What is Form 8949?

Form 8949 is essential for anyone who has sold or traded investments, like stocks or bonds, during the year. It helps you report capital gains or losses to the IRS. This form is crucial for accurately calculating your tax liability related to investments. Whether you experienced gains or losses, filling out Form 8949 is a step towards ensuring your taxes are complete and correct.

What is Form 8949 used for?

Form 8949 is a crucial document for reporting sales and exchanges of capital assets. Here's what it's used for:

- To report sales or exchanges of capital assets not reported on another form.

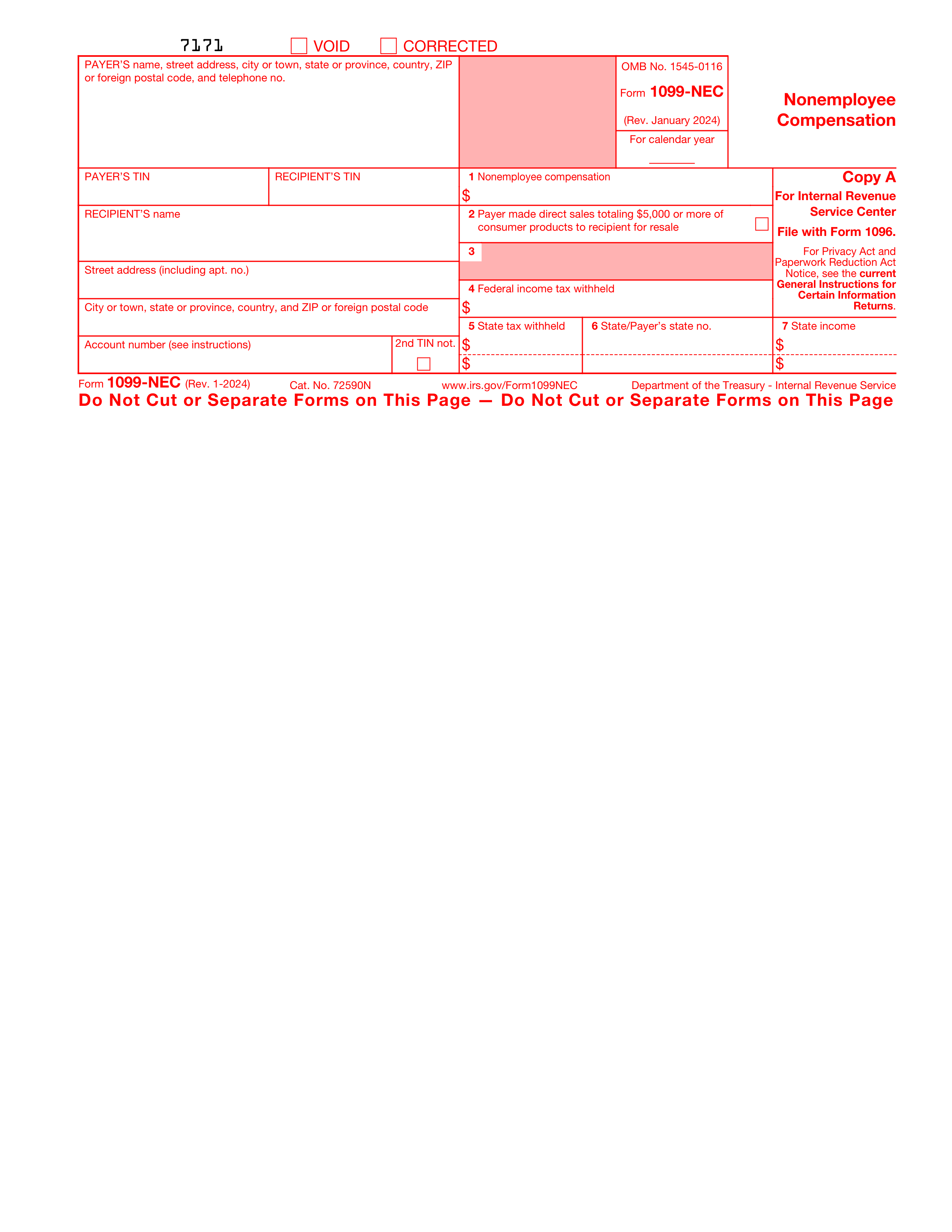

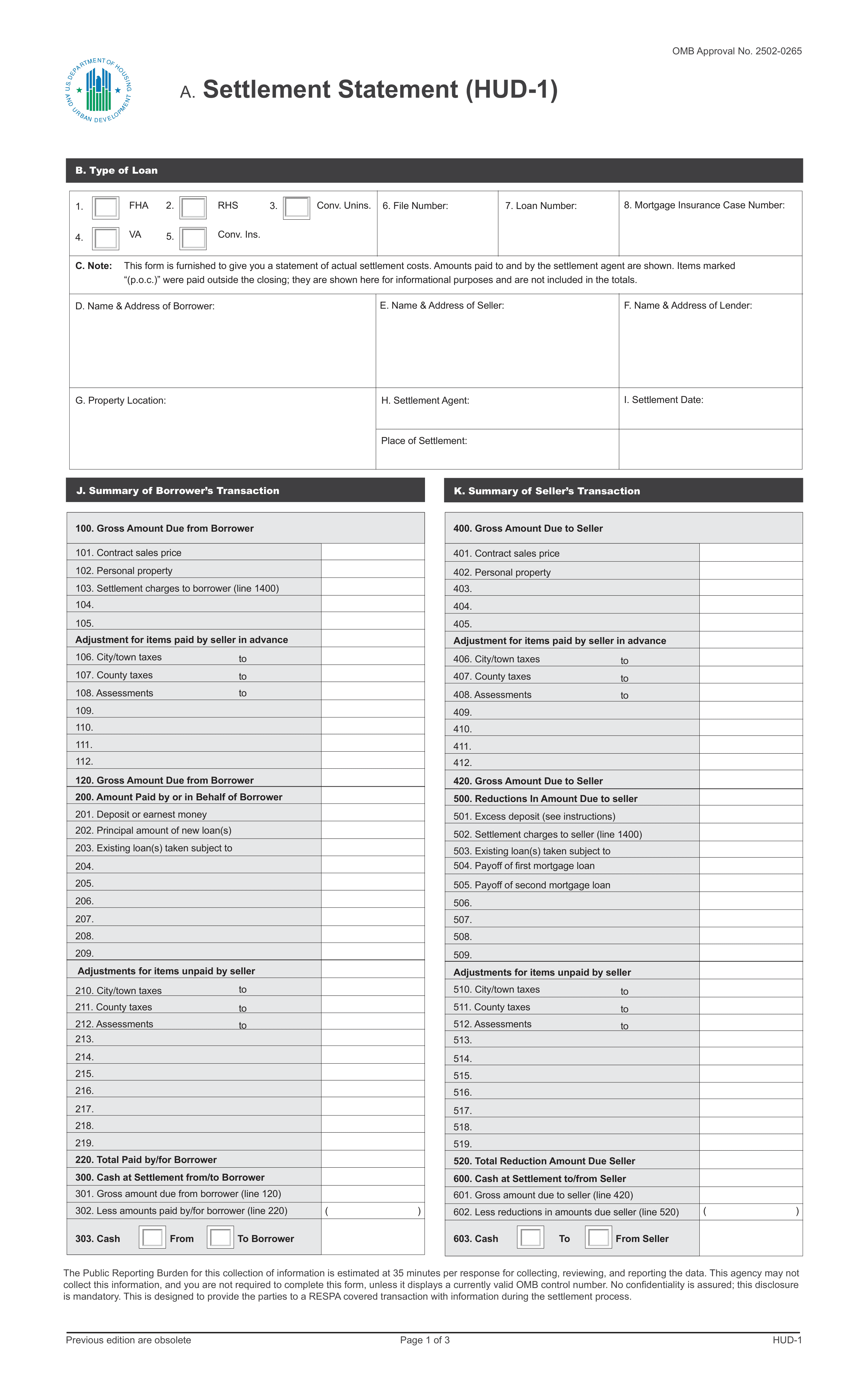

- To reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S.

- To calculate the capital gains and losses from transactions.

How to fill out Form 8949?

- 1

Identify sales or exchanges of capital assets and segregate them based on whether they are short-term or long-term.

- 2

Fill in details for each transaction, including description, dates of acquisition and sale, proceeds, cost, and adjustments.

- 3

Calculate gains or losses for each transaction by comparing proceeds against the cost or adjusted basis.

- 4

Sum up totals for short-term and long-term sections and transfer these to the Schedule D form.

- 5

Review carefully for accuracy and completeness before attaching it to your tax return.

- 6

Consult the IRS instructions for Form 8949 for any specific scenarios or exceptions that may apply to your situation.

Who is required to fill out Form 8949?

Individual taxpayers who sell or exchange capital assets must complete Form 8949. This includes sales of stocks, bonds, and real estate.

