What is Form 8997?

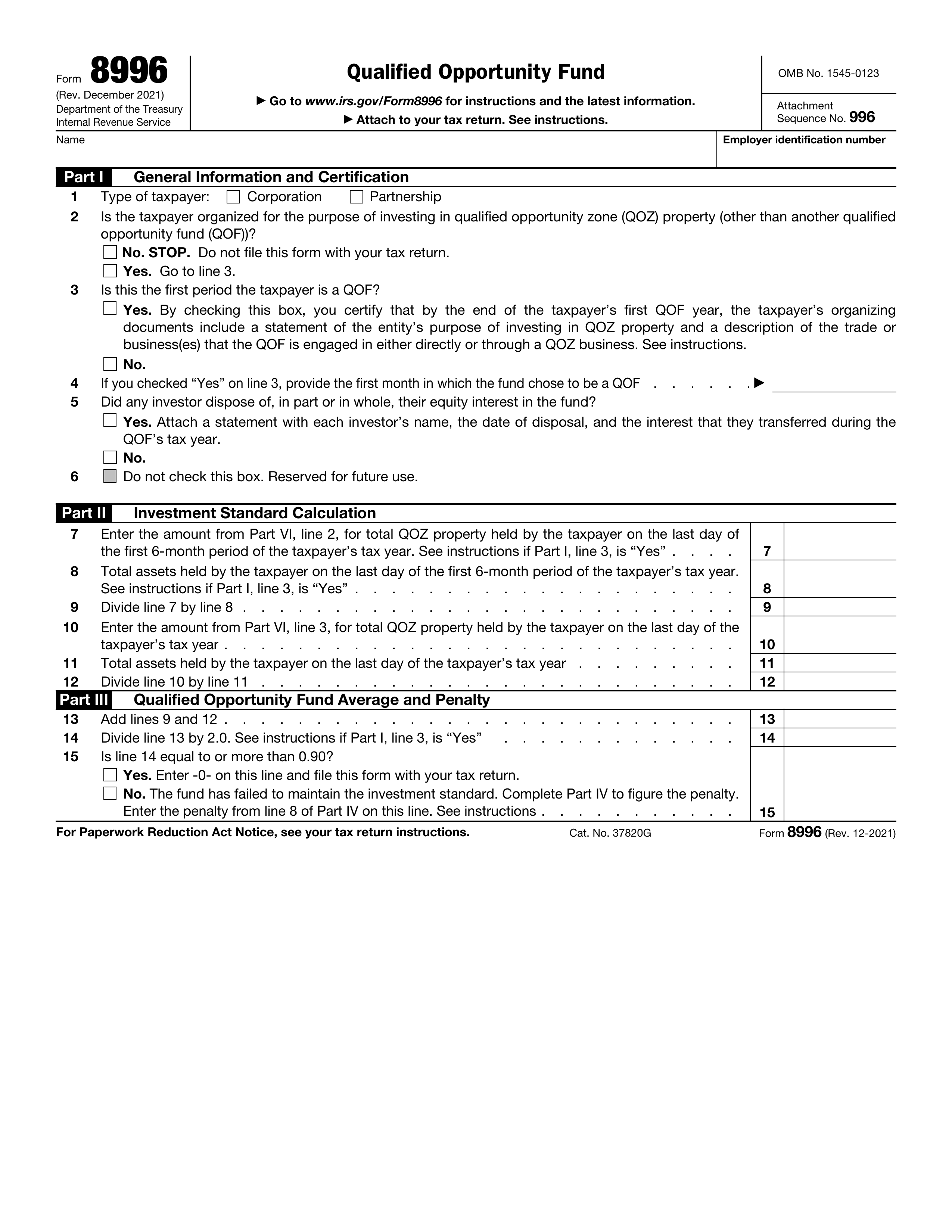

Form 8997 is a tax form designed for investors in Qualified Opportunity Funds (QOFs). This form is crucial as it helps report QOF investments and any deferred gains to the IRS, ensuring that investors can claim the appropriate tax benefits while staying compliant with the Opportunity Zone program. It tracks the investments held at the beginning and end of the year, as well as any investments sold during the year, making it essential for accurate tax reporting.

What is Form 8997 used for?

Form 8997 is essential for those involved with Qualified Opportunity Funds (QOFs). It serves several key functions:

- Reporting QOF Investments: Inform the IRS about QOF investments and deferred gains at the start and end of the tax year.

- Tracking Deferred Gains: Report any capital gains that are deferred by investing in a QOF.

- Reporting Disposed Investments: Provide details on QOZ investments that were disposed of during the tax year.

- Maintaining Compliance: Help ensure adherence to the Opportunity Zone program’s reporting requirements.

How to fill out Form 8997?

- 1

Identify all QOF investments held at the start and end of the tax year.

- 2

Report any new QOF investments made during the tax year.

- 3

Record any QOF investments disposed of during the tax year.

- 4

Calculate deferred gains and any capital gains included in income.

- 5

Total and balance the initial and acquired investments with dispositions and gains.

- 6

Verify all figures for accuracy.

Who is required to fill out Form 8997?

Taxpayers holding investments in Qualified Opportunity Funds (QOFs) must complete Form 8997 to comply with IRS regulations. This includes reporting the QOF investments and deferred gains at the year's start and end, along with any capital gains related to QOF activities.

Investors in QOFs use Form 8997 to inform the IRS about their investments and deferred gains. This reporting is essential for meeting tax obligations and ensuring accurate documentation of their QOF activities.

When is Form 8997 not required?

Form 8997 is not required for U.S. citizens or resident aliens who do not defer capital gains into a Qualified Opportunity Fund (QOF). If you do not hold any QOF investments at the start, acquire, or dispose of them during the tax year, you also do not need this form. Non-U.S. persons who do not waive treaty benefits are exempt from filing as well.

When is Form 8997 due?

The deadline for Form 8997 is the same as your federal tax return. For individuals, this is April 15, with an extension option until October 15 using Form 4868. Partnerships and S corporations need to file by March 15 or extend to September 15. C corporations also have an April 15 deadline, with an extension available until October 15.

How to get a blank Form 8997?

To get a blank Form 8997, simply visit our website. The Internal Revenue Service issues this form, and we have a blank version pre-loaded in our editor for you to fill out. Remember, our platform assists in filling and downloading forms but not in filing them.

How to sign Form 8997?

To sign Form 8997, you don't need a signature since it's a statement attached to your tax return, like Form 1040 or Form 1120-F. Just ensure you include your name, address, and identification number. For additional details, check the latest updates on the IRS website. Once you've filled out the form using PDF Guru, download it for your records, and remember that submission isn't supported through our platform.

Where to file Form 8997?

To submit Form 8997, attach it to your appropriate tax return, like Form 1040 or Form 1120-F. Include your name, address, and identification number.

Remember, Form 8997 must be filed on paper and can't be submitted online. Use the IRS addresses designated for individual or entity-level returns.