What is Form 8821?

Form 8821 is an IRS Tax Information Authorization that lets you allow someone else to view your tax records. It’s commonly used to give an accountant, tax professional, or third party access to your IRS information for review or planning purposes.

This form does not give permission to act or speak on your behalf. It only allows the authorized person to inspect and receive tax information for the specific forms and periods you list.

What is Form 8821 used for?

Form 8821 is used to:

- Allow someone to review your IRS tax records

- Let tax professionals obtain transcripts and account details

- Share tax information for planning, compliance, or issue review

- Provide access without granting legal representation or decision-making authority

How to fill out Form 8821

Follow these short Form 8821 instructions: Line 1 — Taxpayer information Enter the taxpayer’s identifying and contact details.

Line 2 — Designee(s) List the person or organization authorized to receive tax information.\  Indicate notice delivery preferences if applicable.

Line 3 — Tax information Define the exact tax types, forms, periods, and matters the authorization covers.

Line 4 — Specific use (if applicable) Check only if the authorization is for a limited purpose not recorded on the IRS system. If checked, skip Line 5.

Line 5 — Prior authorizations Choose whether existing tax information authorizations remain in effect.

Line 6 — Signature Sign and date to validate the authorization. Incomplete forms are returned.

Who is required to fill out Form 8821?

The taxpayer fills out and signs Form 8821 when they want to allow someone else to access their IRS tax information. This can be an individual, business, or other entity.

The person receiving access, such as an accountant or tax advisor, does not file the form themselves. Form 8821 only grants permission to view tax records, not to act or speak on the taxpayer’s behalf.

When is Form 8821 not required?

Form 8821 isn’t needed if you’re handling your tax matters on your own or if you don’t need to share your tax information with anyone else.

It also isn’t used when you want someone to represent you before the IRS. In that case, a different authorization form is required.

When is Form 8821 due?

Form 8821 doesn’t have a set deadline. You file it when you need to give someone access to your tax information.

To avoid delays, submit the form before the other party needs to review your IRS records.

How to get a blank Form 8821

To get an IRS-issued blank Form 8821, just open it on our platform. The template is already loaded in our editor and ready to fill out, so there’s no need to download it from another source.

We help you complete and download the form, but we don’t file it with the IRS on your behalf.

How to sign IRS Form 8821 online

To sign Form 8821 online, open it in PDF Guru and fill in the required fields using the built-in editor.

When you’re done, add a simple electronic signature to complete the form. After that, choose a subscription plan and download the finished document.

Where to file Form 8821?

Form 8821 is submitted to the IRS by mail or fax, using the contact details listed in the IRS instructions. It isn’t filed with your tax return.

Before sending it, make sure the form is fully completed and signed to avoid delays.

Other forms related to 8821

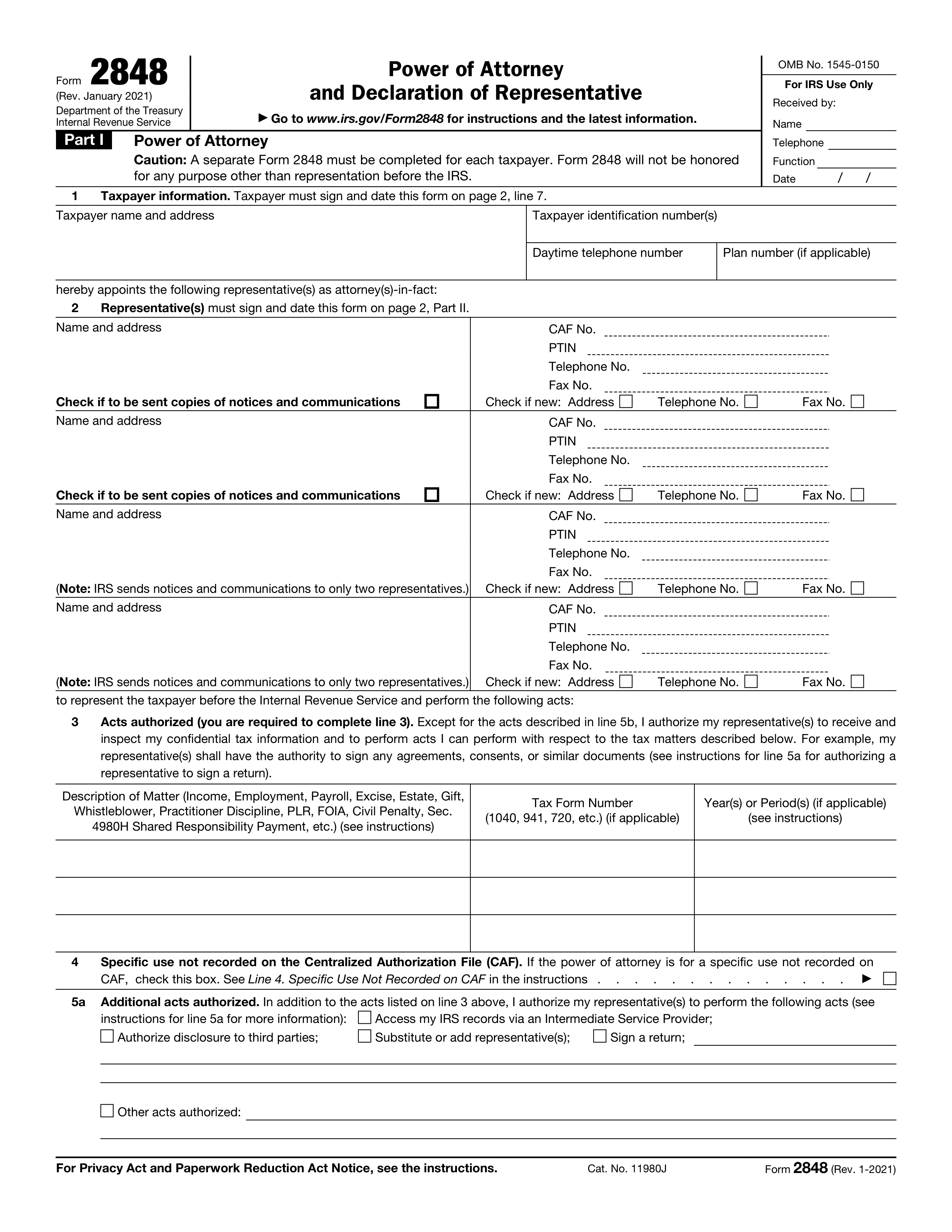

- Form 2848 – Power of Attorney and Declaration of Representative Grants full authority to act on your behalf before the IRS. Form 8821 only allows information sharing.

- Form 4506-C – Request for Transcript of Tax Return Used to request tax transcripts for a specific purpose. It does not provide ongoing access.

- Form 4506 – Request for Copy of Tax Return Used to obtain a full copy of a previously filed tax return directly from the IRS.

- Form 56 – Notice Concerning Fiduciary Relationship Filed when a fiduciary is legally responsible for managing a taxpayer’s tax matters.