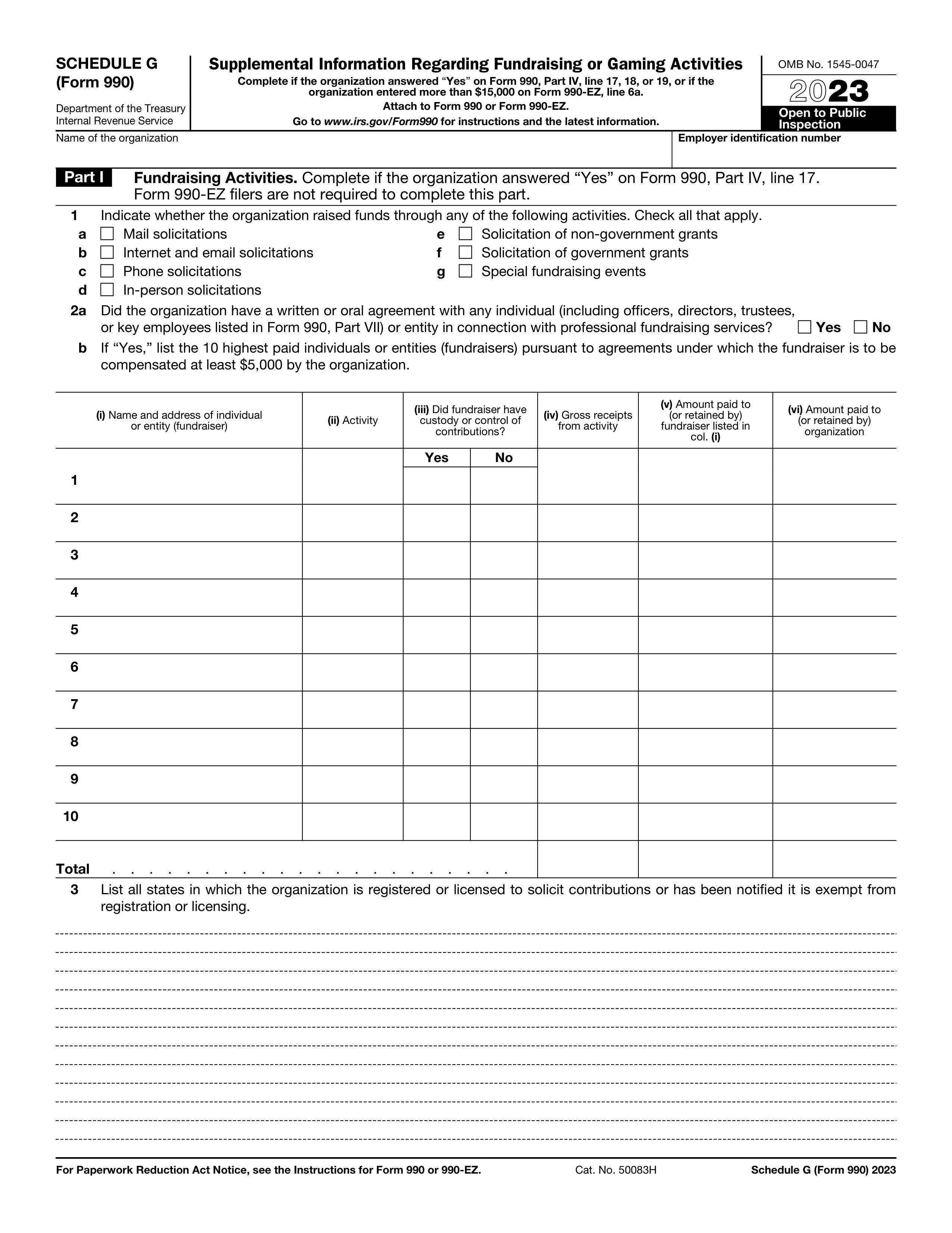

What is Form 990?

Form 990, known as the "Return of Organization Exempt from Income Tax," is a required annual filing for nonprofit organizations with the IRS. This form serves to inform the public about the nonprofit's financial activities and ensures that it maintains its tax-exempt status. It includes detailed financial statements, schedules, and narrative disclosures, promoting transparency and allowing government agencies to oversee nonprofits effectively. This level of transparency is essential for fostering trust and accountability within the nonprofit sector, benefiting both the organizations and the communities they serve.

What is Form 990 used for?

Form 990 is an important document for organizations. It serves several key purposes:

- Reporting Financial Information: Discloses the organization's finances, including income and expenses.

- Governance and Compliance: Reports on governance practices and compliance with federal tax requirements.

- Compensation Disclosure: Details compensation paid to certain individuals.

- Public Disclosure: Makes annual information returns publicly available, with some exceptions.

- State Reporting: Meets state reporting requirements, if needed.

How to fill out Form 990?

- 1

Complete Parts I through XII, detailing exempt activities, finances, governance, compliance, and compensation.

- 2

Determine additional schedules needed based on your organization's activities and type.

- 3

Ensure all required information is accurate and complete.

- 4

Make the finished form accessible to the public, excluding contributor details on Schedule B.

- 5

File the form with the IRS by the specified deadline.

Who is required to fill out Form 990?

Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations are responsible for completing Form 990.

The IRS uses this form to monitor compliance and assess tax-exempt status, while it also serves as a public document for state regulators and the public to verify the legitimacy of these entities.

When is Form 990 not required?

Form 990 isn't required for organizations with annual gross receipts of $50,000 or less, most faith-based organizations, religious schools, and state institutions providing essential services. Additionally, subsidiaries included in a group return by the parent organization and certain government corporations also do not need to file this form.

When is Form 990 due?

The deadline for Form 990 is the 15th day of the 5th month after the accounting period ends. For organizations with a calendar year (January 1 - December 31), the due date is May 15, 2025. For those with a fiscal year ending on January 31, 2025, the due date is June 16, 2025.

How to get a blank Form 990?

To get a blank Form 990, simply visit our website. The Internal Revenue Service (IRS) issues this form, and we have a blank version ready in our editor for you to fill out. Remember, PDF Guru aids in filling and downloading but not filing forms.

How to sign Form 990 online?

To sign Form 990 Return of Organization Exempt from Income Tax, you can choose a handwritten signature or an electronic signature that meets IRS guidelines. Make sure your electronic signature follows IRS criteria, which may include using a PIN or an electronic signature pad. Remember to check for the latest updates on the IRS requirements. With PDF Guru, you can fill out the form, create a simple electronic signature, and download it for your records, but submission is not supported.

Where to file Form 990?

Form 990 can be submitted either by mail or electronically. For paper filing, send it to the IRS in Ogden, UT.

To file electronically, use an IRS-authorized e-file provider like Tax990. This ensures a secure and efficient submission process.