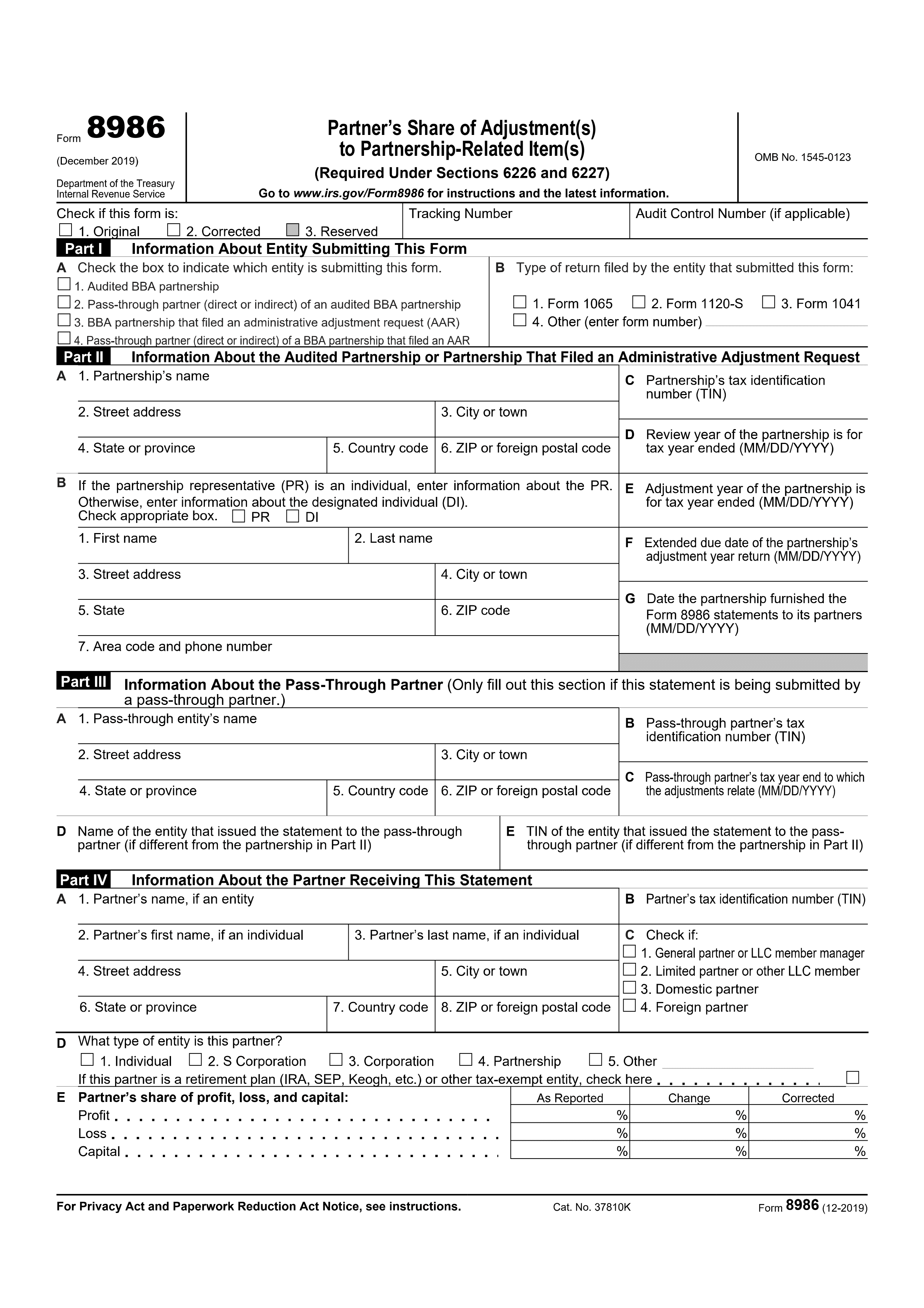

What is an 8993 form?

Form 8993 is designed for businesses to calculate the deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI). It's essential for corporations and individuals with foreign income, helping them determine their tax liability accurately. This form ensures taxpayers comply with the U.S. tax code regarding international earnings, potentially reducing their overall tax burden.

What is an 8993 form used for?

Form 8993 is used by taxpayers to calculate the deduction for Qualified Business Income. Here's what it's for:

- To determine the amount of deduction available under Section 199A.

- To calculate the taxable income reduction for eligible businesses.

How to fill out an 8993 form?

- 1

Start by entering your personal information, including your name and Social Security Number.

- 2

Fill in the business details, including the business name and Employer Identification Number (EIN).

- 3

Specify the tax year and the amount of deduction under Section 199A.

- 4

Review all the information to ensure accuracy and completeness.

- 5

After completing the form, create an electronic signature if the form accepts this type of signature.

- 6

Click Done to prepare your document for download.

- 7

Enter your email, choose a subscription plan, and download the document for your records.

Who is required to fill out Form 8993?

Form 8993 is primarily filled out by businesses subject to the Section 250 deduction, which includes corporations and pass-through entities. These groups use it to calculate their deductions related to foreign-derived intangible income (FDII) and global intangible low-taxed income (GILTI).

After submission, the IRS uses Form 8993 to assess the accuracy of the deductions claimed by these businesses. Additionally, tax professionals may review the form to ensure compliance and optimize tax strategies for their clients.

When is an 8993 form not required?

Form 8993 is specifically designed for calculating the Section 250 deduction related to Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI). If your business does not have income from foreign sources, you likely do not need to fill out this form.

Individuals or entities that solely operate within the United States, without any foreign income or dealings, are not required to complete Form 8993. This makes the form irrelevant for purely domestic businesses.

When is an 8993 form due?

The deadline for Form 8993 is the same as your tax return due date, typically April 15th. If you file for an extension on your tax return, this deadline extends to the extended filing date.

Remember, meeting this deadline is crucial to avoid any penalties or interest for late submission.

How to get a blank 8993 form?

To get a blank Form 8993, simply visit our platform. The form is pre-loaded in our editor, ready for you to fill out and download for your use. Remember, while our website assists in preparing the form, it does not help with submitting it to the relevant authorities.

How to sign 8993 form online?

Signing Form 8993 on PDF Guru begins with loading the form in the PDF editor. Fill out the necessary fields carefully.

After completing the form, create a simple electronic signature to finalize it. Download the document for your records.

Where to file an 8993?

Form 8993 is submitted with your tax return. You can mail it or opt for electronic submission if you're using tax software.

Check the IRS guidelines on which method to use for your situation. Online submissions offer quicker processing times.