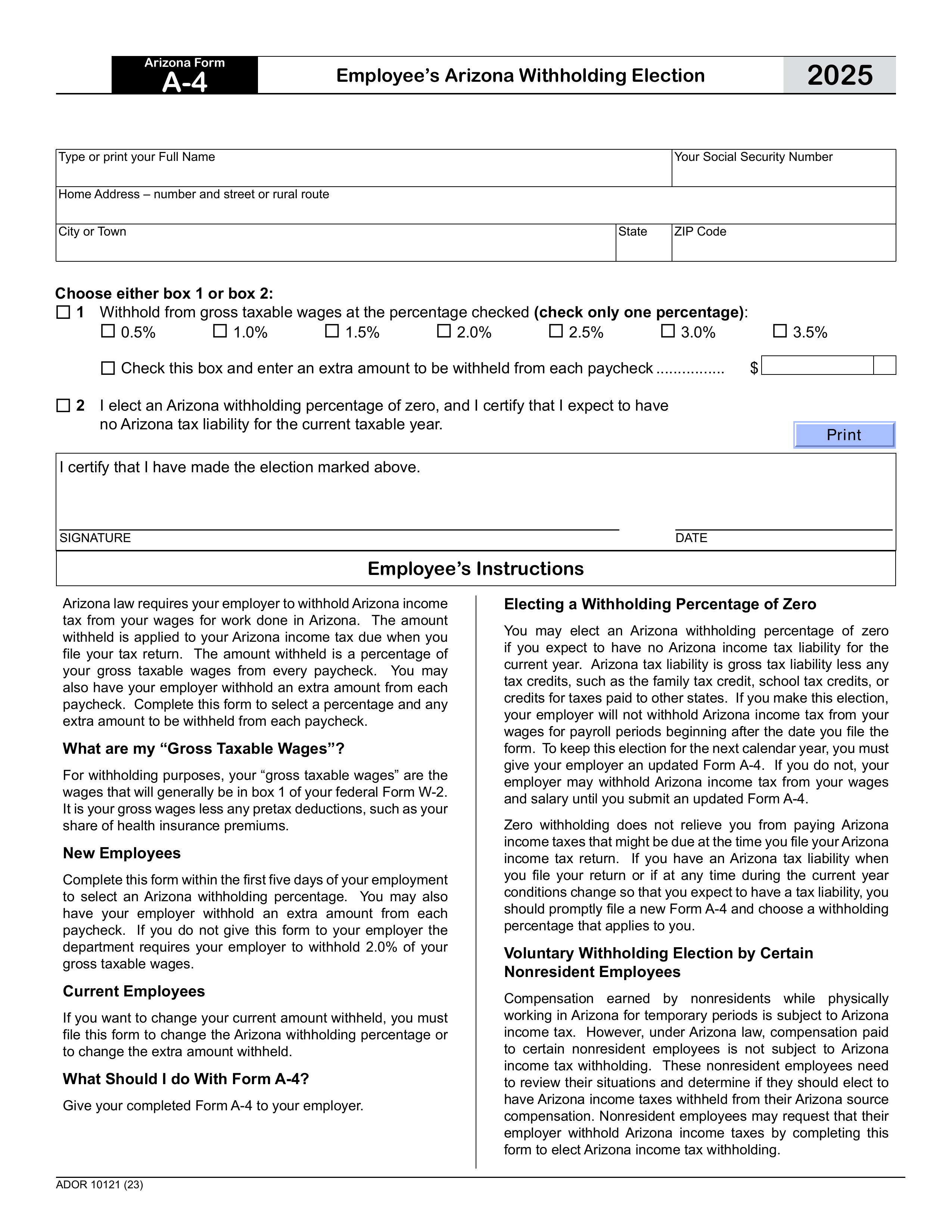

What is Form A-4?

The A-4 Form is an Alabama Employee Withholding Tax Exemption Certificate. It allows employees to claim exemption from state income tax withholding if they expect to owe no tax for the year. This form is important because it helps employees keep more of their earnings if they qualify, ensuring that they don't have unnecessary amounts withheld from their paychecks. Completing this form accurately is crucial to avoid issues with both your employer and the Alabama Department of Revenue.

What is Form A-4 used for?

The A-4 Form is the Alabama Employee Withholding Tax Exemption Certificate. It is used for:

- to claim exemption from state income tax withholding.

- to provide information on personal exemptions.

- to ensure accurate withholding amounts.

How to fill out A-4 Form?

- 1

Obtain the A-4 Form from an official source like the Alabama Department of Revenue website.

- 2

Fill in your personal information, including your name, address, and Social Security number.

- 3

Indicate the reason for claiming exemption by checking the appropriate box.

- 4

Provide your employer's information, including name and address.

- 5

Review all entries for accuracy.

- 6

Sign the form, and check official sources for current signature requirements.

Who is required to fill out A-4 Form?

Employers and employees in Alabama must complete Form A-4 for withholding tax exemptions. It is necessary for tax purposes.

Employers use the completed form to adjust employee withholding amounts on W-2s.

When is Form A-4 not required?

Individuals who are not subject to Alabama income tax do not need to submit the A-4 Form. This includes those whose total income falls below the state's filing threshold or who qualify for exemptions due to specific situations like being a full-time student or having a tax-exempt status.

Additionally, employees who do not wish to claim an exemption from withholding can simply not file this form. Instead, they will have taxes withheld based on their income and filing status.

When is Form A-4 due?

The deadline for Alabama Employee Withholding Tax Exemption Certificate (Form A-4) is typically due on or before the employee's first paycheck of the year.

It's important for employees to submit this form if they qualify for tax exemptions. This helps ensure the correct amount of state tax is withheld from their paychecks. Always check with your employer for specific submission dates.

How to get a blank A-4 Form?

To get a blank A-4 Form, Alabama Employee Withholding Tax Exemption Certificate, you can access it directly through our platform. The Alabama Department of Revenue issues this form. Simply fill it out in our editor and download it once you're done.

How to sign A-4 Form?

To sign the Alabama A-4 Form, you will need to provide a handwritten signature. First, download the form from a reliable source and print it out.

Once printed, sign the form in the designated area. Ensure all information is complete before submitting it to your employer.

Where to file A-4 Form?

The A-4 Form can be filed by mailing it directly to your employer. Make sure to check with your employer for any specific submission guidelines.

Currently, there is no option to file the A-4 Form online. Always keep a copy for your records after submission.