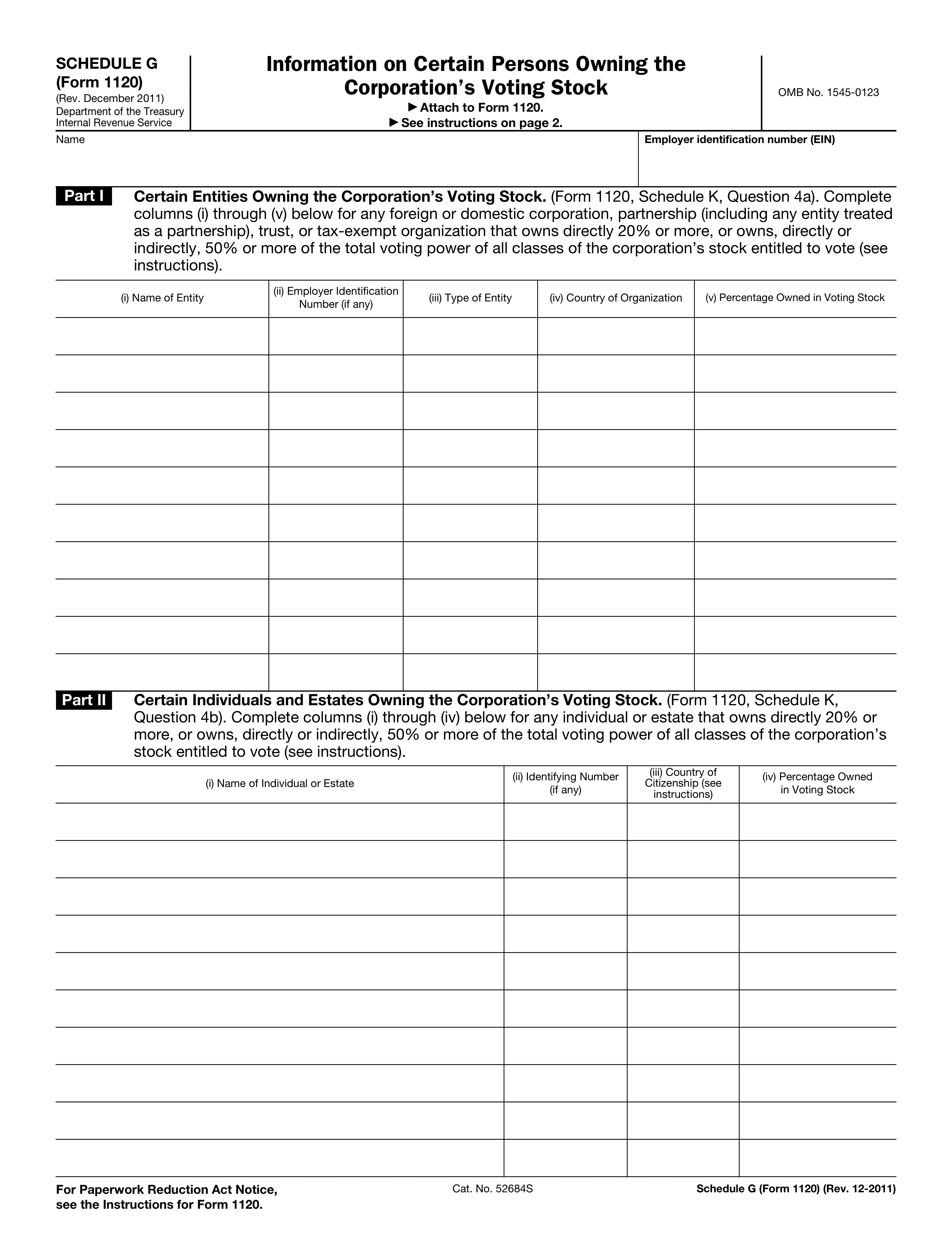

What is Schedule G (Form 990)?

Schedule G (Form 990) is a supplemental form that non-profit organizations use to provide detailed insights into their fundraising activities and events. This form is essential for the IRS as it outlines how the organization generates funds and the expenses incurred for professional fundraising services. By completing Schedule G, non-profits promote transparency and accountability, which are vital for maintaining public trust and adhering to tax regulations. Organizations must detail their fundraising events, the amounts raised, and the payments made to fundraisers, ensuring compliance with legal requirements.

What is Schedule G (Form 990) used for?

Schedule G (Form 990) is important for organizations involved in fundraising or gaming. Here’s what it's used for:

- Professional Fundraising Services: Reports details about services used for fundraising.

- Fundraising Events: Shares information on events, including total receipts and charitable amounts.

- Gaming Activities: Details any gaming activities that may be relevant.

- Supplemental Information: Provides extra details required by the IRS for fundraising or gaming activities.

How to fill out Schedule G (Form 990)?

- 1

Identify Requirements: Check if your organization needs to file Schedule G per Form 990 or 990-EZ guidelines.

- 2

Complete Part I: Fill in details about fundraising activities, including methods and revenue.

- 3

Complete Part II: Report on fundraising events, detailing contributions and gross income.

- 4

Complete Part III: Enter information regarding gaming activities, including state specifics and manager details.

- 5

Provide Supplemental Information: Use Part IV to explain any responses in detail if necessary.

Who is required to fill out Schedule G (Form 990)?

Nonprofits and tax-exempt organizations that file Form 990 or Form 990-EZ are responsible for completing Schedule G when they report professional fundraising expenses exceeding $15,000. This includes groups involved in significant fundraising activities, such as mail and phone solicitations.

After completion, this form is used by organizations that must disclose their fundraising methods, agreements with fundraisers, and financial transactions. They also report on events yielding gross receipts over $5,000, detailing revenue and expenses.

When is Schedule G (Form 990) not required?

Schedule G (Form 990) isn't required for organizations that don’t engage in professional fundraising services, fundraising events, or gaming activities. Additionally, Section 501(c)(7) and 501(c)(15) organizations may skip it if their gross receipts stay below the exemption threshold. Political organizations with gross receipts under $25,000, or $100,000 for qualified state or local groups, also do not need to file Schedule G.

When is Schedule G (Form 990) due?

The deadline for Schedule G (Form 990) is the 15th day of the 5th month after your organization's tax year ends. This applies to both Form 990 and Form 990-EZ filers. Missing the deadline can lead to penalties, costing $20 for each day the form is late.

How to get a blank Schedule G (Form 990)?

To get a blank Schedule G (Form 990), simply visit our website. The Internal Revenue Service (IRS) issues this form, and we have a blank version pre-loaded in our editor for you to fill out. Remember, our platform aids in filling and downloading, but not filing forms.

How to sign Schedule G (Form 990)?

To sign Schedule G (Form 990), you need to provide a handwritten signature, as this is the accepted method. Official guidelines do not mention the use of electronic or digital signatures for this form. After filling out the form using PDF Guru, download it for your records. Remember to check for the latest updates to ensure compliance with any changes in signing requirements. PDF Guru can assist you in preparing and downloading the form, but submission is not supported.

Where to file Schedule G (Form 990)?

To submit Schedule G (Form 990), mail it directly to the IRS. Online filing is not an option for this form.

Make sure to check the IRS website for the correct mailing address based on your organization's location. Follow all IRS instructions to ensure accurate submission.