The IRS uses Form 8949 to match taxpayer sales and exchanges reported on their tax return, ensuring accurate capital gains taxation.

When is Form 8949 not required?

Not everyone needs to fill out Form 8949. If you haven't sold any investments or don't have capital gains or losses to report, this form may not be necessary for your tax situation.

Individuals who use the average cost method for mutual funds and have their capital gains and losses reported directly on Form 1099-B might also bypass Form 8949. In such cases, the information is directly reported on Schedule D, eliminating the need for Form 8949.

When is Form 8949 due?

The deadline for Form 8949 is April 15th, following the end of the tax year you're reporting on.

If this date falls on a weekend or a legal holiday, the due date is moved to the next business day. This form accompanies your tax return, detailing sales and exchanges of capital assets.

How to get a blank Form 8949?

To get a blank Form 8949, provided by IRS, simply visit our platform where the template is pre-loaded in our editor, ready for you to fill out. Remember, while our website helps you create and download the form, it does not support submitting the form to official bodies.

Do you need to sign Form 8949?

Form 8949, as per our latest information, does not require a signature. It's important to always verify with current guidelines for any updates.

Remember, staying informed on official requirements is key. Checking for the most recent information ensures your documents are correctly prepared.

Where to file Form 8949?

Form 8949 can be submitted online through certain IRS e-file services. This method provides a quick way to submit your documents.

Alternatively, you can send Form 8949 by mail. This option is suitable for those who prefer traditional paper filing.