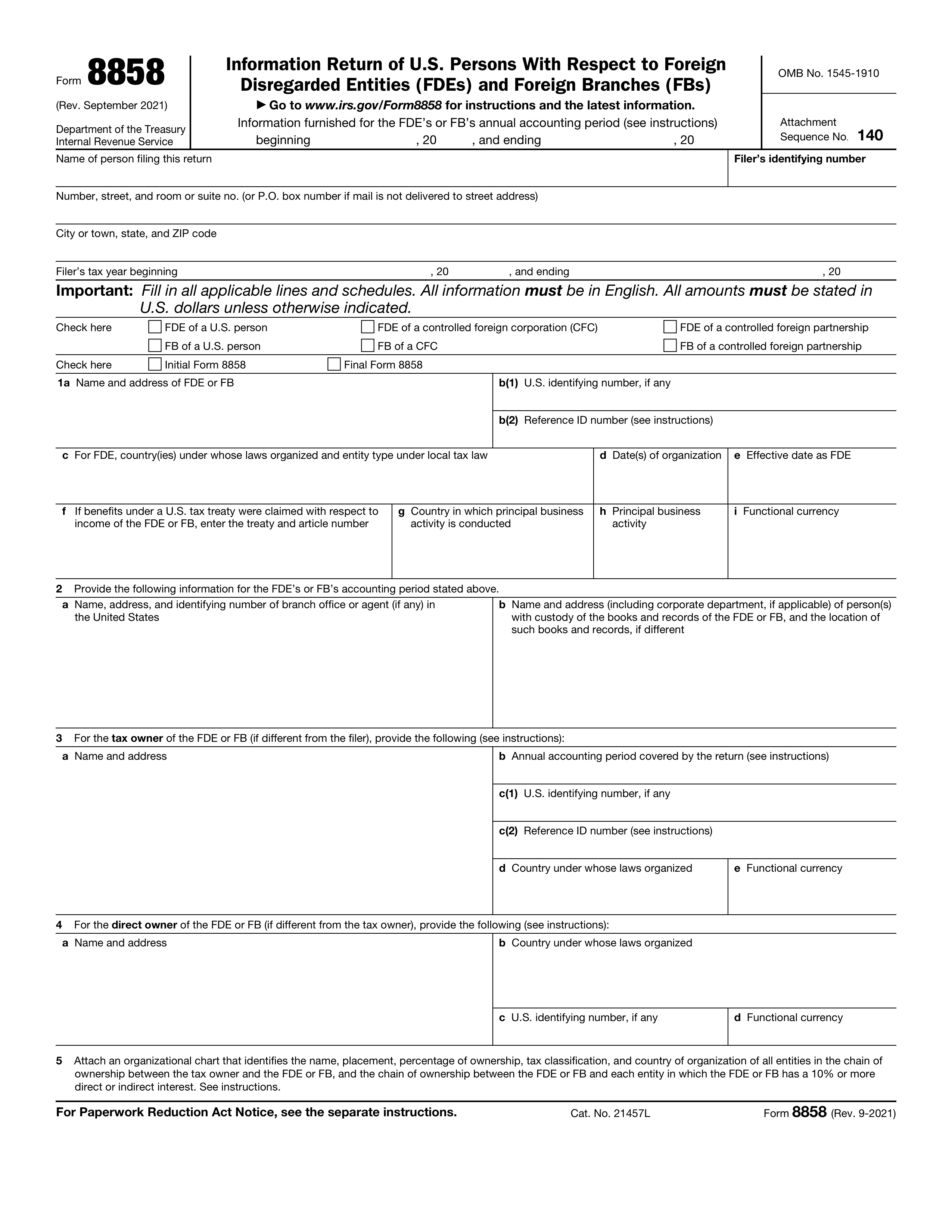

What is Form 926?

Form 926 is a tax document that U.S. taxpayers must complete when transferring property to foreign corporations. Its purpose is to help the IRS monitor these transactions, preventing tax avoidance and ensuring that all transfers are reported accurately. The form requires information about the property being transferred, details about the foreign corporation receiving it, and the taxpayer’s ownership interest. By doing so, Form 926 aids the IRS in tracking cross-border transactions and maintaining tax compliance, which is vital for preventing income or assets from being improperly shifted to other countries.

What is Form 926 used for?

Form 926 is important for U.S. taxpayers engaged with foreign corporations. Here’s what it’s used for:

- Reporting Transfers: Reports property transfers from U.S. taxpayers to foreign entities.

- Tracking Assets: Keeps track of tangible and intangible assets, like real estate and intellectual property.

- Anti-Money Laundering: Aids the IRS in preventing money laundering through accurate reporting.

- Tax Compliance: Ensures adherence to international tax laws and prevents tax avoidance.

How to fill out Form 926?

- 1

Provide the name, address, and taxpayer identification number of the U.S. transferor.

- 2

Detail the property being transferred, including its nature and value.

- 3

Enter information about the foreign corporation, including its name, address, and country of incorporation.

- 4

Explain the relationship between the U.S. transferor and the foreign corporation.

- 5

Verify that the income from the transfer is reported on the timely filed return.

- 6

Confirm if any exemptions apply to the transfer.

Who is required to fill out Form 926?

U.S. citizens or residents, domestic corporations, and domestic estates or trusts are responsible for completing Form 926.

These entities must file this form to report specific transfers of property to foreign corporations, particularly those worth over $100,000 or involving a 10% ownership interest.

When is Form 926 not required?

Form 926 is not required when a domestic corporation distributes stock or securities under Section 355. It also doesn't apply to exchanges described in Sections 354 and 356 related to recapitalization or asset reorganization. Additionally, if a U.S. person transfers stock and securities under Section 367(a) and meets specific criteria, they do not need to file Form 926.

When is Form 926 due?

The deadline for Form 926 is the due date of the U.S. transferor’s income tax return for the tax year that includes the date of transfer. For most individuals and calendar-year entities, this is typically April 15 of the following year, or the extended due date if you have filed for an extension. The specific due date aligns with the due date of your federal income tax return for that tax year.

How to get a blank Form 926?

To get a blank Form 926, simply visit our platform where the Internal Revenue Service provides this form. We have it pre-loaded in our editor, ready for you to fill out. Remember, our website helps with filling and downloading forms, but does not support filing.

How to sign Form 926?

You must sign Form 926 by signing the income tax return to which Form 926 is attached; no separate signature is required on Form 926 itself. Therefore, you may sign by hand if filing a paper return, or electronically if e-filing, but you do not sign Form 926 separately.

Where to file Form 926?

Form 926 must be filed with the IRS by mailing it alongside your income tax return for the year of the property transfer.

Make sure to attach the form to the tax return and send it to the correct IRS address for processing.