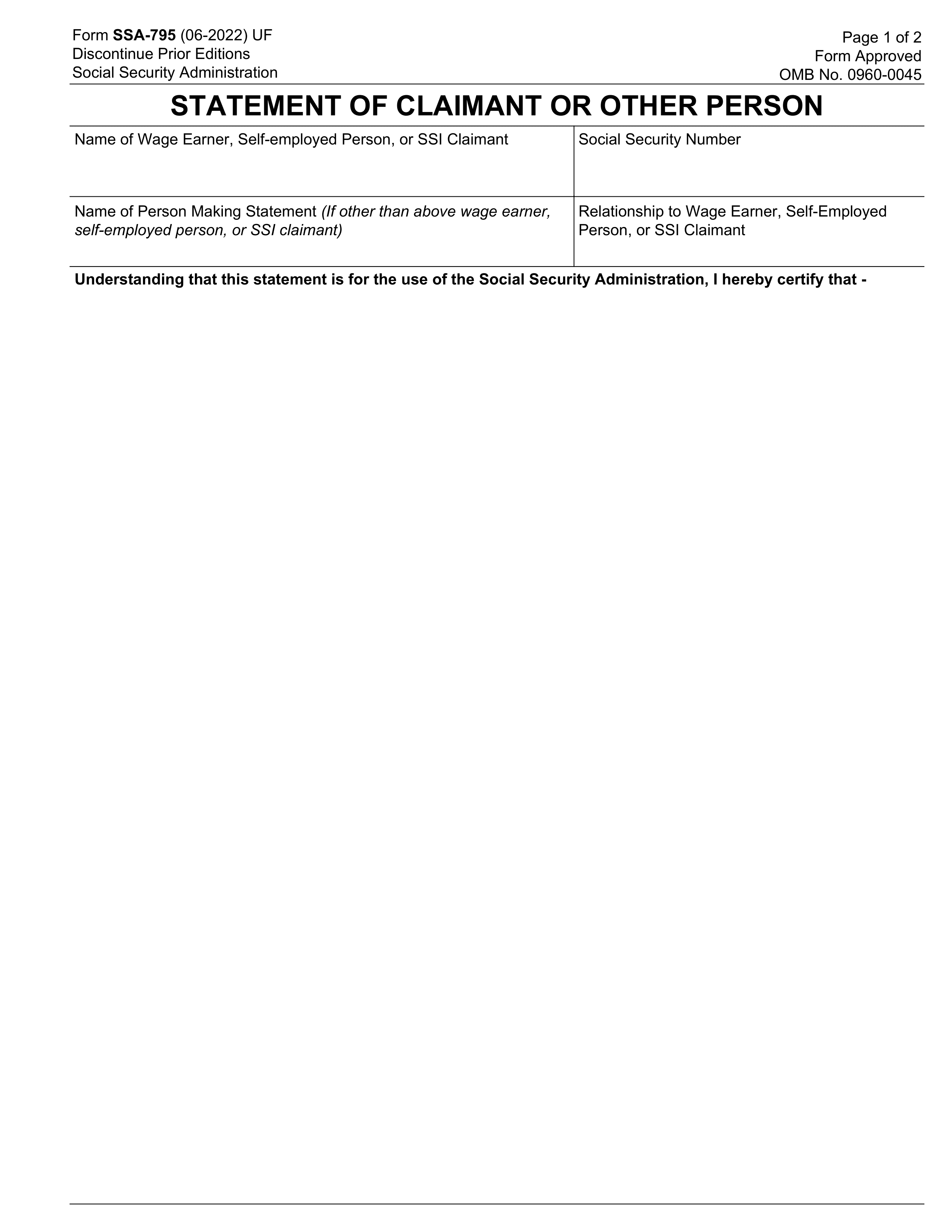

Start by entering your personal information, including your name, address, and Social Security Number.

- 2

Fill in your employment details, such as employer's name and address.

- 3

Report your income accurately, including all sources of earnings.

- 4

Calculate and enter the tax owed based on the provided tax tables.

- 5

Review the form for accuracy, then sign with an electronic signature if accepted.

- 6

Download the completed document and submit it to the appropriate tax authority.

Who is required to fill out Form 8752?

Form 8752 is primarily filled out by businesses involved in partnerships or S corporations participating in a required payment plan for passive activity loss limitations.

After submission, the IRS uses Form 8752 to assess and ensure the correct required payment is made by these entities, maintaining tax compliance.

When is an 8752 form not required?

Certain individuals and businesses might not need to fill out Form 8752. This includes those who are not involved in a partnership or a corporation that uses the fiscal year for tax purposes.

Entities that operate solely on a calendar year basis typically do not require this form. Additionally, individuals who do not have any applicable passive activity losses are also exempt from using Form 8752.

When is an 8752 form due?

The deadline for Form 8752 is May 15th of each year.

This form must be submitted by partnerships and S Corporations that have made the election to be taxed as an entity under the Revenue Procedure 2002-69. If May 15th falls on a weekend or a holiday, the due date is the next business day.

How to get a blank 8752 form?

To get a blank Form 8752, simply visit our platform where it is pre-loaded in our editor, ready for you to fill out. There's no need to download the template from anywhere else. Remember, our website helps you fill out and download the form, but we don't assist with filing it.

How to sign 8752 form online?

To sign Form 8752 online with PDF Guru, first load it in our PDF editor. Fill out the necessary fields as required.

After completing the form, use PDF Guru's feature to create an electronic signature. Then, apply this signature to the designated area on Form 8752.

Where to file an 8752?

Form 8752 can be submitted online via the IRS e-file system. This method offers a quick and efficient way to ensure the form reaches the IRS.

Alternatively, taxpayers have the option to mail Form 8752. This traditional method requires sending the completed form to the IRS's designated mailing address.