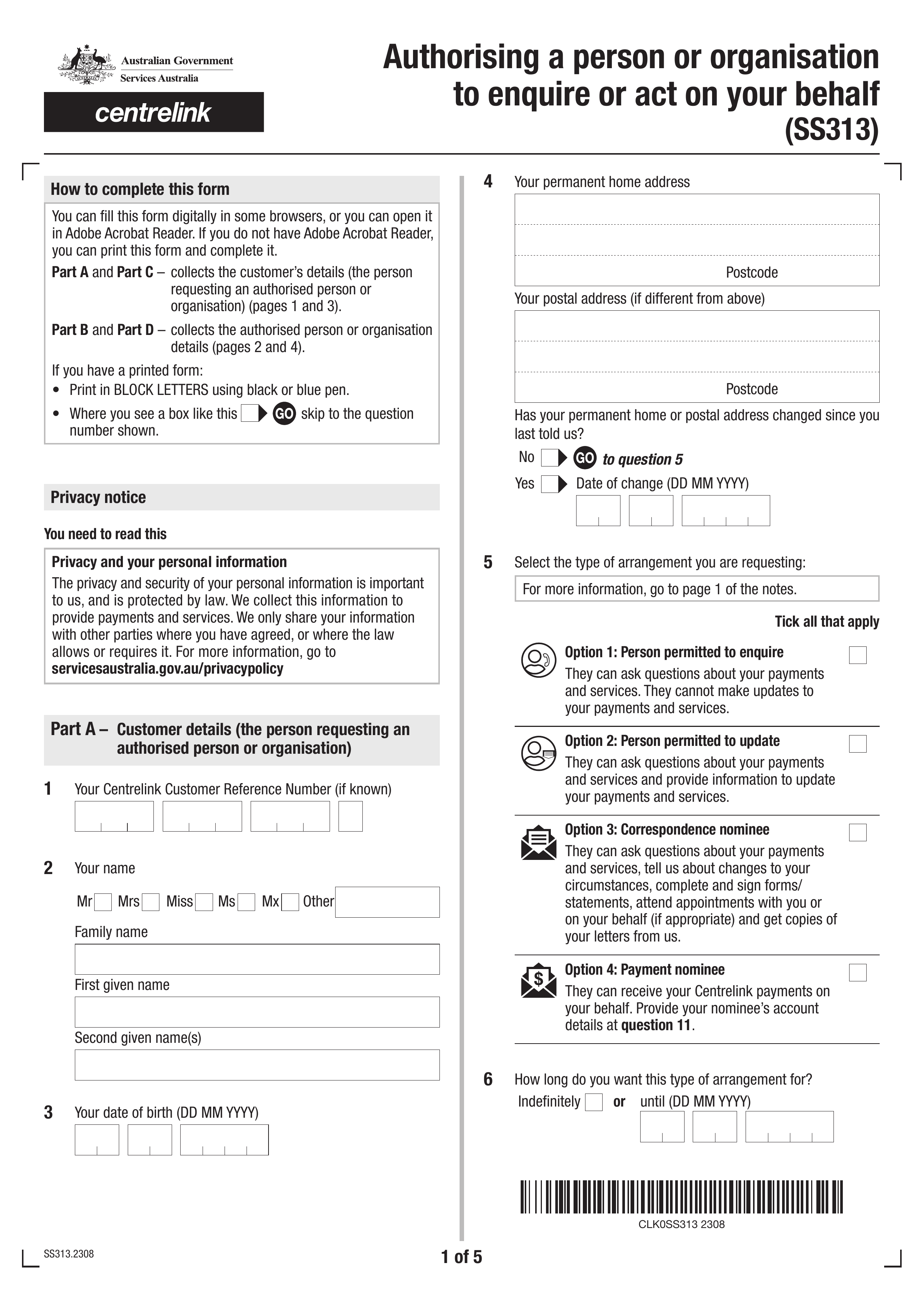

What is Form FA012?

The FA012 form, known as the "Details of your child's care arrangements," is essential for informing Services Australia about your child's care situation. If you receive Family Tax Benefit (FTB) or Child Care Subsidy, this form helps clarify your child's daily routine and any changes in their care. It becomes particularly important if your child spends time with someone other than you or your current partner, such as during weekends or school holidays. Accurate information on this form can impact your payments.

What is Form FA012 used for?

Form FA012 is essential for managing child care details with Centrelink. It serves several important functions:

- Confirms child care arrangements for Family Tax Benefit (FTB) Part A and Child Care Subsidy applications.

- Notifies Centrelink about any changes in a child's care arrangements.

- Provides information on the child's daily routine, including pick-up and drop-off times, to child care providers.

- Documents evidence of care arrangements, such as signed contracts or statements from carers and recipients.

How to fill out Form FA012?

- 1

Gather personal information: name, address, and contact details.

- 2

Fill in sections about your child's care arrangements.

- 3

Provide details about the caregivers, including names and contact information.

- 4

Ensure all information is accurate and complete.

- 5

Click Done to download the form for future use.

Who is required to fill out Form FA012?

Parents and guardians are responsible for completing Form FA012 to share details about their child's care arrangements. This is particularly relevant for those who are applying for or receiving Family Tax Benefit or Child Care Subsidy, as well as notifying Centrelink of any changes.

After completion, the form is used by Services Australia to update records related to child support and Family Tax Benefit payments, ensuring that the information on your child’s daily care is accurate and current.

When is Form FA012 not required?

You don't need to fill out Form FA012 if your child usually lives with you and you're not applying for or receiving Family Tax Benefit or Child Care Subsidy. If you already receive these benefits and the information is on record, the form is also unnecessary.

When is Form FA012 due?

The deadline for Form FA012 is within 14 days from when you are asked to provide the information. Make sure to complete and return the form promptly to confirm your child's care arrangements.

How to get a blank Form FA012?

To get a blank Form FA012, simply visit our website. The form is provided by Services Australia and is ready for you to fill out in our editor. Remember, our platform supports filling and downloading forms but not filing them.

How to sign Form FA012 online?

To sign the Details of your child's care arrangements form (FA012), you can create a simple electronic signature using PDF Guru, which is legally valid just like a hand-signed signature. After filling out the necessary fields in our PDF editor, remember to check for the latest updates regarding any signing requirements. Once completed, you can download the form. However, please note that PDF Guru does not support form submission.

Where to file Form FA012?

You can submit the Details of your child's care arrangements form (FA012) online via your Centrelink account. Simply upload the completed form and any supporting documents through the Centrelink upload documents service.

If you prefer to submit by mail, follow the specific instructions provided by Centrelink. This will help ensure that your form is processed quickly and efficiently.