What is an 8840 form?

Form 8840 ias also known as the "Closer Connection Exception Statement for Aliens." It is used by non-U.S. residents who spend a significant amount of time in the U.S. but want to assert they have a closer connection to another country, avoiding being taxed as U.S. residents. This form helps demonstrate ties to another country, such as location of home, family, and personal belongings, to maintain non-resident status for tax purposes. It's crucial for those who wish to maintain their tax status correctly while spending time in the U.S.

What is an 8840 form used for?

The Form 8840 is a crucial document for certain non-residents. It helps them:

- To establish a closer connection to a foreign country.

- To claim a tax exemption on U.S. income due to residency status.

- To demonstrate ties to a country other than the U.S. for tax purposes.

How to fill out an 8840 form?

- 1

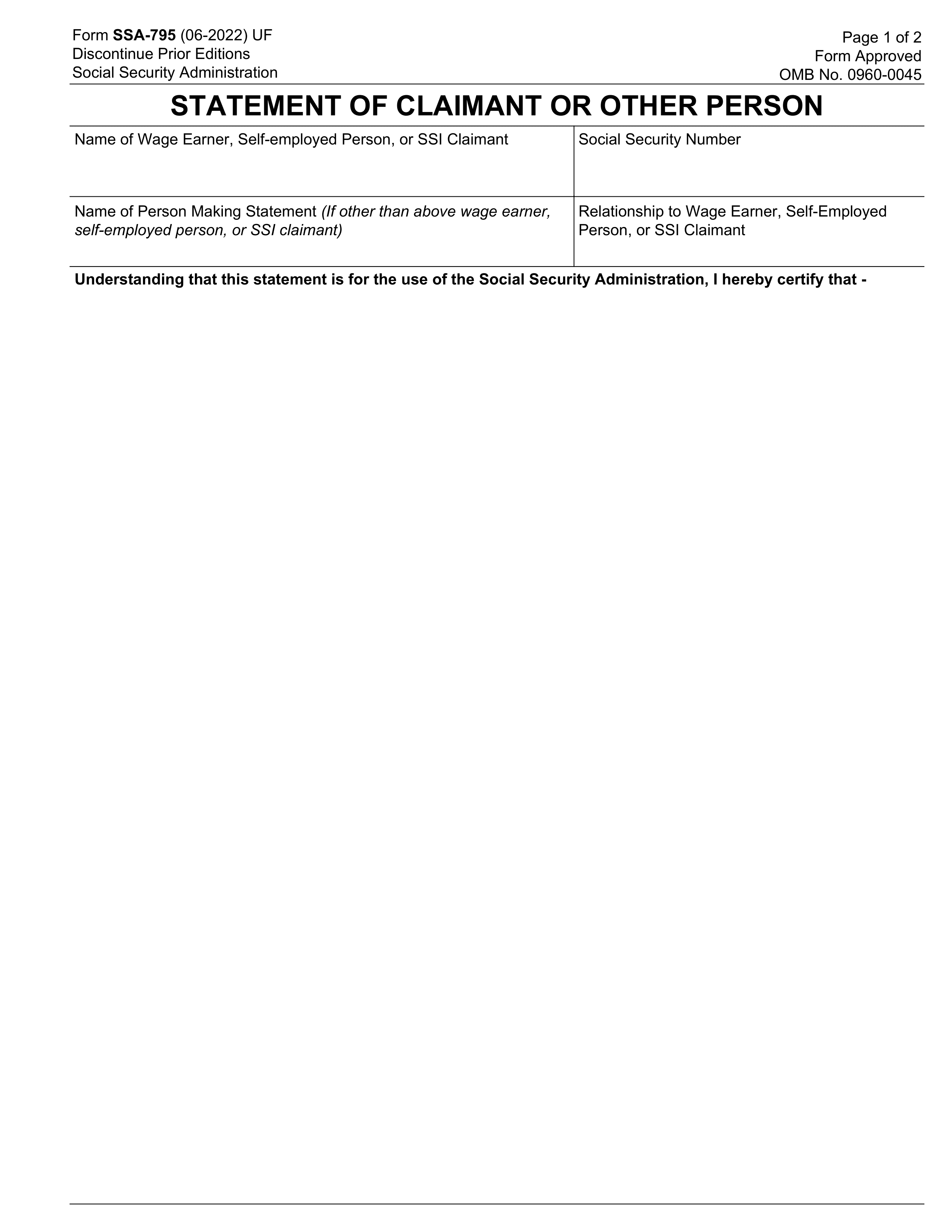

Start by entering your personal information, including your name, address, and tax identification number.

- 2

Complete Part I to determine your closer connection to a foreign country.

- 3

In Part II, list all significant contacts with the U.S. and the foreign country.

- 4

Fill out Part III if you are claiming a closer connection to more than one foreign country.

- 5

Review your answers, ensure all sections are completed accurately.

- 6

Create a simple electronic signature if the form accepts it.

- 7

Download the completed document for your records.

Who is required to fill out Form 8840?

Form 8840 is primarily filled out by Canadian and other foreign citizens who spend a significant amount of time in the U.S. but want to claim closer connection to their home country to avoid being taxed as U.S. residents.

The IRS uses Form 8840 to assess the filer's tax status, determining if they are subject to U.S. taxes based on their days of presence in the United States.

When is an 8840 form not required?

Not everyone needs to complete Form 8840. If you don't meet the substantial presence test, this form isn't necessary for you.

Individuals who are in the United States for less than 183 days in a given year might not need to fill out Form 8840. It's designed for those with closer connections to the U.S. based on days spent in the country.

When is an 8840 form due?

The deadline for Form 8840 is June 15th of the current year.

This form is important for those needing to declare closer connection exception to the Substantial Presence Test. Make sure to prepare your documents early to meet this deadline.

How to get a blank 8840 form?

To get a blank Form 8840, visit our platform where the template is pre-loaded in our editor, ready for you to fill out. There's no need to download the template from anywhere else, making it convenient to start the process right away on our website.

How to sign 8840 form online?

To sign Form 8840 online with PDF Guru, first load your form in the PDF editor. Fill out the required fields with your information.

After completing the form, use the option to create a simple electronic signature. Follow the prompts to add your signature before downloading the document.

Where to file an 8840?

Form 8840 can be submitted by mail to the IRS. Ensure all sections are accurately completed.

Online filing for Form 8840 is not currently supported by the IRS.