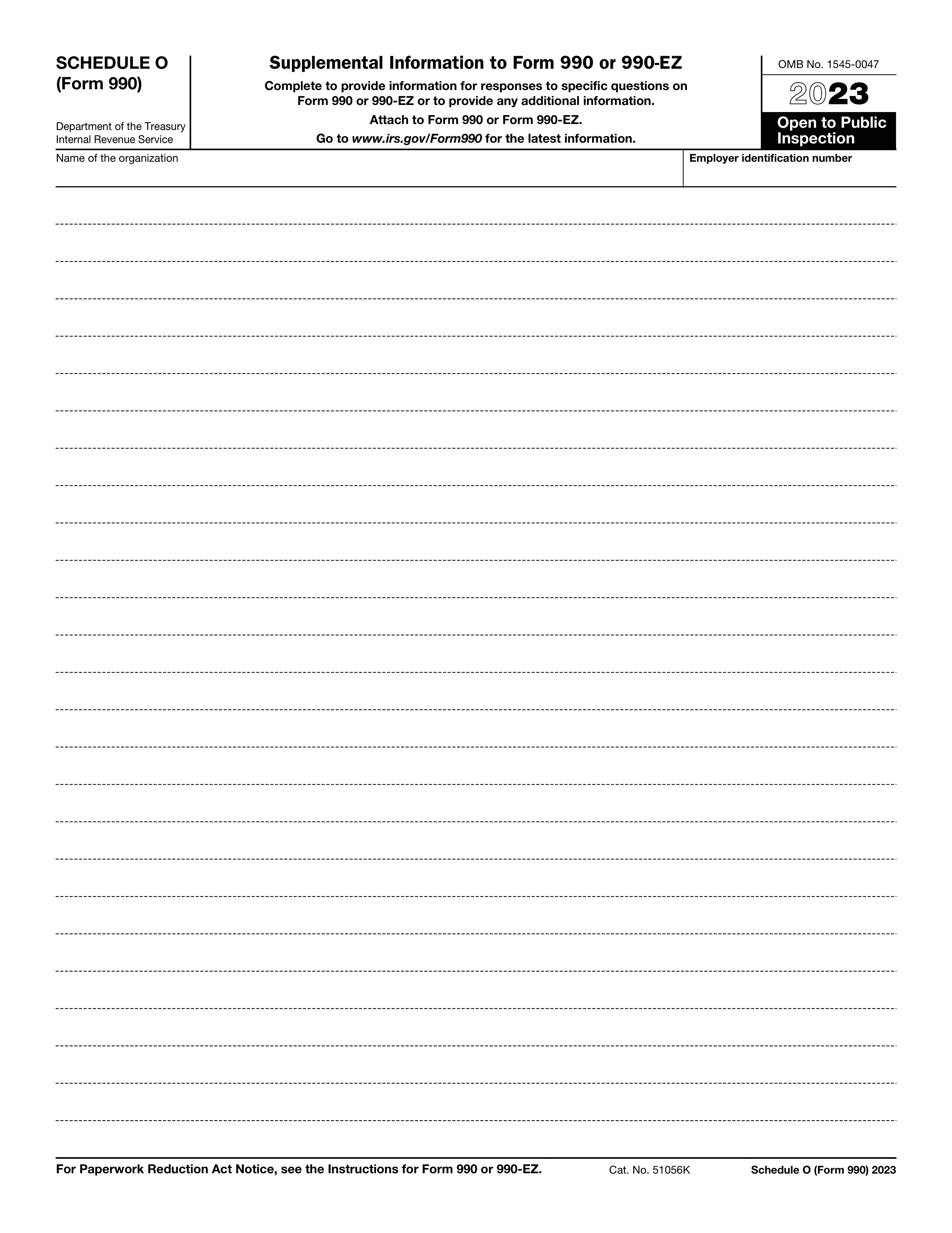

What is Schedule D?

Schedule D (Form 990) is an important document for nonprofit organizations. It provides additional details about an organization's financial activities, including investments and other assets. This form helps the IRS and the public understand how nonprofits manage their funds, ensuring transparency and accountability. By completing this schedule, organizations can report their financial health accurately, which is crucial for maintaining tax-exempt status and building trust with donors and the community.

What is Schedule D used for?

Schedule D (Form 990) is used by tax-exempt organizations to provide additional financial information. This includes:

- to report various financial statements.

- to disclose specific details about the organization’s assets.

- to explain financial policies and practices.

- to provide information on fund balances.

How to fill out Schedule D of Form 990?

- 1

Review the instructions for Schedule D to understand requirements.

- 2

Gather necessary financial documents, including balance sheets and income statements.

- 3

Complete each section of the form carefully, ensuring all fields are filled out correctly.

- 4

Double-check your entries for accuracy and completeness before finalizing.

- 5

Verify that all supporting schedules and documents are attached as required.

Who is required to fill out Schedule D of Form 990?

Organizations like charities and nonprofits fill out Schedule D for financial reporting. This form helps ensure transparency in their finances.

After completion, stakeholders like donors, regulators, and the public use the form to review the organization’s financial health.

When is Schedule D not required?

Nonprofit organizations with gross receipts under $200,000 and total assets under $500,000 do not need to file Schedule D. Additionally, private foundations that only report on their Form 990-PF are also exempt from this requirement.

If your organization qualifies under these thresholds, you can focus on submitting the primary Form 990 or Form 990-PF without needing to include Schedule D.

When is Schedule D due?

The deadline for Schedule D of Form 990 is the same as the deadline for Form 990, which is the 15th day of the 5th month after the end of your organization's fiscal year. For most organizations that operate on a calendar year, this means the due date is May 15.

If you need more time, you can file for an extension using Form 8868. This can give you an additional six months, making the new deadline November 15 for calendar year organizations.

How to get a blank Schedule D?

To get a blank Schedule D, simply visit our platform where the form is pre-loaded in our editor. You can fill it out and download it for your records.

Alternatively, the form is available for download from the IRS website.

Do you need to sign Schedule D?

Schedule D from Form 990 does not require a signature according to the IRS guidelines. However, always verify this with the IRS for the latest updates.

Checking the IRS website ensures you have the most accurate information. Staying informed can help minimize liability for any misinformation.

Where to file Schedule D?

Form 990 Schedule D must be filed with the IRS alongside Form 990 or Form 990-EZ.

You can submit Schedule D by mail or electronically through authorized e-file providers. Make sure to follow official guidelines for submission.